by Pam Martens and Russ Martens, Wall St On Parade:

According to data from the Federal Deposit Insurance Corporation, and using a graph from the St. Louis Fed above, the liquidity crisis among banks in the spring of last year was far more dramatic than has been acknowledged by banking regulators.

According to the data, during the worst financial crisis since the Great Depression (at the end of the fourth quarter of 2008 when Wall Street was in a state of collapse), banks had borrowed a total of $790 billion in advances from Federal Home Loan Banks (FHLBs). But during the bank panic in the spring of last year, those FHLB advances topped the Q4 2008 number, registering $804 billion as of March 31, 2023.

Public testimony Wednesday by two impeachment witnesses sharply contradicted President Biden’s denials of knowledge of his son’s business dealings.

Public testimony Wednesday by two impeachment witnesses sharply contradicted President Biden’s denials of knowledge of his son’s business dealings.

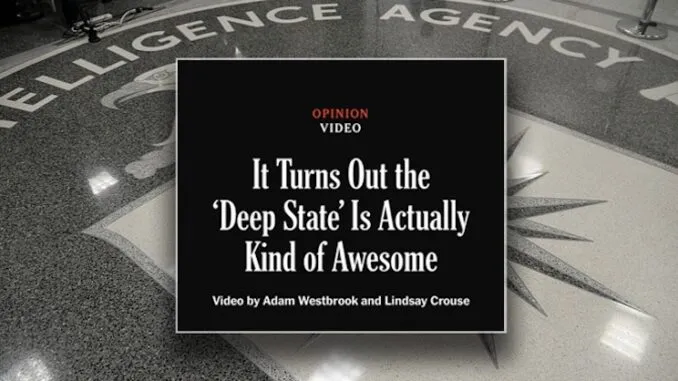

The New York Times is now openly bragging that it fully supports the ‘Deep State’ and hopes the shadowy group of unelected bureaucrats are successful at preventing another Trump presidency.

The New York Times is now openly bragging that it fully supports the ‘Deep State’ and hopes the shadowy group of unelected bureaucrats are successful at preventing another Trump presidency.