by Philip Giraldi, The Unz Review:

I think the striking events we have witnessed in American society over the last few months—and especially the last few days—are best understood if we consider a shrewd observation widely misattributed to Voltaire:

To learn who rules over you, simply find out who are not allowed to criticize.

From the years of my childhood I’d always been aware that political activism and protests were a regular feature of college life, with the 1960s movement against our Vietnam War representing one of its peaks, an effort widely lauded in our later textbooks and media accounts for its heroic idealism. During the 1980s I remember seeing a long line of crudely constructed shanties protesting South African Apartheid that spent weeks occupying the edges of the Harvard Yard or perhaps it was the Stanford Quad, and I think around the same time other shanties and protesters at UCLA maintained a long vigil in support of the Jewish Refusedniks of the USSR. Political protests seemed as much a normal aspect of college years as final exams and had largely replaced the hazing rituals and wild pranks of traditional fraternities, which were increasingly vilified as politically incorrect by hostile social censors among the students and faculty.

Not to overly dwell — let alone predict — by subject title, however if we search our recollect (thank you Ken Starr), was it not by this time a year ago that we’d witnessed a few banks go? Whilst not first, First Republic failed. And now a year hence, Republic First has failed. How palindromic its that? Or from the “What’s in a Numerological Name Dept.” ought we now be concerned about Old Second National, or dare we say, Fifth Third? (Not to panic as both those two institutions appear quite solvent, whereas New York’s Fourth National went defunct 110 years ago, but we digress…)

Not to overly dwell — let alone predict — by subject title, however if we search our recollect (thank you Ken Starr), was it not by this time a year ago that we’d witnessed a few banks go? Whilst not first, First Republic failed. And now a year hence, Republic First has failed. How palindromic its that? Or from the “What’s in a Numerological Name Dept.” ought we now be concerned about Old Second National, or dare we say, Fifth Third? (Not to panic as both those two institutions appear quite solvent, whereas New York’s Fourth National went defunct 110 years ago, but we digress…) The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that

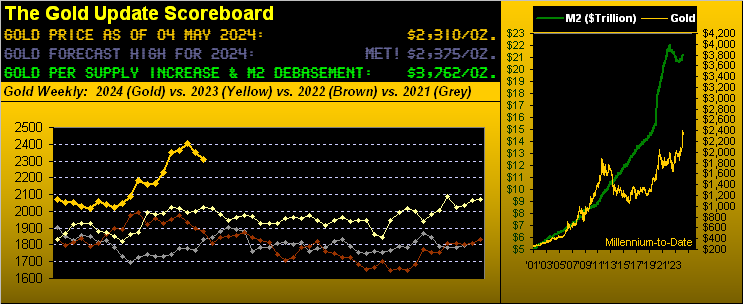

World reserve status allows for amazing latitude in terms of monetary policy. The Federal Reserve understands that there is constant demand for dollars overseas as a means to more easily import and export goods. The dollar’s petro-status also makes it essential for trading oil globally. This means that the central bank of the US has been able to create fiat currency from thin air to a far higher degree than any other central bank on the planet while avoiding the immediate effects of hyperinflation.

World reserve status allows for amazing latitude in terms of monetary policy. The Federal Reserve understands that there is constant demand for dollars overseas as a means to more easily import and export goods. The dollar’s petro-status also makes it essential for trading oil globally. This means that the central bank of the US has been able to create fiat currency from thin air to a far higher degree than any other central bank on the planet while avoiding the immediate effects of hyperinflation. Who could have seen this coming?

Who could have seen this coming?