by John Rubino, John Rubino’s Substack:

The standard silver pitch is that when gold goes up, stackers note the immense number of silver coins they can get for the price of a single gold Krugerand or Maple Leaf. Then they proceed to pile into the cheaper metal, sending its price up by multiples of gold’s subsequent percentage gains.

But this time around, gold rose for several years without lighting a serious fire under silver. Why? Well, sometimes things just take longer than they should, and the real test of a thesis is not when it works but if it works at all.

TRUTH LIVES on at https://sgtreport.tv/

By that standard, the silver thesis is holding up nicely as the metal finally starts a run. This morning it’s within a single good trading day of $33/oz, a level last tested a decade ago (Has it really been that long?? This was a lost decade for stackers).

What Now?

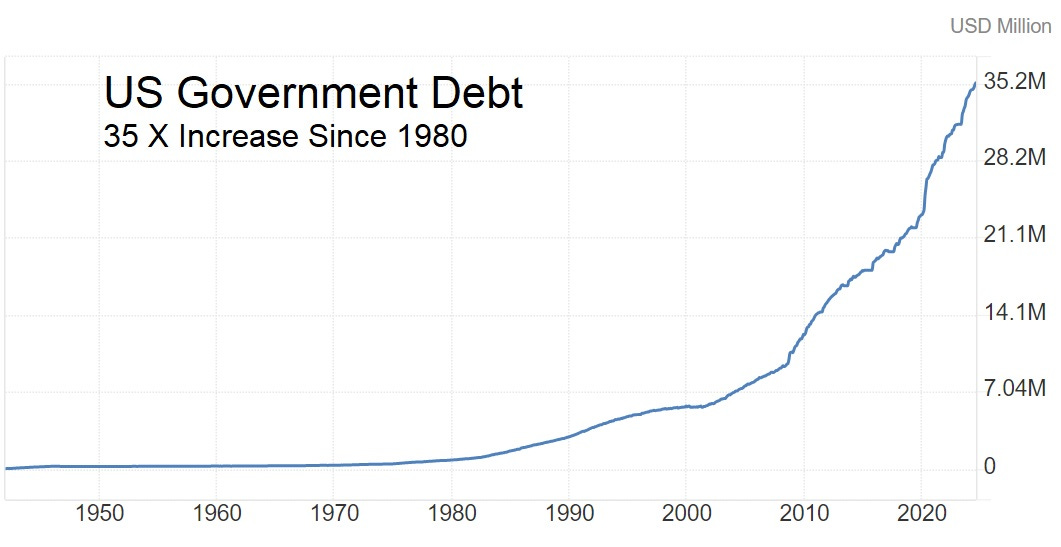

When silver last pierced $33 on the way up, it almost instantly jumped to $49. And its current story is much, much more favorable, as government debt soars…

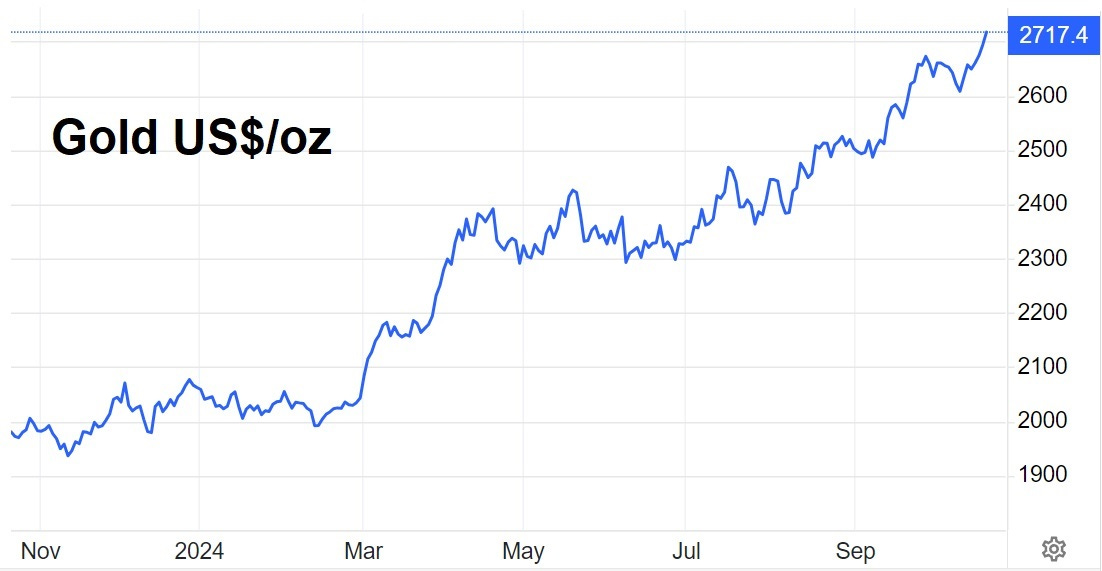

… gold continues to break records…

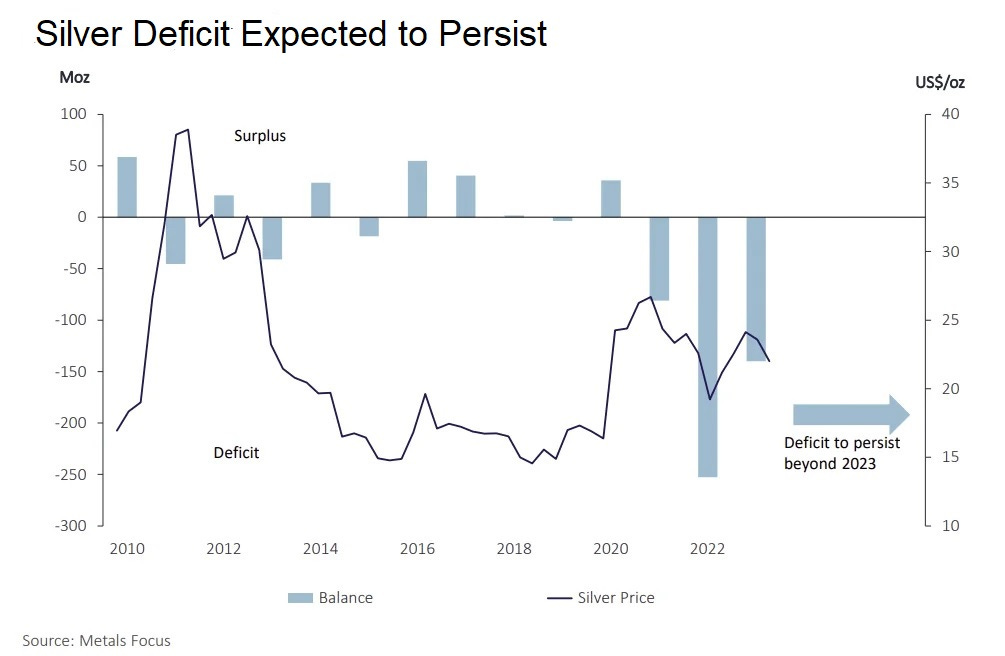

and silver’s supply/demand situation becomes downright dire:

The conclusion? No one can predict the next few weeks or months, but silver’s long-term dynamics are as good as they’ve ever been. So keep the FOMO under control but continue to add to physical holdings and high-quality miners. And get ready for a fascinating few years.

Read More @ rubino.substack.com