from SD Bullion:

TRUTH LIVES on at https://sgtreport.tv/

from SD Bullion:

TRUTH LIVES on at https://sgtreport.tv/

by Peter Schiff, Schiff Gold:

In a special video released yesterday, Peter discusses the ongoing fallout from President Trump’s tariff policy and the broader implications for the American economy. He outlines how the tariffs are not only ineffective but also counterproductive, worsening the trade deficit and the nation’s competitiveness. Additionally, Peter highlights the growing demand for gold amidst economic trouble and suggests strategic opportunities for investors looking for sound money alternatives.

from, Sprott Money:

In this episode, Andrew Sleigh from Sprott Money unpacks the deeper implications of Canadian tariffs on China, the accelerating gold and silver markets, and what a weakening USD means for everyday Canadians. He explains how the rising gold price reflects a global loss of confidence in fiat currencies, and how the silver price could surge as more sectors underperform and investors seek real assets. From the looming CBDC rollout in Europe to how the elite may be preparing for a monetary reset, this is a deep dive into the state of our global financial system — and why owning precious metals might be your safest move.

from BullionStar:

As banking systems falter, currencies devalue, and global conflicts escalate, millions of Americans hold savings and portfolios that are dangerously exposed to systemic risks—all because financial advisors intentionally exclude one critical asset class: physical gold bullion.

This omission leaves hardworking savers just one market crash away from devastating losses while denying them the wealth preservation power that has safeguarded families through wars, depressions, and currency collapses for over 5,000 years.

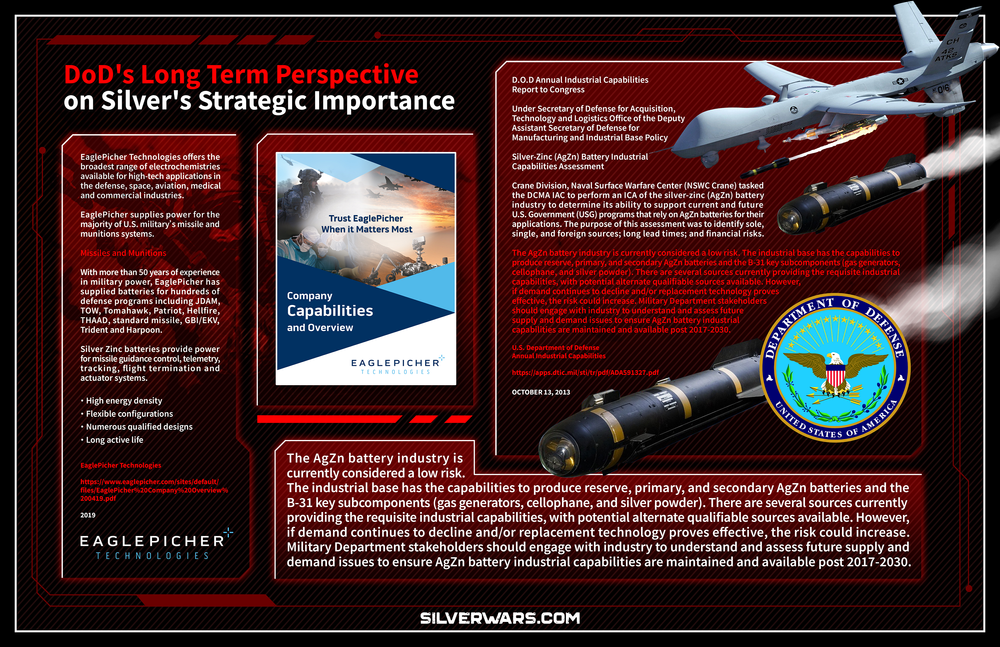

by SilverWars, Silver Seek:

For the last five years, the world has consumed more silver than it produced. Demand from the US Military (for electronics, ships, and weapon systems), the aerospace sector, EVs, and photovoltaic manufacturers keeps climbing—yet supplies lags. By all accounts, the fundamentals of silver are rock solid. You’d think this supply crunch and industrial appetite would send prices soaring and convince retails holders to cling to their physical silver. But instead, many small investors are losing faith at the worst possible time. What gives?

It turns out the real battle is not in the mines, but in our minds!

by Craig Hemke, Sprott Money:

The long-awaited announcement of President Trump’s tariff plans last week sent the world’s markets tumbling, with gold and silver prices nonresistant to the move. What happens next is impossible to state with certainty, but we’ll give it a try anyway.

As last week began, everything looked great for gold and silver. In fact, in response to the initial tariff headlines, gold and silver prices saw their highest levels of the new year with COMEX gold tapping $3200 and COMEX silver reaching $35. It’s what happened next that ruined everything. The markets soon discovered that Trump’s tariffs were far more severe than expected…and down we went, along with just about every other “risk asset” on the planet.

by John Rubino, John Rubino:

Gold and silver are being pulled down by a general equities bear market this morning. That’s not surprising, but the details are interesting. Some background:

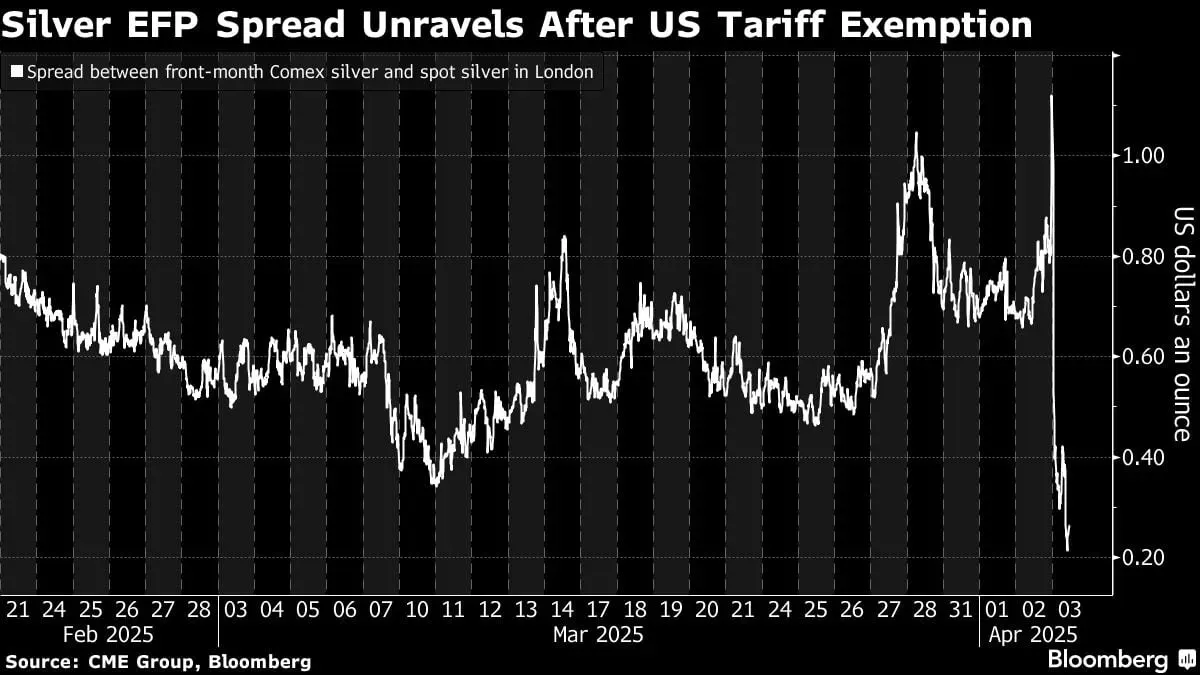

Rush to get gold to the U.S. halts abruptly with tariff exemption

(Bloomberg) – A massive arbitrage trade that has drawn tens of billions of dollars’ worth of gold and silver to the U.S. came to an abrupt halt with Wednesday’s announcement that precious metals would be exempt from Donald Trump’s sweeping tariffs.

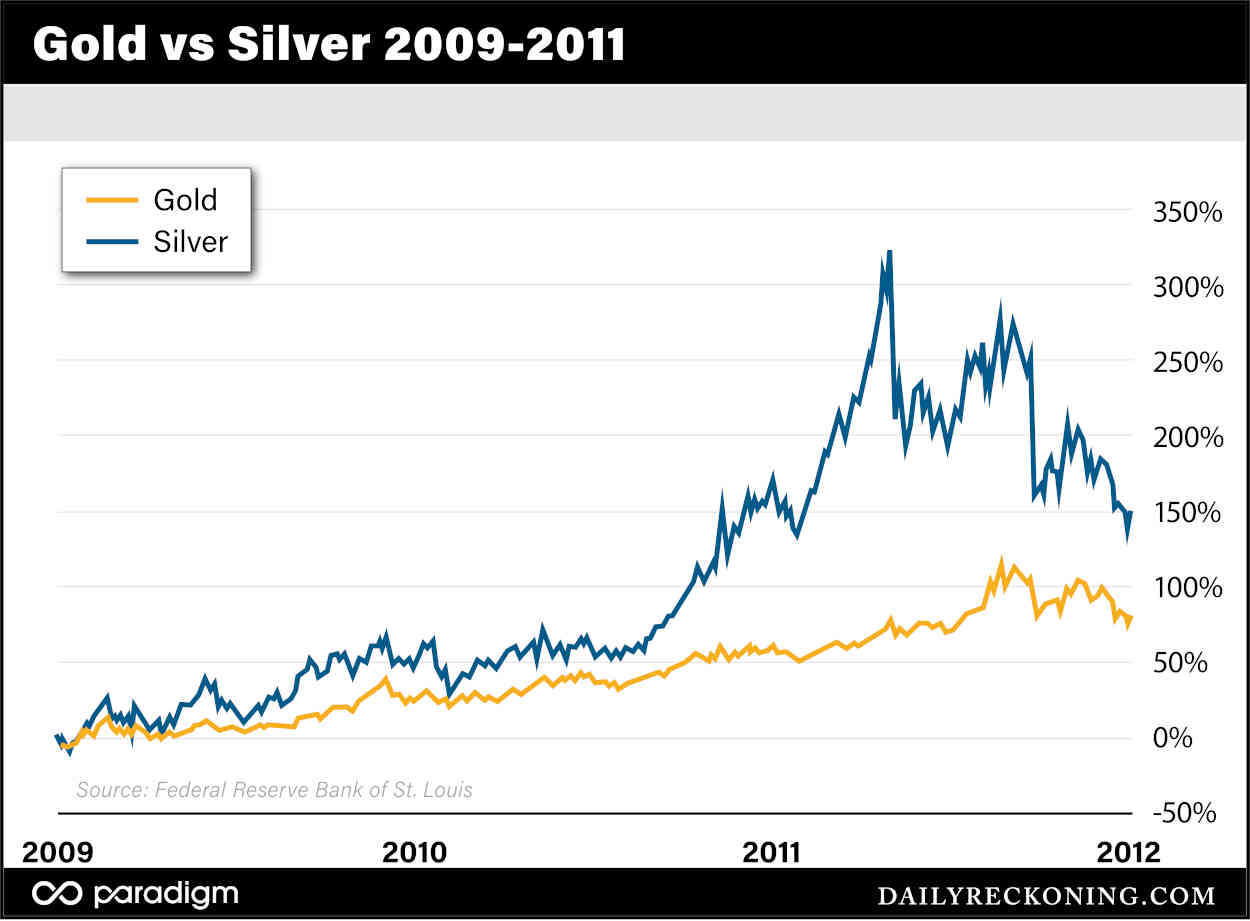

by Adam Sharp, Daily Reckoning:

Every so often, silver goes through a mania phase.

I experienced my first and only silver mania from 2009-2011. There’s nothing quite like it in the investment world. Simultaneously thrilling, nauseating, and lucrative.

Silver is tiny compared to gold and other commodities, so bull markets tend to be almost violent in nature. Once generalist investors get involved, things can quickly get out of hand, in the best kind of way.

Here’s a chart showing the relative performance of silver vs gold from 2009 through 2011:

by Martin Armstrong, Armstrong Economics:

Two men were pulled over while driving on I-20 in Texas, carrying $250,000 worth of gold bars. US law permits and encourages law enforcement to confiscate assets. Civil asset forfeiture enables the government to simply seize assets and declare that the owner is guilty of money laundering before any due process occurs.

“We have to be able to prove what that criminal activity was, in other words how they got the money that they laundered. A lot of times that’s hard when your case starts with a traffic stop,” DA Tonda Curry said. Officers and drug sniffing dogs searched the men and their vehicle but found nothing aside from the gold. Curry initially attempted to pin the men with money laundering charges but could not make a case. The DA then determined that the men were involved in some criminal organization “that defrauds the elderly with investment-type scams.”

from The Morgan Report:

TRUTH LIVES on at https://sgtreport.tv/

from Arcadia Economics:

TRUTH LIVES on at https://sgtreport.tv/