from GoldSilver (w/ Mike Maloney):

TRUTH LIVES on at https://sgtreport.tv/

by Rhoda Wilson, Expose News:

The pilot project of Brazil’s Central Bank Digital Currency the Real Digital allows the freezing of user wallets and reducing balances, as was always highly suspected by “conspiracy theorists!”

The president of the Central Bank, Roberto Campos Neto, presented Brazil’s digital agenda back in November 2022 where a preview of the Real Digital app was presented. According to Campos “The Real Digital, the central bank digital currency (CBDC) in Brazil, appears to tokenize the banking system” he explained that the “CBDC is nothing more than a token issued by the bank upon deposit” (source).

from ZeroHedge:

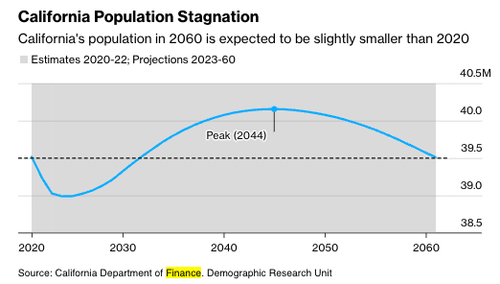

Readers are already familiar with the mass migration from the Democratic strongholds of California and New York, known for high crime and tax rates. We have delved into this in our article, “Americans Continue To Flee High-Tax New York And California,” highlighting Texas and Florida as preferred destinations.

by Alasdair Macleod, GoldMoney:

It is an error to expect inflation to continue to fall in America. All financial market values in the US and elsewhere are predicated on this hope.

The misunderstanding is to assume that the widely expected recession will lead to further falls in consumer price inflation, and that therefore interest rates and bond yields will decline. These hopes are based on Keynes’s rejection of Say’s law, which simply points out there is no such thing as Keynes’s general glut because the unemployed stop producing.

by Mac Slavo, SHTF Plan:

Russia’s foreign ministry spokesperson Maria Zakharova said on Wednesday that Russia intends to work with Africa to destroy the United States dollar. Zakharova’s direct, provocative challenge to Washington and its dollar dominance, asserting that the U.S. is using the dollar for “global hegemony” and as “a means of realizing its aggression.”

De-dollarization chatter is not new. It has long been in the air, particularly in the lead-up to BRICS nations gathering in South Africa in August, with the question high on the agenda.

by Claudio Grass, Claudio Grass:

Part II of II

If this kind of theoretical reasoning seems too abstract, let us think about it more practically: Any public servant, any member of government, and even the leader of a nation, has very different motivations than any private sector decision-maker. Their financial compensation is a given and their time preference is dictated by their job description.

from WND:

Refuses to explain abrupt cancellation of business, personal services

Refuses to explain abrupt cancellation of business, personal services

An old-line banking corporation has launched an attack on vaccine skeptic Dr. Joseph Mercola by closing his business account, according to a report from the Daily Caller News Foundation.

The publication said it obtained copies of documents showing the accounts closed by JPMorgan Chase include those for Mercola’s business, Mercola Market, officers of his company and an officer’s wife.

from The David Knight Show:

TRUTH LIVES on at https://sgtreport.tv/

by Frank Bergman, Slay News:

Democrat presidential candidate Robert F. Kennedy Jr. has issued a warning to the public about the global plans to abolish physical cash to create “cashless societies.”

In an interview with The New York Post, RFK Jr., the nephew of President John F. Kennedy, took a deep dive into the topic of currency and the coming “digital cash” era.

As Slay News previously reported, Democrat President Joe Biden has ordered the Federal Reserve to implement a CBDC that will replace traditional money as a “digital dollar.”

by Chris Menahan, Information Liberation:

Capital is flooding into El Salvador thanks to President Nayib Bukele’s hugely successful crackdown on gangs.

Capital is flooding into El Salvador thanks to President Nayib Bukele’s hugely successful crackdown on gangs.

From Reuters, “Move over, bitcoin: El Salvador sovereign bonds not done rallying”:

NEW YORK, July 19 (Reuters) – Investors in El Salvador international bonds are relishing 60% returns this year alone as debt issued by the Central American country recovers from calls of doom and default, with some betting the rally is not quite over yet.