by Mish Shedlock, Mish Talk:

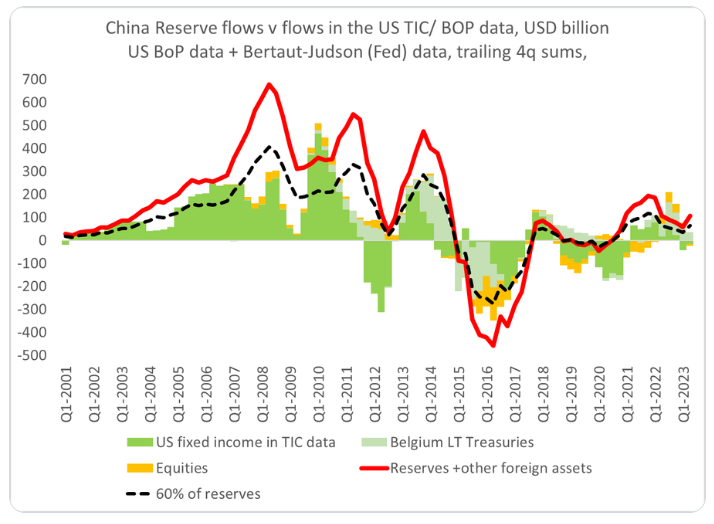

Numerous articles and Tweets have surfaced about China dumping Treasuries. First let’s investigate the rumors. Then let’s look at conditions in which China might dump dollar assets.

Numerous articles and Tweets have surfaced about China dumping Treasuries. First let’s investigate the rumors. Then let’s look at conditions in which China might dump dollar assets.

Not China Dumping

Until the past week there was a relentless selloff in US treasuries that sent bond yields soaring.

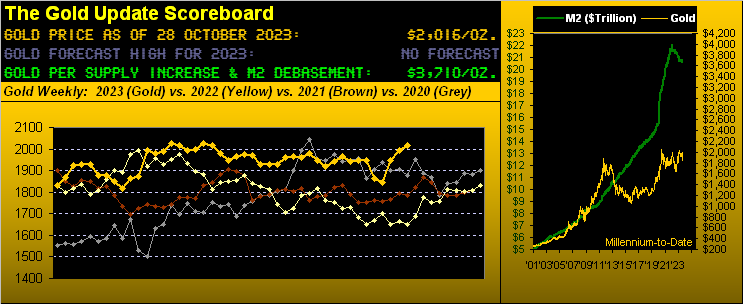

The writing of this market report was at a time of great volatility, due to it coinciding with the speech of the Hezbollah leader, Hassan Nasrallah. The drift of it appears to be that Hezbollah will support Hamas. If so, it means an intensification of the Palestinian crisis Which would presumably drive gold and silver prices higher. This market report should be read in this context.

The writing of this market report was at a time of great volatility, due to it coinciding with the speech of the Hezbollah leader, Hassan Nasrallah. The drift of it appears to be that Hezbollah will support Hamas. If so, it means an intensification of the Palestinian crisis Which would presumably drive gold and silver prices higher. This market report should be read in this context.

GOLD CLOSED DOWN $6.15 TO $1979.35 WHILE SILVER CLOSED DOWN 11 CENTS TO $22.73 AS THE SPECS ADD MASSIVELY TO THEIR SHORT POSITION AND CENTRAL BANKS TAKE THE BUY SIDE AND THEN TAKING DELIVERY ESPECIALLY GOLD (800 TONNES THIS QUARTER//PLATINUM CLOSED DOWN $8.90 TO $924.95 WHILE PALLADIUM CLOSED DOWN $20.35 TO $1107.65//ROBERT LAMBOURNE REPORTS ON THE BIS GOLD SWAPS WITH THE FED LOWERING ITS SHORTFALL IN SEPT DOWN TO 96 TONNES..STILL A LONG WAY TO GO//CENTRAL BANKS CONTINUE TO GORGE ON PHYSICAL GOLD ACCUMULATION//GOLD COMMENTARY TODAY FROM PETER SCHIFF/EPOCH TIMES PROVIDES AN EXCELLENT COMMENTARY ON THE DETERORIATING HEALTH OF THE CHINESE ECONOMY//PALESTINIAN THROW RATS INTO MACDONALDS//ISRAEL VS HAMAS: ISRAEL NOW CONTROLS THE NORTH SECTOR OF HAMAS WITH THEIR TANKS AS WELL AS NORTH SOUTH ROADS BUT WITH 15 CASUALTIES//STARVING YEMEN DECLARES WAR ON ISRAEL//NEW DATA RELEASED BY THE USA SUGGESTS THAT THEY ARE IN THE MIDST OF STAGFLATION//ADP REPORT AND JOLTS REPORT//SUBPRIME AUTO LOANS SKYROCKET AND IT LOOKS LIKE WE WORK WILL FINALLY SUCCUMB

GOLD CLOSED DOWN $6.15 TO $1979.35 WHILE SILVER CLOSED DOWN 11 CENTS TO $22.73 AS THE SPECS ADD MASSIVELY TO THEIR SHORT POSITION AND CENTRAL BANKS TAKE THE BUY SIDE AND THEN TAKING DELIVERY ESPECIALLY GOLD (800 TONNES THIS QUARTER//PLATINUM CLOSED DOWN $8.90 TO $924.95 WHILE PALLADIUM CLOSED DOWN $20.35 TO $1107.65//ROBERT LAMBOURNE REPORTS ON THE BIS GOLD SWAPS WITH THE FED LOWERING ITS SHORTFALL IN SEPT DOWN TO 96 TONNES..STILL A LONG WAY TO GO//CENTRAL BANKS CONTINUE TO GORGE ON PHYSICAL GOLD ACCUMULATION//GOLD COMMENTARY TODAY FROM PETER SCHIFF/EPOCH TIMES PROVIDES AN EXCELLENT COMMENTARY ON THE DETERORIATING HEALTH OF THE CHINESE ECONOMY//PALESTINIAN THROW RATS INTO MACDONALDS//ISRAEL VS HAMAS: ISRAEL NOW CONTROLS THE NORTH SECTOR OF HAMAS WITH THEIR TANKS AS WELL AS NORTH SOUTH ROADS BUT WITH 15 CASUALTIES//STARVING YEMEN DECLARES WAR ON ISRAEL//NEW DATA RELEASED BY THE USA SUGGESTS THAT THEY ARE IN THE MIDST OF STAGFLATION//ADP REPORT AND JOLTS REPORT//SUBPRIME AUTO LOANS SKYROCKET AND IT LOOKS LIKE WE WORK WILL FINALLY SUCCUMB