by Jan Nieuwenhuijs, Money Metals:

President de Gaulle of France initiated the secret operation “Vide-Gousset” and repatriated 3,313 tonnes of gold reserves from the vaults of the Federal Reserve in New York and the Bank of England in London from 1963 until 1966. De Gaulle feared America’s deficit in its balance of payments would rupture Bretton Woods and lead to a devaluation of the dollar against gold.

All France’s dollars were converted into gold, and to avoid treachery, the metal was repatriated over the course of three years. It took 44 boat trips and 129 flights to bring home more than three thousand tonnes of gold to the Banque de France in Paris.

TRUTH LIVES on at https://sgtreport.tv/

France’s decision turned out extremely well. As was foreseen by the French, the price of gold in dollars increased sharply, from $35 to $800 dollars an ounce, from 1968 until 1980—the dollar lost 96% of its value against gold. Countries that held on to their dollars were less fortunate.

More recently, after the Great Financial Crisis, the Banque de France repatriated 211 tonnes, upgraded all its bars to current wholesale standards, overhauled its vaults, revived Paris as a trading hub for institutional investors, and history repeats itself as we are in a gold bull market presently.

Introduction to Bretton Woods

At a conference in Bretton Woods, New Hampshire, in 1944, delegates from 44 allied nations forged a new international monetary system. An agreement was made on a system of fixed exchange rates and free trade. Currencies were tied to gold via the dollar, as the Federal Reserve promised to buy and sell gold at a fixed price of $35 dollars per ounce, and foreign central banks had the obligation to keep their currencies within the “par values” to the dollar1.

The greenback was seen as “good as gold” because dollars could always be converted into gold at the Federal Reserve (Fed). And thus, next to gold, foreign central banks would hold dollars as international reserves, which made the Bretton Woods system comparable to the “gold exchange standard” from before the Second World War.

The newly erected International Monetary Fund (IMF) was to supervise Bretton Woods and support countries with short-term balance of payments deficits by lending reserves. With approval from the IMF, countries could devalue (revalue) their currency in case of persistent balance of payments deficits (surpluses) to restore equilibrium.

France’s Criticism of Bretton Woods

In 1959, former General of the French military Charles de Gaulle became the President of France and sided with his most influential economic advisor, Jaques Rueff. Rueff and de Gaulle were vocal critcs of Bretton Woods and America’s “exorbitant privilige.”

Bretton Woods allowed the U.S. to pay for imports with dollars it created out of thin air, as the system inherently made foreigners need dollars as a trade, intervention, and reserve currency. Only foreign central banks could redeem dollars for gold at the Fed if the Fed allowed them to2. In addition, exported dollars caused inflation abroad as central banks were obliged to defend their exchange rates and thus had to print currency to buy dollars.

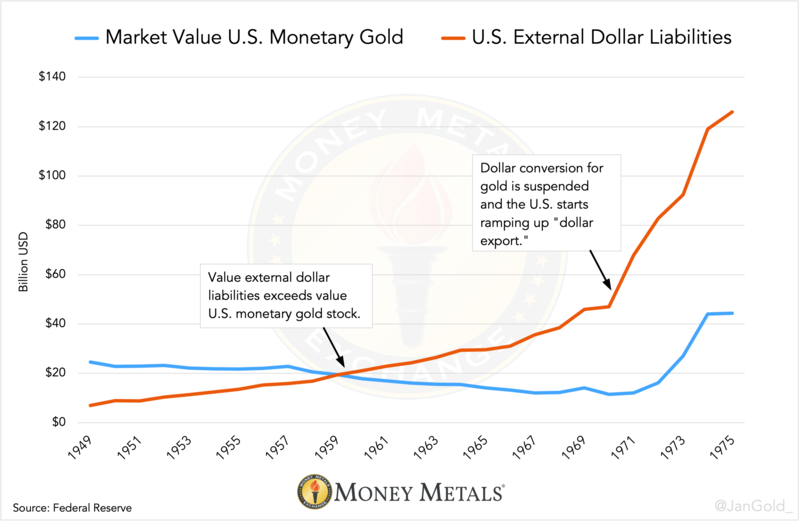

The United States was running a balance of payments deficit (more money was exported than imported) since the 1950s, which made U.S. official gold reserves decline—foreign central banks redeemed part of the imported dollars at the Fed. A tipping point was reached in 1960 when America’s external dollar liabilities exceeded its monetary gold holdings, prompting global concern regarding convertibility.

Chart 1. Instead of devaluing the dollar, which would harm the dollar’s power, the U.S. began selling of its gold, slashing their holdings from 20,312 tonnes in 1957 to 9,679 tonnes in 1968.

The Increase of France’s Gold Reserves at the Fed

In the decade from 1958 through 1968, France experienced strong economic growth and had a balance of payments surplus, generating an increase of its international reserves. In 1961, Rueff, as well as other advisors to De Gaulle, theorized that Bretton Woods couldn’t survive because central banks eventually would be unwilling to hoard dollars as the U.S. was running out of gold. The United States would be forced to either devalue the dollar against gold or suspend gold convertibility.

De Gaulle and his team painfully recalled what happened in 1931 when the U.K. devalued sterling against gold in a similar fashion, causing the Banque de France (BdF) to suffer a loss of 2.35 billion French francs, twice the size of its capital. The French Treasury (taxpayer) had to step in to bail out BdF.