by Jim Rickards, Daily Reckoning:

The stock market has topped out and is headed down.

The Dow Jones Industrial Average peaked at 45,014 on December 4, 2024, and was at 41,911 by March 10, 2025, down 3,101 points or 6.9% in just over three months.

The S&P 500 Index peaked at 6,130 on February 18, 2025, and was at 5,614 on March 10, 2025, down 516 points or 8.4% in less than one month.

The NASDAQ Composite Index peaked at 20,174 on December 16, 2024, and was at 17,468 on March 7, 2025, down 2,706 points or 13.4% in less than three months and technically a market “correction” (defined as a 10% or more decline from a previous peak).

TRUTH LIVES on at https://sgtreport.tv/

None of those index performances is a full-blown crash nor do they represent a market panic. Stock market indices are volatile, and they may partially bounce back by the time you read this. Still, down is down. We have to look at the reasons for this and use our predictive analytical techniques to see where the markets go from here.

A Crash Can Be Profitable

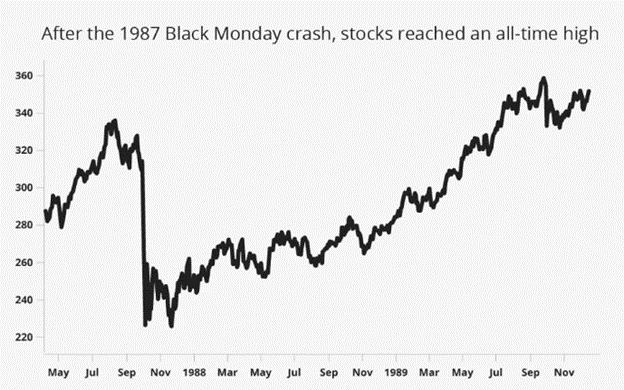

While investors worry about a market crash such as a one-day crash of over 20% (this happened on October 19, 1987) or a one-month crash of over 30% (this happened in March 2020), those are not necessarily the worst outcomes for investors.

The losses from the 1987 crash were almost 60% recovered in two trading days and were 100% recovered in less than two years. Losses from the 2020 crash were fully recovered in four months making it the fastest recovery of any crash in the past 150 years. Buying stocks in the aftermath of a crash can turn out to be a very good trade.

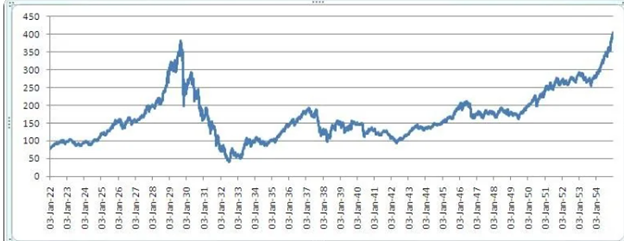

To be clear, not every crash has such a rosy recovery. The 1929 stock market crash took 25 years to recover from its 1932 low. Stocks took 6 years to recover from the 2000 dot.com crash.

A Long Slow Grind Down Is Worse

What is worse than a crash and quick recovery is a long, slow grind down. That does not mean a one-day crash of 10% or more. It could mean a slow grind down perhaps 20% or 30% over six months or even longer. A quick crash can recover quickly. With a slow grind, many investors tell themselves it will come back or “buy the dips” or hang in there. Then it will grind down some more until the retail investor finally capitulates with large losses.

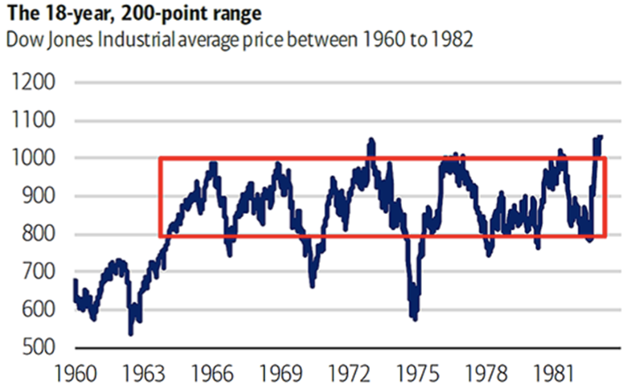

The most striking example of this is the stock market behavior during the lost decade of the 1970s. The Dow Jones hit an all-time high over 1,000 in 1969. From there, stocks fell during the 1969 recession, rallied in the early 1970s, crashed again in 1974, rallied back and then fell sharply in the 1981-82 recession. In fact, from 1960 to 1982, the Dow stayed in a 200-point range for 18 years!

Stocks leveled off with the Dow around 800 in 1982 at which point a rally began and the Dow again hit 1,000 for the first time since 1969. In terms of index points, stocks took 13 years to regain the old high despite volatility along the way. Adjusted for inflation, the new high of 1,000 was worth only 50% of the 1969 high in real terms. While waiting for the index to recover, investors permanently lost half their money in terms of purchasing power. That 13-year episode is what we mean by a long, slow grind down.

Will The Fed Ride to the Rescue?

The Fed actually doesn’t care about the stock market unless it becomes “disorderly.” We’re not there yet. Down is not the same as disorderly. If markets crash as they did in March 2020, the Fed probably will activate the Powell Put and cut rates. But the Fed won’t do anything specific to help stocks in the slow grind scenario. That’s not their job.

The Fed will “pause” again at their next meeting on March 19. There will be no rate cut and no rate hike. The Fed did cut rates beginning last September, but they paused the rate cut cycle in January. The Fed doesn’t turn on a dime. Even though inflation cooled lower than expected in this morning’s inflation report, the Fed need to see a few months of evidence that inflation is under control and unemployment is the bigger problem.

The Fed will return to rate cuts by their May meeting but not yet. Fed Chair Jay Powell will focus on the dual mandate of low unemployment and price stability. He’s required to do so by law. But the Fed can juggle which part of the mandate (jobs or inflation) takes precedence at any point in time.

Lower Rates: Be Careful What You Wish For

Trump says he wants lower rates, but he won’t intentionally sacrifice the stock market to get them. Still, stocks and bond yields may both go down on their own for reasons having very little to do with Trump or the Fed and everything to do with slower growth and possible recession in the U.S. When stocks go down, Trump will simply blame the Fed for not cutting rates more and sooner.

Rates going down is a case of “be careful what you wish for.” Most people think of lower rates as “stimulus.” They’re not. Lower rates are associated with depression and recession. In a strong economy, rates actually go up a bit because higher returns are available, and entrepreneurs compete for funds.

Right now, the signs of recession in the U.S. are everywhere. The Federal Reserve Bank of Atlanta GDPNow tracker just collapsed. Its Q1 forecast for GDP growth was +2.3% (annualized) on February 26. By March 7, it showed -2.4%. That’s a shocking decline in growth and a shocking collapse of 4.7 percentage points in just over a week.

Read More @ DailyReckoning.com