Just going to leave this here for now #BankFailures pic.twitter.com/4mOTzoPFsj

— Edward Dowd (@DowdEdward) May 3, 2023

Just going to leave this here for now #BankFailures pic.twitter.com/4mOTzoPFsj

— Edward Dowd (@DowdEdward) May 3, 2023

by Wolf Richter, Wolf Street:

Massive gyrations on the balance sheet after FDIC’s take-down of First Republic, sale of its assets to JP Morgan, and FDIC’s loan to JPM.

Massive gyrations on the balance sheet after FDIC’s take-down of First Republic, sale of its assets to JP Morgan, and FDIC’s loan to JPM.

Today we were served a special spectacle on the Federal Reserve’s weekly balance sheet. Total assets dropped by $59 billion in the week, and by $230 billion in the six weeks since peak bank bailout, to $8.50 trillion, as QT continued on track with a big Treasury securities roll-off, and as First Republic, the FDIC, and JP Morgan were splattered all over this balance sheet.

by Tom Luongo, Tom Luongo:

Now that we’re post-FOMC and ECB we have a clear playing field for another 6 weeks. The US debt ceiling theater is now center-stage along with completing the transition away from LIBOR, which will become an anachronism at the end of Q2.

SOFR will be the law of the land in the US come July. The change over from LIBOR is effectively complete with LIBOR-based Eurodollar Futures now consigned to the dustbin of history.

from Bannons War Room:

TRUTH LIVES on at https://sgtreport.tv/

by C. Mitchell Shaw, The New American:

It appears that another left-leaning media outlet is going under. Just weeks after fellow traveler Buzzfeed shut down and became a part of HuffPost’s brand, Vice appears to be headed toward bankruptcy. Vice — valued at nearly $6 billion in 2017 — has been unable to find a buyer willing to pay even the $1 billion sales price needed to save the company from declaring itself insolvent.

by Michael Snyder, The Economic Collapse Blog:

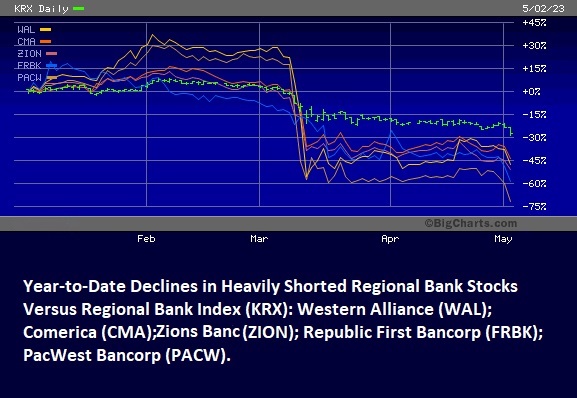

Every time that they tell us that everything is fine, things just seem to get even worse. This banking crisis was supposed to be “over” after Silicon Valley Bank and Signature Bank collapsed. It wasn’t. Then it was supposed to be “over” after First Republic collapsed. It wasn’t. By now, most of you already know about what has been happening to PacWest, Western Alliance, First Horizon and countless other regional bank stocks. In all my years, I have never seen banking stocks fall so quickly. If this avalanche continues to pick up momentum, pretty soon we will have to stop talking about a “banking industry crisis” and start talking about a “banking industry apocalypse”.

by Jordan Schachtel, The Dossier:

As part of their marketing to support Ukraine’s reportedly planned military counteroffensive against Russia, the anti-humans in Washington, D.C. have presented some very bold plans for the fulfillment of their Slava Slush Fund.

by Brandon Smith, Alt Market:

The one thing about the financial world that never ceases to amaze me is how far behind the curve mainstream economists always seem to be. Not long ago we had both Janet Yellen and Paul Krugman, economists supposedly at the front of the pack, both proving to be utterly ignorant (or strategically dishonest) on the effects of central bank stimulus measures and the threat of inflation. In fact, they both consistently denied such a threat existed until they were crushed by the evidence.

The one thing about the financial world that never ceases to amaze me is how far behind the curve mainstream economists always seem to be. Not long ago we had both Janet Yellen and Paul Krugman, economists supposedly at the front of the pack, both proving to be utterly ignorant (or strategically dishonest) on the effects of central bank stimulus measures and the threat of inflation. In fact, they both consistently denied such a threat existed until they were crushed by the evidence.

from Moonbattery:

San Francisco has reached the point in the Democrat Death Spiral where it is becoming impossible to do business there. Consequently, Nordstrom is closing both its stores in this mecca of moonbattery:

The company’s chief stores officer notified employees in an email that “the dynamics of the downtown San Francisco market have changed dramatically over the past several years, impacting customer foot traffic to our stores and our ability to operate successfully.”

Those dynamics involve the homelessness and crime that result from liberal policy. Derelicts are lavishly subsidized. Shoplifting is effectively legal in San Francisco. Crime control consists of paying thugs not to shoot people.

by Pam Martens and Russ Martens, Wall St On Parade:

President Joe Biden is putting the national security of the United States at risk by not suspending the short-selling of federally-insured banks. Concerns over the safety and soundness of the U.S. financial system could cause money flight out of the U.S., impacting the strength of the U.S. dollar and a loss of confidence by our foreign allies.

This is also a matter that impacts the financial lives of every American, because every American – rich, poor or middle class – will suffer the consequences in terms of ability to access bank credit and higher fees on that credit as a result of rebuilding the rapidly depleting federal Deposit Insurance Fund that protects bank deposits.