from Arcadia Economics:

TRUTH LIVES on at https://sgtreport.tv/

by TheDarkMan, The Duran:

Cheques (or checks in American parlance) have been with us a long time. Although they take a while to clear, they are safer to use than cash, especially for large purchases. At one time, ordinary people, especially women, would not be issued with chequebooks by their banks. Cheques have two big advantages over cash. If you sign a cheque for a thousand dollars then lose it or it is stolen, you simply put a stop on it with your bank whereas if you lose cash, it’s usually gone forever. Cheque payments can also be traced, so again, they are safer than cash.

by Jeffrey Tucker, Daily Reckoning:

There was an oblique message buried in a recent New York Times story on the growing crisis in commercial real estate in cities.

Yes, this is exactly the kind of article that people pass over because it seems like it doesn’t have broad application. In fact, it does.

It affects the core of issues like our city skylines, how we think about urbanism and progress, where we vacation and work and whether the big cities are drivers or drains on national productivity.

by Pam Martens and Russ Martens, Wall St On Parade:

Yesterday, the Dow Jones Industrial Average took a tumble of 361 points by the closing bell. Numerous headlines attributed the big decline to a weakening economy in China. But the actual trigger for angst among traders was a headline at 5:30 a.m. EDT yesterday at CNBC. The headline read: “Fitch warns it may be forced to downgrade dozens of banks, including JPMorgan Chase.”

JPMorgan Chase is not just the biggest bank in the United States in terms of assets and deposits. It is the biggest bank in terms of its derivative exposure. According to the federal regulator of national banks (those operating across state lines), the Office of the Comptroller of the Currency (OCC), as of March 31, 2023, JPMorgan Chase Bank had assets of $3.2 trillion and derivative exposure of more than $59 trillion notional (face amount).

by Ava Grace, News Target:

The Russian government is exploring the creation of a strategic Bitcoin reserve to enhance the country’s financial stability amid economic sanctions and global financial unpredictability.

Russia argues a Bitcoin reserve is immune to international sanctions and offers an alternative to traditional currency reserves that are subject to inflation and geopolitical pressures.

What is happening? Dollar Tree is now $7 Tree and now this.

Inflation is radically transforming the world we live in, faster than I’ve ever seen before. https://t.co/6lPS6lrDiQ

— Open Mike

(@mikeCAburritos) April 5, 2024

by Alasdair Macleod, Schiff Gold:

The writing of this market report was at a time of great volatility, due to it coinciding with the speech of the Hezbollah leader, Hassan Nasrallah. The drift of it appears to be that Hezbollah will support Hamas. If so, it means an intensification of the Palestinian crisis Which would presumably drive gold and silver prices higher. This market report should be read in this context.

The writing of this market report was at a time of great volatility, due to it coinciding with the speech of the Hezbollah leader, Hassan Nasrallah. The drift of it appears to be that Hezbollah will support Hamas. If so, it means an intensification of the Palestinian crisis Which would presumably drive gold and silver prices higher. This market report should be read in this context.

by Kerry Lutz, Financial Survival Network:

John Rubino returns… Blow-out jobs report means interest rates have to rise. 10-year Treasury broke 4% this morning. In the past two bubbles interest rates rose along with stocks until the markets broke. We’re repeating that pattern. The Big Toy indicator is flashing: RV and Rolex sales down. Commodities getting whacked. Are we in a bear market? France is burning. A sign of the future? Quality of life in our major cities is rapidly declining. The Supreme Court is issuing some big rulings. What does that mean?

TRUTH LIVES on at https://sgtreport.tv/

by Mish Shedlock, Mish Talk:

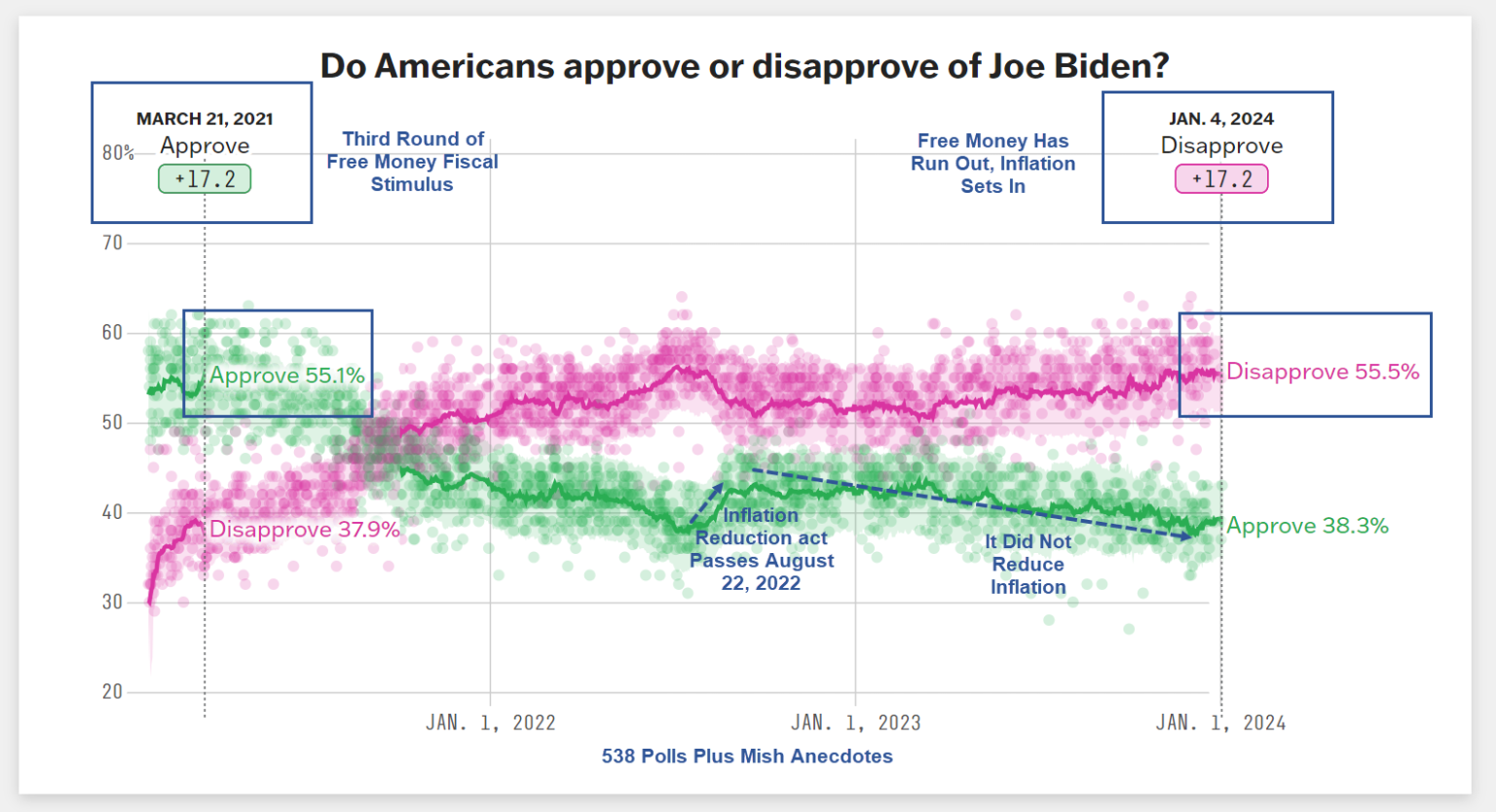

The third and largest round of fiscal stimulus was in March of 2021. That’s when Biden’s popularity peaked at 55.1 percent.

The third and largest round of fiscal stimulus was in March of 2021. That’s when Biden’s popularity peaked at 55.1 percent.

Base image from 588 Biden Approval Ratings.

Why Biden’s Approval Rating Is Miserable

Income is rising and so are wages. Even real income is up. But real wages are another matter.

from Nomad Capitalist:

TRUTH LIVES on at https://sgtreport.tv/