by Ronan Manly, BullionStar:

TRUTH LIVES on at https://sgtreport.tv/

Even if this year-to-date performance is maintained and the price stays where it is now, it would mean that 2024 will record the best annual calendar year gold price return since 2007 (when the gold price rose by 30.9%), and would be the second best performing year since the new millennium.

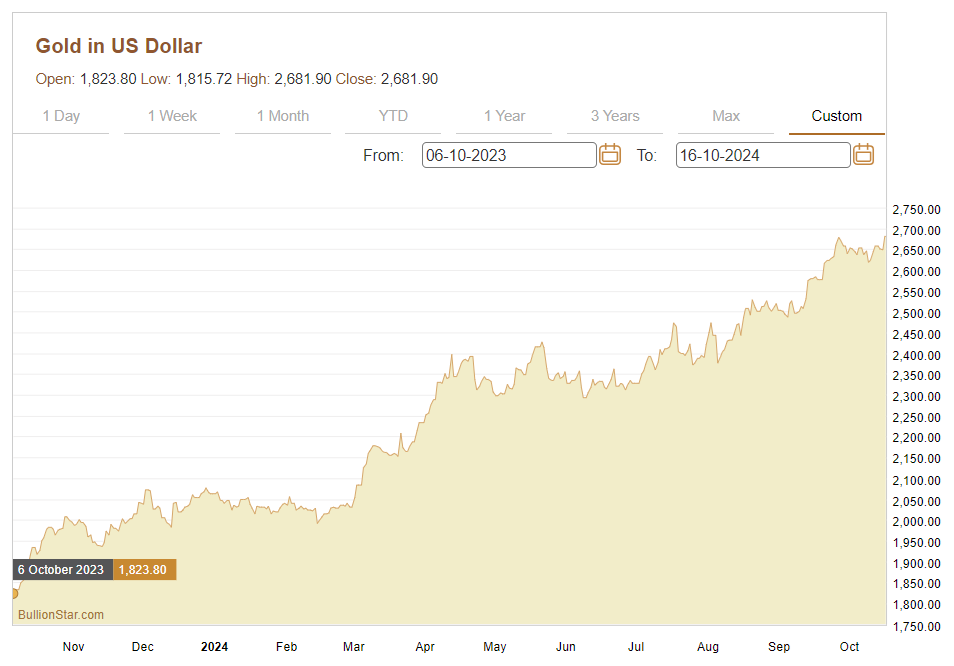

The US dollar gold price is also now up an astonishing 47.7% since 6 October 2023 when it lingered around the $1815 mark. What a difference a year makes!

Not only has the gold price broken out to all-time highs in US dollar terms, it has also broken out to all-time highs in every major fiat currency, including the Euro, British pound, Japanese yen, Chinese yuan, Swiss franc, Australian dollar, Singapore dollar, Hong Kong dollar and Canadian dollar.

The rapidity of the gold price rise since March 2024 has also been astounding, with the price surge having been driven by a combination of factors which have led investors to seek out gold as a safe haven, as a store of value and as an inflation hedge:

• Geopolitical uncertainty and conflict (particularly from conflicts in Ukraine/Russia and the Middle East)

• A monetary policy shift by the Federal Reserve and other central banks from interest rate tightening to an interest rate cutting cycle

• Increased inflation expectations and currency debasement fears

• Concerns over renewed quantitative easing, accelerating money supply growth, and an ever growing US federal debt

Additionally, due to the expectation of higher gold prices and the resulting momentum, the gold price has seen speculative trading activity on derivatives exchanges in China (the Shanghai Futures Exchange – SHFE) and on the COMEX.

De-dollarisation themes are also becoming influential in shaping investors’ perceptions of gold due to speculation about gold’s role in a future BRICS monetary system, as well as the continual moves by central banks to increase the gold component of their reserve assets, given that physical gold held in their own vaults has no counterparty risk or sanctions risk.

More and more participants in the global financial markets are thus flocking to obtain exposure to the gold price, so as to benefit from the perennial safe haven and store of value attributes which gold provides, and as a form of financial insurance and wealth preservation.

An Under-the-Radar Move

However, this gold bull move is still in some ways an under-the-radar stealth rally, and has arguably not yet gained universal investor attention.

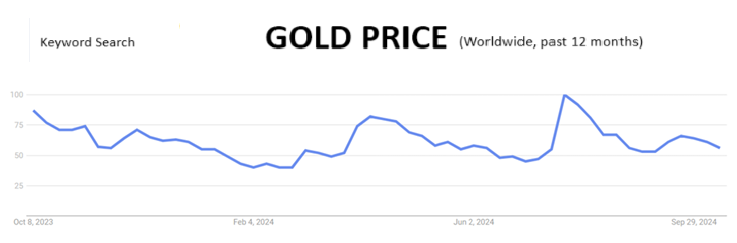

Interestingly, on a worldwide basis, the search term ‘Gold Price’ in Google Trends has actually been falling since it peaked at ‘100’ during the last week of July, and is now at ‘69’, which is even below a secondary peak which was recorded in mid April 2024 (which had a value of ‘82’). In fact, in terms of search frequency, ‘Gold Price’ as a keyword search term is now below levels recorded in early December 2023 (when it recorded a value of ‘71’).

On a country basis, the countries recording the highest search interest in ‘Gold Price’ are, not surprisingly, countries in the Middle East and South Asia / South East Asia, such as the United Arab Emirates (with a perfect score of ‘100’), Lebanon (with a score of ‘91’), Qatar (‘89’), Kuwait (‘86’), and India (‘75’). These very high scores are due to these countries either being gold trading hubs, and/or countries with traditional keen interest in gold, as well as arguably a geopolitical risk premium due to the conflicts in the Middle East.

Notably, interest in the search term ‘Gold Price’ is still anemic in the US and UK, with each having a paltry score of ‘11’ a piece, which is a useful metric showing that interest in gold in these Western nations is still nothing like a frenzy and has not been picked up by the mainstream investment community.