by Ronan Manly, Gold Seek:

With the price of gold rocketing and with gold re-establishing itself as the leading monetary reserve asset for central banks worldwide, the quantities of physical gold held by each central bank and the locations of those reserves are becoming increasingly critical questions.

While most have heard of the Bank of England’s fabled gold vault in London and the New York Fed’s deep underground gold vault in Manhattan — both preferred storage facilities for central banks — did you know that four central banks from Europe claim to store a substantial amount of gold with the Bank of Canada in Ottawa?

TRUTH LIVES on at https://sgtreport.tv/

These are the central banks of the Netherlands, Switzerland, Sweden and Belgium, known respectively as De Nederlandsche Bank (DNB), the Swiss National Bank (SNB), the Swedish Riksbank, and the National Bank of Belgium (NBB). And the amount of gold that these four central banks claim to hold in Ottawa is not insubstantial, totaling approximately 270 tonnes.

Like nearly everything in the opaque and secretive world of central bank gold, these four central banks had been, for many years, quietly keeping their heads down, never revealing that portions of their national monetary gold holdings were supposedly being stored in Ottawa.

But then a perfect storm of factors aligned that forced them to break the secrecy, factors which interplayed and triggered increased expectations for gold holdings transparency — the Great Financial Crisis of 2007–2009 which intensified scrutiny on central banks; the European Debt Crisis of 2010–2012 which spurred demands for transparency in monetary reserves; political pressure and calls from state auditors for gold holdings disclosure; public activism pushing for gold repatriation and domestic gold storage; and finally the German Bundesbank’s high-profile decision that emerged in 2012 to repatriate some of its gold from storage in New York and Paris.

Swiss, Dutch, Swedish and Belgian

In the case of the Netherlands central bank (DNB), the trigger to reveal the location of its gold reserves came from Dutch members of parliament who in December 2012, noticing that the German Bundesbank was being pressured into explaining if its enormous gold holdings at the New York Fed were actually there, forced the then Dutch finance minister Jeroen Dijsselbloem to reveal that 51% of the DNB’s 612 tonnes of gold was claimed to be held at the New York Fed, 20% of the gold at the Bank of Canada in Ottawa (i.e. 122.5 tonnes), 18% at the Bank of England in London, and the rest stored domestically in the Netherlands.

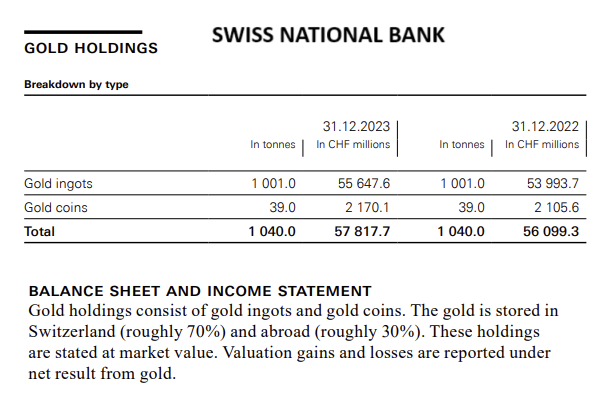

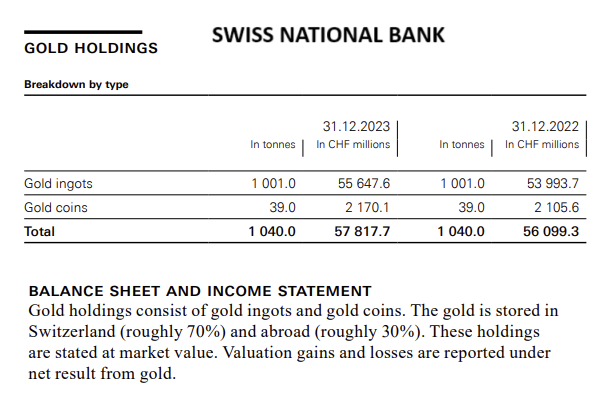

In the SNB’s case it was the “Save Our Swiss Gold” campaign, a national referendum initiative that spanned 2013 — 2014 which among other things called for a ban on SNB gold sales and the repatriation of all Swiss gold reserves stored abroad. In fighting this referendum, which it was successful in doing, the SNB’s then president, Thomas Jordan, in April 2013 was forced to reveal the previously confidential information that only 70% of the SNB’s 1040 tonnes of gold reserves were held in Switzerland, with 20% of the gold held at the Bank of England, and 10% of the gold held with the Bank of Canada in Ottawa (equivalent to 104 tonnes).

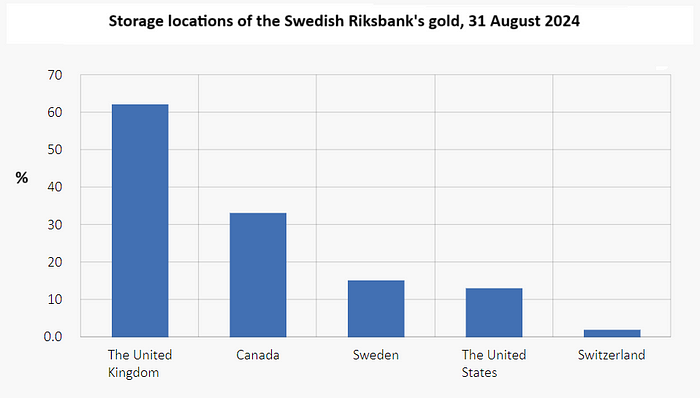

In October 2013, the Swedish Riksbank, up until then secretive about where its gold was located, also revealed that just under half of its 125.7 tonnes of gold was stored at the Bank of England, with another 33.2 tonnes (26.4%) stored with the Bank of Canada in Ottawa, and the rest stored at the New York Fed (10.5%), Swiss National Bank (2.2%), and domestically at the Riksbank (12%).

While the Riksbank at the time said that its new found openness was “part of the Riksbank endeavours to be as transparent as we can”, the real triggers for the Riksbank revelation were peer pressure from other European central banks (for example, in neighbouring Finland, the Finnish central bank revealed the location of its gold reserves during the same week as the Riksbank), and of course the by then in progress German Bundesbank gold repatriation operation from Paris and New York which began in 2013.

Turning to Belgium, following a series of parliamentary questions put to the Belgian Minister of Finance, Koen Geens, during the March 2013 period about the storage locations of the NBB’s gold (in light of the move by the Bundesbank to repatriate some of its gold), Geens reluctantly revealed that of the 227.5 tonnes of gold held by the National Bank of Belgium (NBB) “the largest part of the gold stock of the NBB is held at the Bank of England. A much smaller quantity is held at the Bank of Canada and the Bank for International Settlements (BIS). A very limited quantity is stored at the National Bank of Belgium.”

While this answer did not state how much NBB gold was stored in each location, other media reports from 2014 stated that the NBB held 200 tonnes of gold in London. That being the case, if just less than half the remaining was held by the Bank of Canada (with the rest held by the BIS and domestically by the NBB), that would imply approximately 13 tonnes of Belgian gold claimed to be held in Ottawa.

More than 270 Tonnes of Gold

Adding together all the Swiss, Dutch, Swedish and Belgian gold claimed to be held at the Bank of Canada in Ottawa yields the following: 10% of Swiss gold holdings of 1040 tonnes = 104 tonnes; 20% of Dutch gold holdings of 612.5 tonnes = 122.5 tonnes, Swedish gold 33.2 tonnes; Belgian gold 13 tonnes; for a grand total of 272.7 tonnes, which would be approximately 8.768 million troy ozs of gold, and if in the form of Good Delivery gold bars (400 oz bars) would equate to 21,816 gold bars.