by Wolf Richter, Wolf Street:

QT’s impact on the Fed’s liabilities, and the massive movements between them.

QT’s impact on the Fed’s liabilities, and the massive movements between them.

The daily measure of Overnight Reverse Repurchase agreements (ON RRPs) at the Fed have plunged to $1.40 trillion as of Friday. This is down by 45%, or by $1.152 trillion, from the one-day-wonder peak on December 31, 2022.

Under these RRPs, the Fed takes in cash and hands out collateral (Treasury securities). RRPs are a liability for the Fed because they’re cash that the Fed owes its counterparties. The counterparties are mostly US money market funds, but also banks, and government-sponsored enterprises (Federal Home Loan Banks, Fannie Mae, Freddie Mac, etc.). These counterparties use ON RRPs to park their extra cash risk-free at the Fed, and earn interest. As of the rate hike in July, the Fed pays them 5.3% in interest.

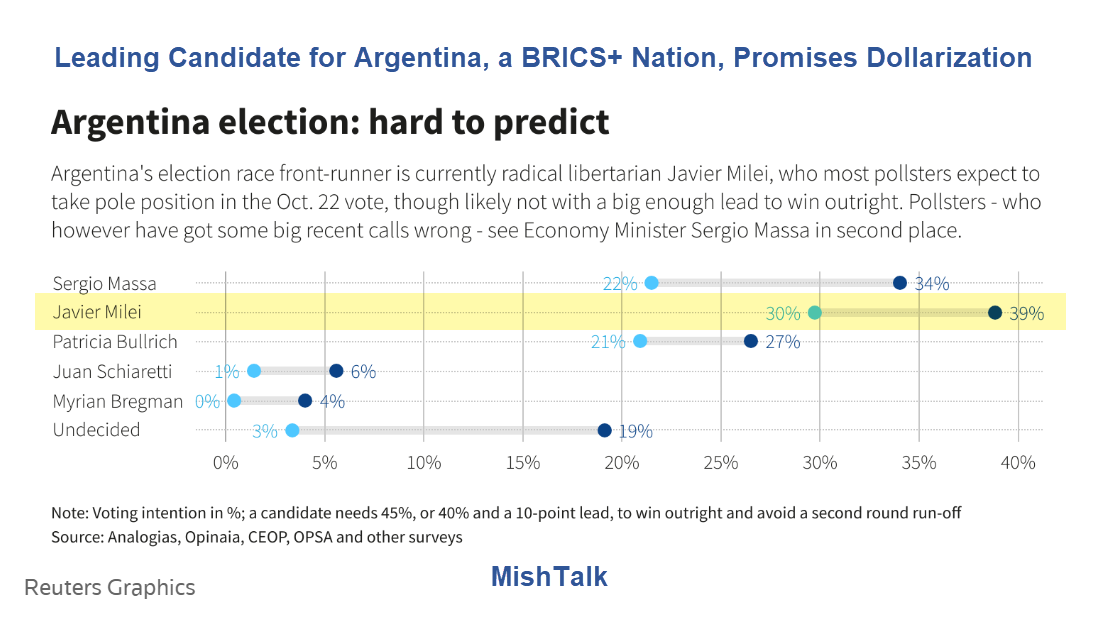

The leading candidate in the Argentina presidential election promises dollarization.

The leading candidate in the Argentina presidential election promises dollarization.