by Michael Snyder, The Economic Collapse Blog:

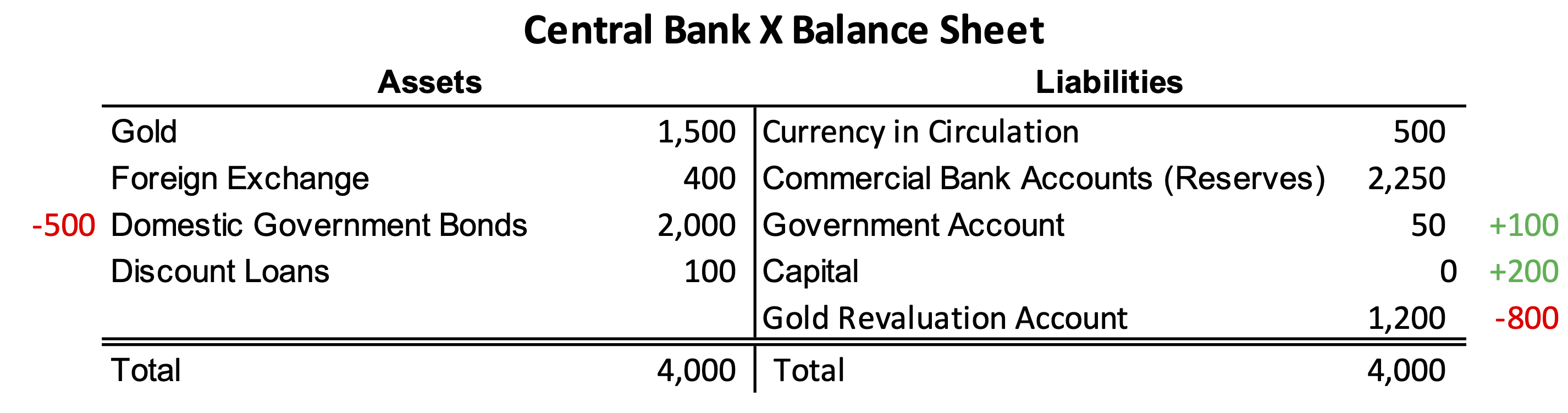

The rich have been getting richer and the poor have been getting poorer, and this is causing all sorts of societal problems. Thanks to social media, the poor can see the incredible affluence that the wealthy are enjoying, and they are deeply envious. Of course it certainly doesn’t help that flaunting wealth has become one of the favorite pastimes of the wealthy. Many of them love to post photos and videos of their luxury lifestyles on their social media accounts, and that is not a good thing. Because times have not been good for most of the country. In fact, a brand new study from the Federal Reserve has discovered that the bottom 80 percent have “lower bank deposits and other liquid assets compared to their status in March 2020”…