by Richard Mills, Ahead Of The Herd:

Gold’s rally, which started in mid-February, has been underpinned by increased geopolitical risks, the upcoming US election, central bank buying, and slowing ETF sales. It last traded at $2,744 an ounce, up 37% so far in 2024.

But silver has done even better, notching a YTD gain of 46%. Spot silver is now worth $33.67, as of Monday, 20:30 New York time. Last Tuesday it hit $34, the highest level since 2012.

TRUTH LIVES on at https://sgtreport.tv/

Silver looks ready to rip — Richard Mills

Silver has benefited mostly due to physical buying in India and China. So-called “paper silver” has also been a factor. In July, two months of outflows reversed to inflows.

The Globe and Mail reported on Monday the 28th that silver ETFs saw the strongest rise amongst precious metals exchange-traded funds, with the iShares Silver Bullion ETF (SVR) and Purpose Silver Bullion Trust ETF (SBT.B) posting last week gains of 3.40% and 3.96% respectively.

October has been the best month on record for gold ETFs.

Source: Kitco

Price revisions

After silver struck a near 12-year peak on Monday, Oct. 21, Citi Research revised its six to 12-month forecast for silver prices upward to $40 per ounce from $38/oz.

UBS Bank is also bullish on silver, with the caveat that the gold-silver ratio rose above 85:1 (1 gold ounce to 85 silver ounces) in September after hitting lows of around 73X in May. (The higher the ratio, the more silver is considered to be undervalued compared to gold.)

“Despite this, we maintain our view that silver is set to benefit from a rising gold price environment, which is aligned with Fed policy easing,” analysts at the bank said. “Our expectation that the silver market will remain in deficit over the coming years implies continuous declines in above-ground inventories, which should help fundamentally underpin prices as well as act as a tailwind for investor interest.”

“We see silver outperforming gold over 12 months, with the potential for its ratio to test the long-term average of just below 70X.”

Banks face billions in losses

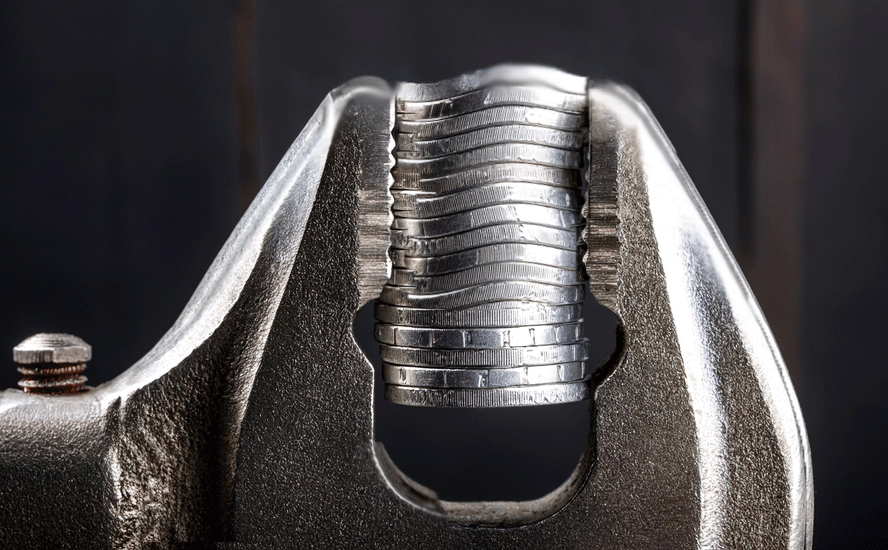

The unexpected price surge has put five US banks at risk of substantial losses due to their large silver short positions.

A “short squeeze” refers to a situation where an individual or legal entity sells an asset in the future without owning it first, in the hope of buying it back later at a lower price to make a profit. However, if the price of this asset increases instead of falling as expected, this individual or legal entity is forced to buy it quickly to honor the delivery of their forward sale. This hasty buying movement then contributes to accentuating the rise in prices — Goldbroker.com, ‘A Massive Short Squeeze on Gold’, Oct. 28, 2024

The Commodities Futures Trading Commission reported last week, via Yahoo Finance, that open interest in silver futures contracts has reached 141,580 contracts, each representing 5,000 ounces.

This amounts to approximately 707.9 million ounces, nearly equaling a year’s global silver production. With silver prices increasing by $1.84 per ounce, these short positions are now estimated to be underwater by $1.3 billion.

“This behavior undermines market integrity and could have far-reaching consequences for both the financial sector and industries that depend on stable silver prices,” said The Silver Academy.

The concentration of these short positions among just five U.S. banks has raised concerns among industry analysts. Critics argue that this level of short-selling artificially depresses silver prices, despite strong industrial demand from sectors like electric vehicles and solar panels.

Read More @ AheadOfTheHerd.com