from The Alex Jones Show:

TRUTH LIVES on at https://sgtreport.tv/

from The Alex Jones Show:

TRUTH LIVES on at https://sgtreport.tv/

by Jose Nino, Big League Politics:

On February 6, 2024, TJ Roberts, a candidate running for Kentucky House of Representatives District 66, published a press release unveiling his plan to turn Kentucky into a hub for economic freedom.

He specifically cited the United States’ growing inflation as the main catalyst for his plan to make Kentucky “the Crypto Capital of the World.” He stated the following:

by Greg Hunter, USA Watchdog:

Tucker Carlson interviewed Vladimir Putin, and the Deep State melted down. They called him a “Mouthpiece for Putin,” a “traitor” and threatened to sanction Carlson. Why? The truth is a powerful thing, and the Deep State wants you to think the lies they are telling you about the Ukraine war are true. This against a backdrop of the US Senate sending another $60 billion for a war that has already cost the lives of 500,000 Ukrainian soldiers. Putin says he is ready to stop the war and negotiate a peace deal. It is dangerous for you to hear that blasphemy when so much money and kickbacks are being made off a war that was lost long ago. Way to go, Tucker!

Tucker Carlson interviewed Vladimir Putin, and the Deep State melted down. They called him a “Mouthpiece for Putin,” a “traitor” and threatened to sanction Carlson. Why? The truth is a powerful thing, and the Deep State wants you to think the lies they are telling you about the Ukraine war are true. This against a backdrop of the US Senate sending another $60 billion for a war that has already cost the lives of 500,000 Ukrainian soldiers. Putin says he is ready to stop the war and negotiate a peace deal. It is dangerous for you to hear that blasphemy when so much money and kickbacks are being made off a war that was lost long ago. Way to go, Tucker!

by Michael Snyder, The Economic Collapse Blog:

Over the last several years we have seen commercial real estate values plummet dramatically all over the United States. One of the reasons why this is happening is because millions of Americans started working from home during the pandemic, and many of them never returned to the office once the pandemic subsided. Another reason why this is happening is because there has been a mass exodus of businesses from our core urban areas. Conditions have rapidly deteriorated in many of our largest cities, and it is exceedingly difficult to run a profitable business in the midst of an environment of constant theft and violence. Ultimately, it is very easy to understand why commercial real estate values have crashed, and they will almost certainly go even lower.

by Jim Rickards, Daily Reckoning:

When will the Fed cut rates? Before giving you the answer, let’s back up.

Before last week’s Federal Reserve meeting, I offered readers the following forecast of what would happen at that meeting:

On Wednesday, the Fed will leave its target rate for fed funds unchanged. That decision will keep the federal funds target at 5.50% as set at the July 26, 2023 meeting. Over the course of fifteen FOMC meetings beginning March 16, 2022, I’ve been correct in all my forecasts including the “skipped” rate hikes at the June, September, November, and December 2023 meetings. I’m confident I’ll be correct on Wednesday also.

The Fed did keep the fed funds rate unchanged as I projected. That makes 16 Fed meetings in a row going back to March 16, 2022, when I got the Fed forecast right. Events remain uncertain from here, but it’s so far, so good for my forecasting.

by Karen Kwiatkowski, Lew Rockwell:

The current US government has become “a form of fraud that … pays profits to earlier investors with funds from more recent investors” – in other words, a Ponzi scheme. No doubt the social security, Medicare/Medicaid and government retirement systems meet this definition of fraud directly. But we may also apply it to other sectors of the federal government, including how the government funds defense, conducts a vast system of student loans, or pays the interest on the federal debt.

by Dave Kranzler, Investment Research Dynamics:

I didn’t watch Jay Powell on “60 Minutes” because I knew it would mainstream media sugar-coated drivel wrapped around propaganda as the obsequious 60 Minutes anchor tossed J-Pow meatball questions. But I did learn that Powell asserted that it is unlikely that there will be another real estate led bank crisis, particular with the TBTF banks. I course, there’s no way he can honestly say that he has a clue as to the potential magnitude of CRE exposure via OTC derivatives at the TBTF’s – no one does. And Powell’s statement is certainly reminscient of when Ben Bernanke asserted that the subprime debt problem was “contained” in 2007…

by Susan Duclos, All News Pipeline:

A multi-day fire in Texas where multiple buildings at Feather Crest Farms was finally extinguished, making this just the latest in more than 100 accidents, plane crashes, explosions and fires, at food processing/manufacturing facilities since 2021.

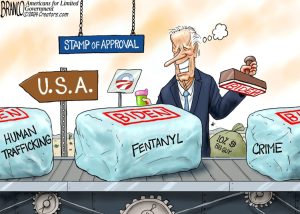

Add that to the US cattle herd shrinking to the lowest level in more than seven decades, Amish farmers still under siege by the Biden regime, war affecting food prices in multiple categories, and unprecedented amounts of food recalls, food costs 20% higher than when Biden started occupying the White House, and we have the perfect storm of events making it difficult for parents to feed themselves and their children.