from RoadtoRoota:

TRUTH LIVES on at https://sgtreport.tv/

by Craig Hemke, Sprott Money:

It has been quite the year so far for mining companies. A soaring gold price, combined with falling energy prices, has led to wide margins and rising share prices. However, the silver mining sector has been left behind somewhat. Could that be about to change?

by Alex Newman, Liberty Sentinel:

With the dollar’s decades-long decline in purchasing power accelerating in recent years, state governments across America are moving quickly to give citizens a constitutional option for both saving and commerce. Known as “transactional gold,” the idea is for state governments to create a system where gold and silver can easily be acquired, stored, used, saved, and turned back to dollars to be spent. Multiple states have already approved bills to do it, with more expected.

from SalivateMetal:

TRUTH LIVES on at https://sgtreport.tv/

from ZeroHedge:

Submitted by QTR’s Fringe Finance

In April 2025, the gold market continued its unprecedented surge in physical deliveries from futures exchanges, signaling a significant shift in global financial dynamics. The COMEX reported the delivery of 64,514 gold contracts, equivalent to approximately 6.45 million ounces or $21.3 billion in value, marking the second-highest delivery volume on record.

The CME Comex is a key marketplace for trading futures in gold, silver, and other commodities, where contracts can also be converted into physical metal through delivery.

from Birch Gold Group:

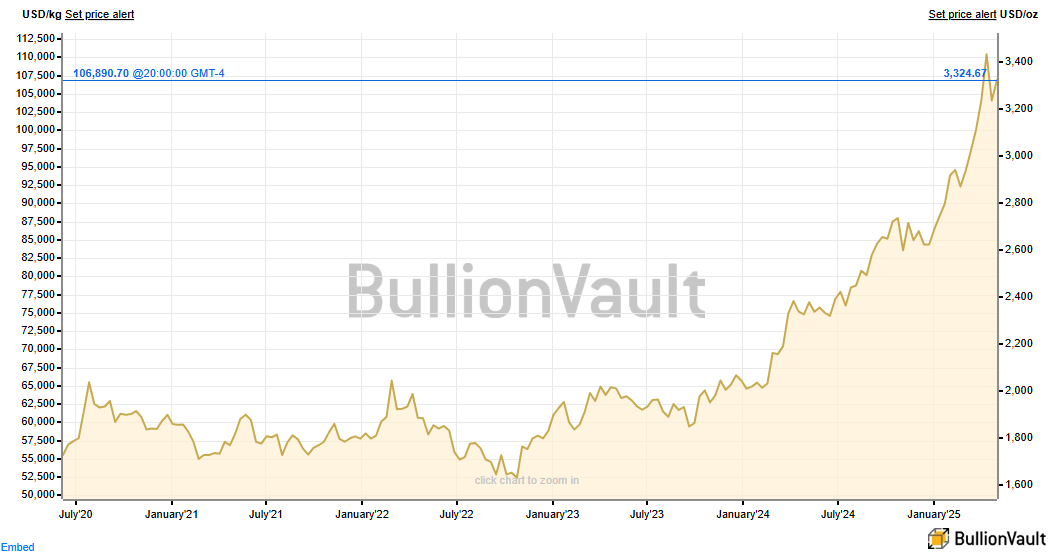

From China’s buying spree to dollar devaluation fears, gold’s surge past $3,000 may be just the beginning. As global demand explodes and trust in fiat currencies crumbles, is $4,000 gold just the new floor of a multi-year bull market?

From China’s buying spree to dollar devaluation fears, gold’s surge past $3,000 may be just the beginning. As global demand explodes and trust in fiat currencies crumbles, is $4,000 gold just the new floor of a multi-year bull market?

Your News to Know rounds up the most important stories about precious metals and the overall economy. This week, we’ll cover:

from Operation Freedom:

TRUTH LIVES on at https://sgtreport.tv/

by Matt Bracken, Matthew’s Substack:

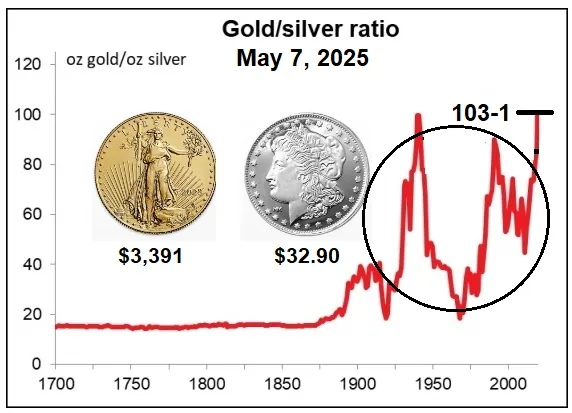

Not one financial expert I follow agrees with me, they mostly think gold and silver are totally decoupled, and the GSR has no meaning in the modern era. Currently the GSR is around 103-1.

Not one financial expert I follow agrees with me, they mostly think gold and silver are totally decoupled, and the GSR has no meaning in the modern era. Currently the GSR is around 103-1.

Personally, I disagree with most analysts, because I foresee a period after a fiat currency system collapse when the government will not be able to swoop in and immediately install some kind of a workable replacement CBDR or Stablecoin system that satisfies all monetary functions. For some period, and this could last for weeks or years, supply chains will break down and many of our cities will probably burn, after all the stores are looted to bare shelves and never restocked.

from GoldSilver:

TRUTH LIVES on at https://sgtreport.tv/

from GoldSilver:

TRUTH LIVES on at https://sgtreport.tv/

by Matthew Piepenburg, Von Greyerz:

Many, from Elliot Wave experts to the dollar-hugging faithful, are asking if we are now reaching a moment of “peak gold”?

The evidence, and answer, is: No.

Our Currency, Our Problem

Gold has made massive price moves in 2025, touching $3500 just days ago and finally making headlines in a politicized world, media and financial system that has otherwise deliberately attempted to ignore and downplay gold for decades.

from And We Know:

15 seconds

15 seconds

TRUTH LIVES on at https://sgtreport.tv/

from SGT Report:

Bix Weir joins me for a big, beautiful far reaching conversation about all things, including Trump, treason, the breakaway civilization, woo and of course precious metals. Thanks for tuning in!

Protect Your Retirement W/ a PHYSICAL Gold IRA

https://www.sgtreportgold.com/

CALL( 877) 646-5347 – Noble Gold is Who I Trust

——

Visit LIMITLESS Peptides, use code SGT15 for 15% off:

www.limitlesslifenootropics.com/SGT15

Bix’s website:

https://www.roadtoroota.com/