by Chris Marcus, Gold & Silver Daily:

It was another historic day in the gold and silver markets, in a year that’s been full of historic days, and now has the BRICS Summit coming up next Tuesday.

The December gold futures closed $29 higher on the day at $2,736, which of course is another new all-time record high.

Meanwhile, the silver price rose a stunning $2.15 to finish the week at $33.92, a new high for silver on the year, and the first time silver has risen more than $2 in a day since the Silver Squeeze of 2021.

TRUTH LIVES on at https://sgtreport.tv/

Yet another significant aspect to the large moves is the timing, as this is happening with the Summit now only a few days away.

Pepe Escobar, who has been reporting on potential BRICS plans for a gold-backed payment settlement currency, shared an update today in which he suggested to be prepared for “big news coming next week from Kazan.”

So far everything else he has reported in regards to the BRICS plans has either occurred, been verified, or remains on track as a legitimate possibility. And this latest comment indicates that he’s still expecting substantive updates to be released at the Summit.

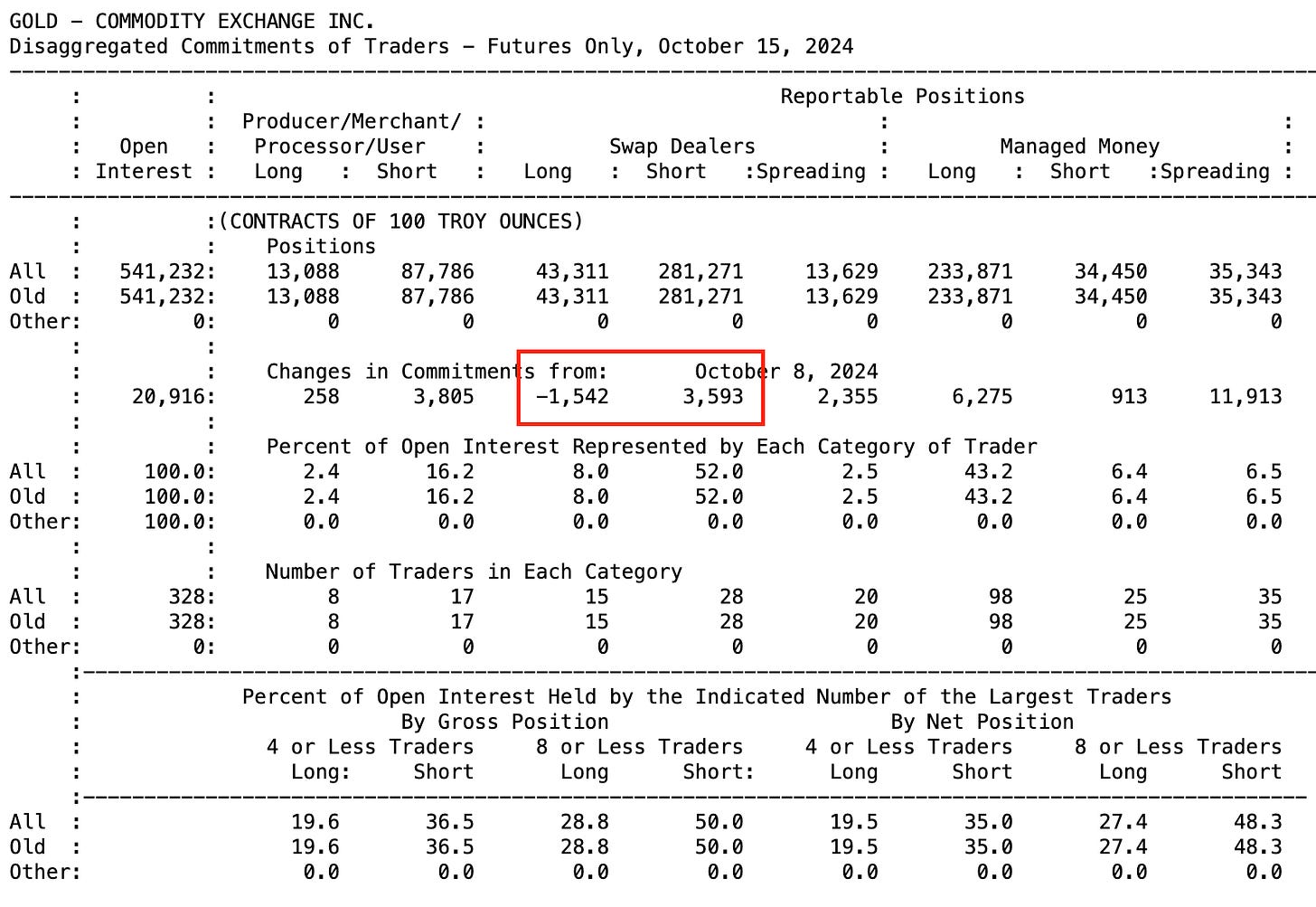

Also of note is that the latest COT report released on Friday showed that the banks (swap dealers) once again increased their gold short position, this time by 5,135 contracts, just a week after reducing it by over 19,000 contracts.

And while the banks’ gold short position is slightly off the record high set 2 weeks ago, it’s still historically large, as has been the case throughout much of this year’s rally.

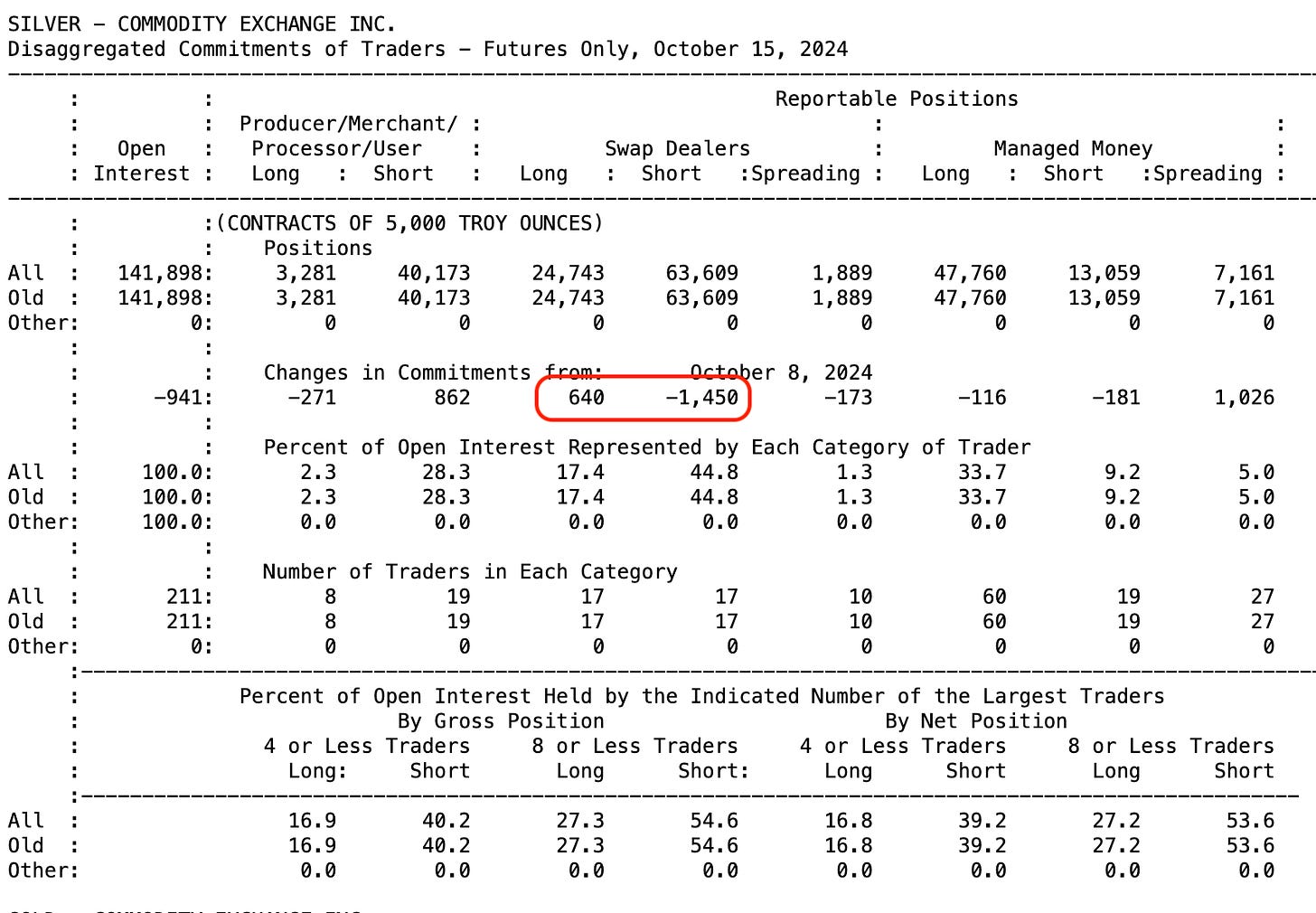

In silver, the banks actually reduced their short position over the past reporting week. Although the 4 largest traders remain short over 278 million ounces of silver, in a market where the mine supply will likely come in at around 820 million ounces, and the overall market is expected to run one of the largest deficits yet.

This means that on days like today, some of these banks are taking large unrealized losses. And they’re also at risk of further losses if the BRICS do make an announcement of significance next week.

All of which makes it an exciting time in the gold and silver markets, especially for those who have been invested for years, or in some cases even decades.

Read More @ goldandsilverdaily.substack.com