by Greg Hunter, USA Watchdog:

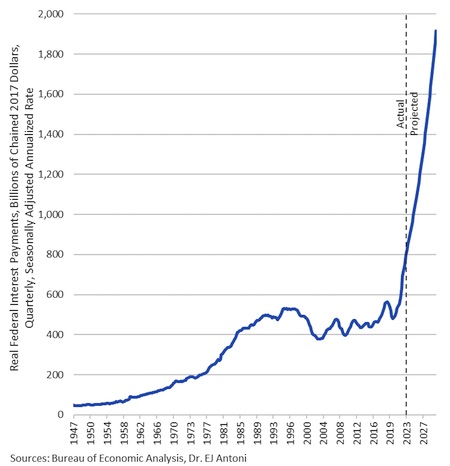

Analyst and financial writer John Rubino has a new warning about being fooled into thinking the economy is improving because inflation and interest rates have fallen some recently. Rubino says, “If the U.S. government is running crisis level deficits, which it is right now, borrowing money and paying interest on it means we are in a financial death spiral. The debt goes up, the interest on the debt goes up and that raises the debt even further, and you just spiral out of control. We are there right now. The official U.S. debt is $33.5 trillion. It’s growing by $1.7 trillion a year, and $1 trillion of that is interest costs. Interest costs are rising as the overall debt goes up. Then throw in this incredibly reckless military spending in the guise of foreign aid, and you get a society that has completely lost control. That’s where we are now. We are in the blowoff stage of a 70-year credit super-cycle. Those things do not end with a whimper, and they certainly do not end with a soft landing. They end with a bang, and the bang is going to be centered on the currency. People are going to look at this and say, ‘Do I really want to hold the currency or bonds of a country that is destroying its finances at this trajectory and this scale?’ The answer will be ‘No.’ At that point, it is game over for a deeply indebted economy. We are headed that way fast, and these wars are taking us that way even faster.”

Analyst and financial writer John Rubino has a new warning about being fooled into thinking the economy is improving because inflation and interest rates have fallen some recently. Rubino says, “If the U.S. government is running crisis level deficits, which it is right now, borrowing money and paying interest on it means we are in a financial death spiral. The debt goes up, the interest on the debt goes up and that raises the debt even further, and you just spiral out of control. We are there right now. The official U.S. debt is $33.5 trillion. It’s growing by $1.7 trillion a year, and $1 trillion of that is interest costs. Interest costs are rising as the overall debt goes up. Then throw in this incredibly reckless military spending in the guise of foreign aid, and you get a society that has completely lost control. That’s where we are now. We are in the blowoff stage of a 70-year credit super-cycle. Those things do not end with a whimper, and they certainly do not end with a soft landing. They end with a bang, and the bang is going to be centered on the currency. People are going to look at this and say, ‘Do I really want to hold the currency or bonds of a country that is destroying its finances at this trajectory and this scale?’ The answer will be ‘No.’ At that point, it is game over for a deeply indebted economy. We are headed that way fast, and these wars are taking us that way even faster.”

GOLD CLOSED DOWN $4.15 TO $1977.95/SILVER CLOSED DOWN 26 CENTS TO $23.51//PLATINUM CLOSED UP $24.95 TO $923.90 WHILE PALLADIUM CLOSED UP $32.25 TO $1087.75//CENTRAL BANKS ARE BUYING PHYSICAL GOLD FOR THEIR OFFICIAL RESERVES AND//IMPORTANT GOLD COMMENTARY TODAY FROM MATHEW PIEPENBERG//MELEI WINS THE ARGENTIAN ELECTION AND HE IS RIGHT WING, A LIBERTARIAN, FREE MARKET AND A STRONG SUPPORTER OF STORING PHYSICAL GOLD AS AN OFFICIAL ASSET. HE IS A STRONG SUPPORTER OF ISRAEL//INDIA PURCHASES A MASSIVE 125 TONNES OF GOLD IN OCT.//WILL BE DIFFICULT FOR THE FED TO PURCHASE IS 67 TONNES OF GOLD SHORTFALL//UPDATES ON ISRAEL-GAZAN WARN: FINALLY SHIFA HOSPITAL REVEALS MASSIVE WEAPONRY AND OTHER STUFF REVEALING ITS MILITARY COMMAND CENTRE//ISRAEL SURROUNDS INDONESIAN HOSPITAL AS WELL AS POUNDING THE SOUTH PART OF GAZA//COVID UPDATES//VACCINE INJURIES//DR PAUL ALEXANDER, SLAY NEWS/EVOL NEWS/NEWS ADDICTS//USA LEADING INDICATORS DROP FOR 19TH STRAIGHT MONTH

GOLD CLOSED DOWN $4.15 TO $1977.95/SILVER CLOSED DOWN 26 CENTS TO $23.51//PLATINUM CLOSED UP $24.95 TO $923.90 WHILE PALLADIUM CLOSED UP $32.25 TO $1087.75//CENTRAL BANKS ARE BUYING PHYSICAL GOLD FOR THEIR OFFICIAL RESERVES AND//IMPORTANT GOLD COMMENTARY TODAY FROM MATHEW PIEPENBERG//MELEI WINS THE ARGENTIAN ELECTION AND HE IS RIGHT WING, A LIBERTARIAN, FREE MARKET AND A STRONG SUPPORTER OF STORING PHYSICAL GOLD AS AN OFFICIAL ASSET. HE IS A STRONG SUPPORTER OF ISRAEL//INDIA PURCHASES A MASSIVE 125 TONNES OF GOLD IN OCT.//WILL BE DIFFICULT FOR THE FED TO PURCHASE IS 67 TONNES OF GOLD SHORTFALL//UPDATES ON ISRAEL-GAZAN WARN: FINALLY SHIFA HOSPITAL REVEALS MASSIVE WEAPONRY AND OTHER STUFF REVEALING ITS MILITARY COMMAND CENTRE//ISRAEL SURROUNDS INDONESIAN HOSPITAL AS WELL AS POUNDING THE SOUTH PART OF GAZA//COVID UPDATES//VACCINE INJURIES//DR PAUL ALEXANDER, SLAY NEWS/EVOL NEWS/NEWS ADDICTS//USA LEADING INDICATORS DROP FOR 19TH STRAIGHT MONTH

At $35 per ounce the Fed values its gold at $11.037 billion. What’s the gold really worth and why the low valuation?

At $35 per ounce the Fed values its gold at $11.037 billion. What’s the gold really worth and why the low valuation?

Javier Milei, the outsider libertarian candidate with radical solutions to Argentina’s economic crisis, has just won Sunday’s presidential runoff against Economy Minister Sergio Massa.

Javier Milei, the outsider libertarian candidate with radical solutions to Argentina’s economic crisis, has just won Sunday’s presidential runoff against Economy Minister Sergio Massa.

Analyst and financial writer John Rubino has a new warning about being fooled into thinking the economy is improving because inflation and interest rates have fallen some recently. Rubino says, “If the U.S. government is running crisis level deficits, which it is right now, borrowing money and paying interest on it means we are in a financial death spiral. The debt goes up, the interest on the debt goes up and that raises the debt even further, and you just spiral out of control. We are there right now. The official U.S. debt is $33.5 trillion. It’s growing by $1.7 trillion a year, and $1 trillion of that is interest costs. Interest costs are rising as the overall debt goes up. Then throw in this incredibly reckless military spending in the guise of foreign aid, and you get a society that has completely lost control. That’s where we are now. We are in the blowoff stage of a 70-year credit super-cycle. Those things do not end with a whimper, and they certainly do not end with a soft landing. They end with a bang, and the bang is going to be centered on the currency. People are going to look at this and say, ‘Do I really want to hold the currency or bonds of a country that is destroying its finances at this trajectory and this scale?’ The answer will be ‘No.’ At that point, it is game over for a deeply indebted economy. We are headed that way fast, and these wars are taking us that way even faster.”

Analyst and financial writer John Rubino has a new warning about being fooled into thinking the economy is improving because inflation and interest rates have fallen some recently. Rubino says, “If the U.S. government is running crisis level deficits, which it is right now, borrowing money and paying interest on it means we are in a financial death spiral. The debt goes up, the interest on the debt goes up and that raises the debt even further, and you just spiral out of control. We are there right now. The official U.S. debt is $33.5 trillion. It’s growing by $1.7 trillion a year, and $1 trillion of that is interest costs. Interest costs are rising as the overall debt goes up. Then throw in this incredibly reckless military spending in the guise of foreign aid, and you get a society that has completely lost control. That’s where we are now. We are in the blowoff stage of a 70-year credit super-cycle. Those things do not end with a whimper, and they certainly do not end with a soft landing. They end with a bang, and the bang is going to be centered on the currency. People are going to look at this and say, ‘Do I really want to hold the currency or bonds of a country that is destroying its finances at this trajectory and this scale?’ The answer will be ‘No.’ At that point, it is game over for a deeply indebted economy. We are headed that way fast, and these wars are taking us that way even faster.”