from GoldSeek Radio:

TRUTH LIVES on at https://sgtreport.tv/

from Peak Prosperity:

TRUTH LIVES on at https://sgtreport.tv/

by Alasdair Macleod, Schiff Gold:

The sell-off in precious metals continued as bond yields continued to rise and a strong dollar persisted. In early trade in Europe this morning, gold was $1822, down another $26, unchanged on the year. Silver traded at $21, down $1.17. Comex volumes in both metals declined from good levels, indicating that selling pressure is declining.

by Mish Shedlock, Mish Talk:

As mortgage rates surge to 7.7 percent, Goldman Sachs revises is 6.5 percent forecast.

As mortgage rates surge to 7.7 percent, Goldman Sachs revises is 6.5 percent forecast.

Mortgage Rates Easily Launched to New Long Term Highs by Upbeat Data

Mortgage News Daily reports Mortgage Rates Easily Launched to New Long Term Highs by Upbeat Data

Mortgage rates were already close to the highest levels in more than 20 years yesterday–an unpleasant milestone that was easily surpassed after today’s Job Openings data came in much higher than expected.

by Peter Schiff, Schiff Gold:

Most people in the mainstream will scoff at that statement. They’ll tell you that the situation is very different today. After all, we don’t have a big problem in the subprime mortgage market. We’re not seeing a big spike in defaults. That’s true. The problem is different this time. And it’s actually worse.

Most people will acknowledge that there are problems in the real estate market. Home sales continue to decline as mortgage rates climb. Pending home sales fell more than expected in August, with the National Association of Realtors’ Pending Home Sales Index falling to the lowest level since September 2022.

from Nomad Capitalist:

TRUTH LIVES on at https://sgtreport.tv/

by Joseph P. Farrell, Giza Death Star:

OK, so here’s my random thought of the day…

There’s a move afoot to prohibit a central bank digital dollar from ever being issued by the Fed – without “authorization” that is – according to this article shared by E.G.(with our thanks):

US lawmakers advance legislation blocking the digital dollar

When I read this article (the first time) I thought, “Well, that’s good, someone out there realizes what Catherine Fitts and many others including yours truly have been warning about: a central bank digital currency is too easy to couple to a social engineering system, and affords no privacy. It’s a sure, certain, and swift route to slavery and feudalism, and it’s nothing but a corporate coupon. It’s a method to prohibit wealth accumulation much less passing it along, because a wholly digital ‘currency’ could be made with an ‘expiration’ date. Use it or loose it.” And so on. Yet, reading it, I had to admit that something about the article gnawed away at me. Something was missing. So I re-read it…

by M.J., Survival Blog:

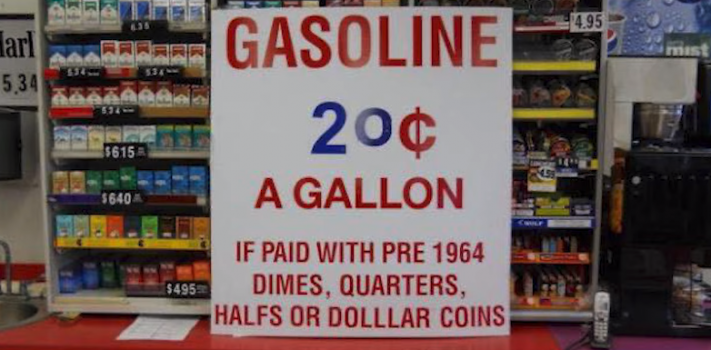

As an intellectual exercise, I converted the price of some of my recent purchases from U.S. dollars to ounces of silver. I did this out of curiosity to see how well I would do in a precious metals-based economy.

I used the spot price of silver per ounce that was quoted at www.apmex.com on 09-16-2023: $23.31. The other spot prices for that day are as follows:

Gold: $1,937.50 per ounce

Platinum: $945.70 per ounce

Palladium: $1,286.00 per ounce