by Joseph P. Farrell, Giza Death Star:

OK, so here’s my random thought of the day…

There’s a move afoot to prohibit a central bank digital dollar from ever being issued by the Fed – without “authorization” that is – according to this article shared by E.G.(with our thanks):

US lawmakers advance legislation blocking the digital dollar

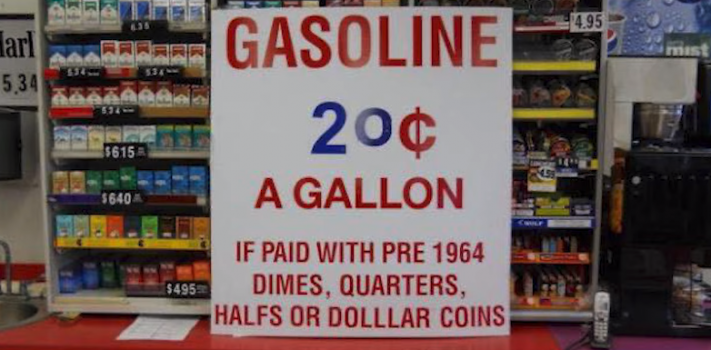

When I read this article (the first time) I thought, “Well, that’s good, someone out there realizes what Catherine Fitts and many others including yours truly have been warning about: a central bank digital currency is too easy to couple to a social engineering system, and affords no privacy. It’s a sure, certain, and swift route to slavery and feudalism, and it’s nothing but a corporate coupon. It’s a method to prohibit wealth accumulation much less passing it along, because a wholly digital ‘currency’ could be made with an ‘expiration’ date. Use it or loose it.” And so on. Yet, reading it, I had to admit that something about the article gnawed away at me. Something was missing. So I re-read it…

Can’t wait for silver ..

Can’t wait for silver ..

Trillions whooshing by so fast they’re hard to see.

Trillions whooshing by so fast they’re hard to see. GOLD CLOSED UP $8.40 TO $1932.00 SILVER CLOSED UP 11 CENTS TO $23.20 //PLATINUM CLOSED UP $26.10 TO $936.65 WHILE PALLADIUM CLOSED DOWN $2.65 TO $1248.45/GOOD GOLD COMMENTARY TODAY FROM MATHEW PIEPENBURG//CHINA EXPERIENCES HUGE OUTFLOWS OF DOLLARS AS ITS ECONOMY IS IMPLODING//ITALY OVERWHELMED WITH MIGRANT INFLUX///IRAN AND USA EXCHANGE PRISONERS IN A RANSOM DEAL//COVID UPDATES/VACCINE UPDATES/DR PAUL ALEXANDER/NEW ADDICTS/EVOL NEWS//UAW STILL FAR APART IN THEIR NEGOTIATIONS WITH THE 3 CAR COMPANIES

GOLD CLOSED UP $8.40 TO $1932.00 SILVER CLOSED UP 11 CENTS TO $23.20 //PLATINUM CLOSED UP $26.10 TO $936.65 WHILE PALLADIUM CLOSED DOWN $2.65 TO $1248.45/GOOD GOLD COMMENTARY TODAY FROM MATHEW PIEPENBURG//CHINA EXPERIENCES HUGE OUTFLOWS OF DOLLARS AS ITS ECONOMY IS IMPLODING//ITALY OVERWHELMED WITH MIGRANT INFLUX///IRAN AND USA EXCHANGE PRISONERS IN A RANSOM DEAL//COVID UPDATES/VACCINE UPDATES/DR PAUL ALEXANDER/NEW ADDICTS/EVOL NEWS//UAW STILL FAR APART IN THEIR NEGOTIATIONS WITH THE 3 CAR COMPANIES