from ZeroHedge:

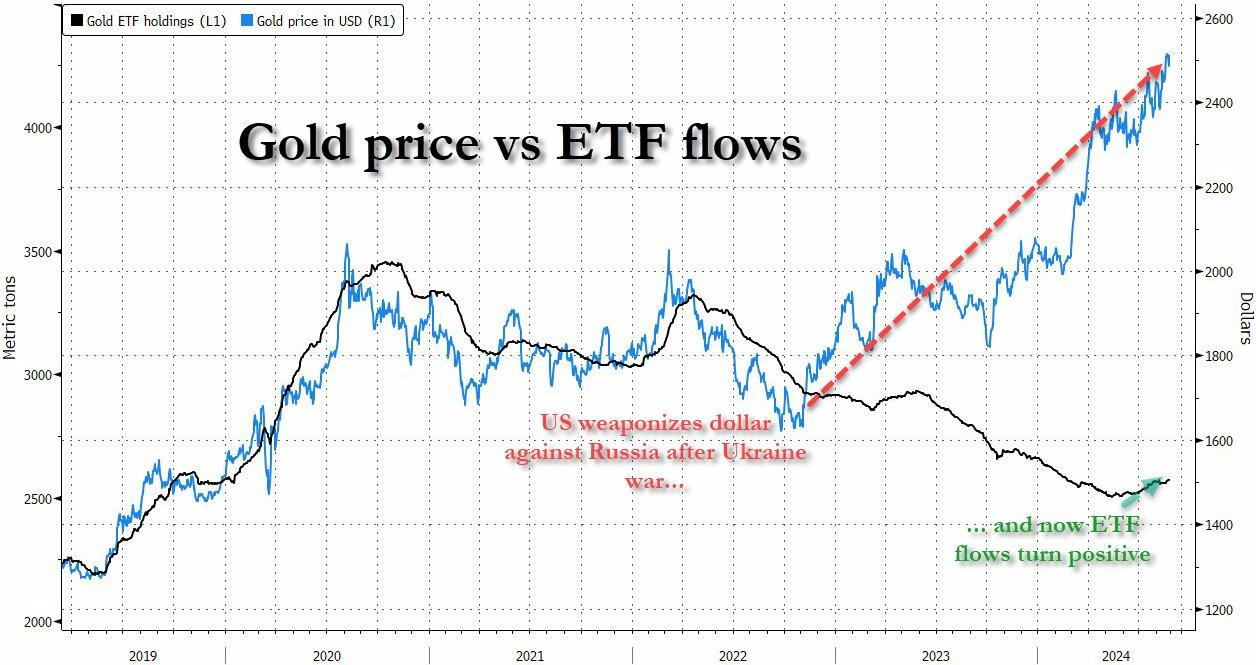

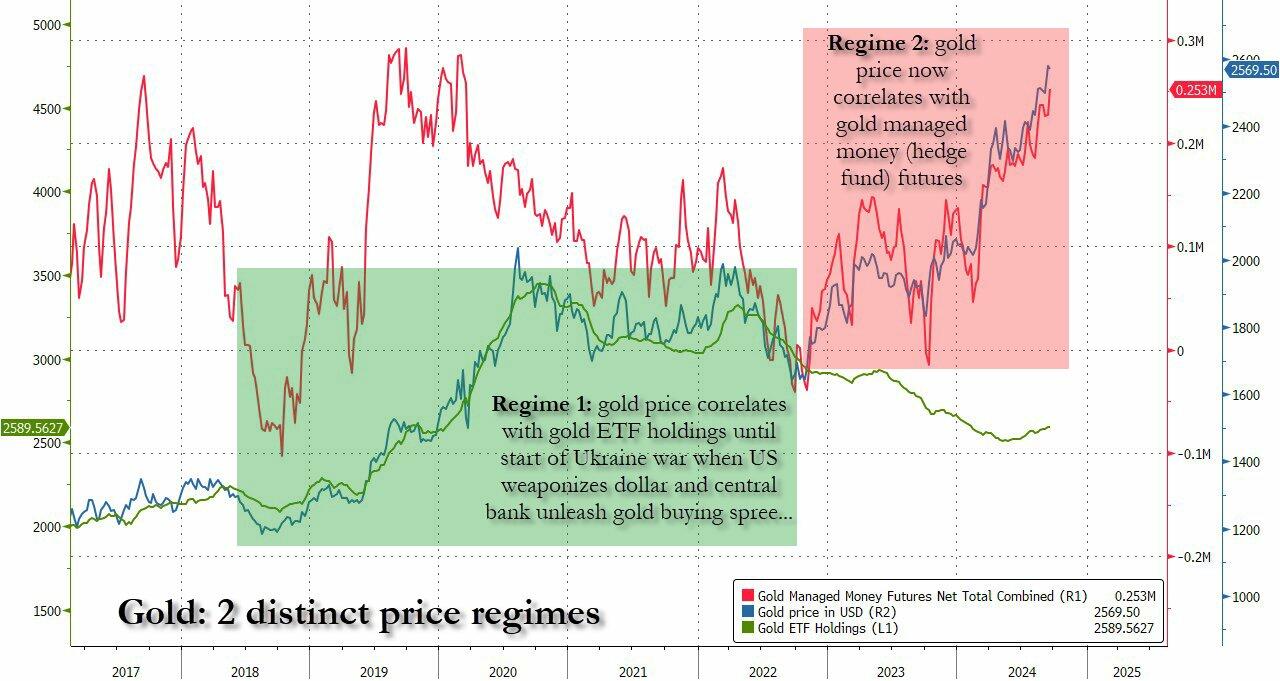

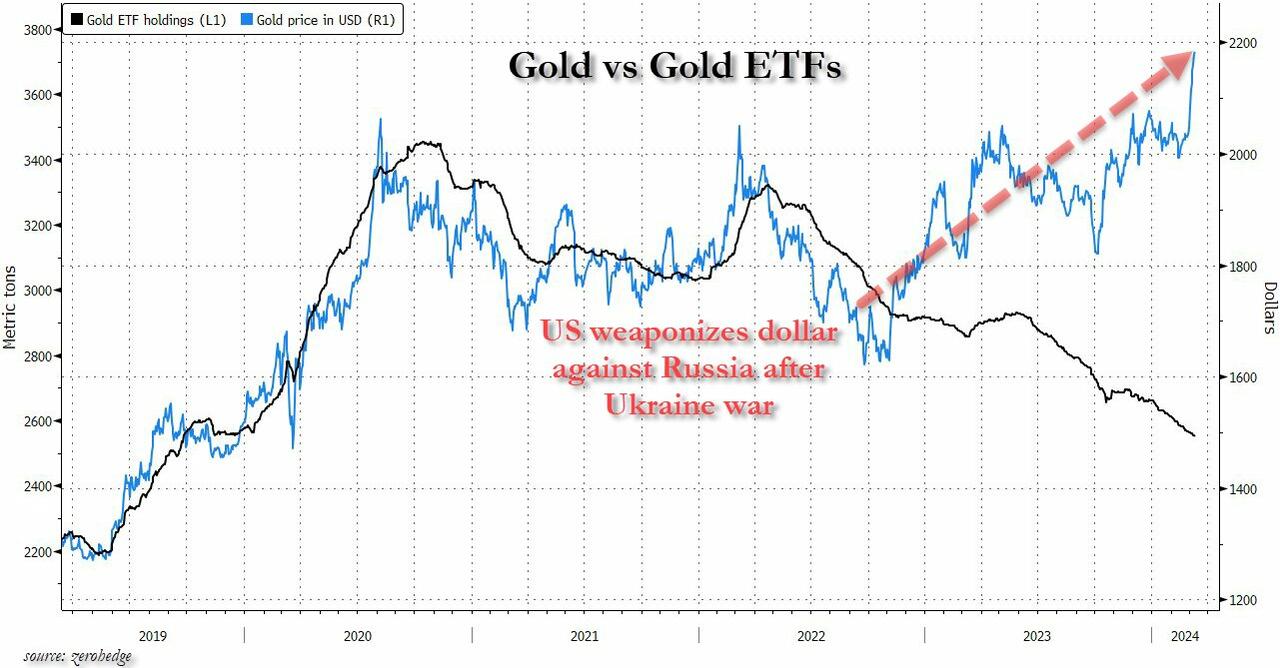

Something remarkable happened to the price of gold back in early 2022 around the time of the Ukraine war: having previously tracked gold ETF inflows to the tick, the price of gold suddenly disconnected and exploded higher even as “paper gold” as some call it, slumped. We showed this for the first time back in April with the following chart which showed the clear decoupling between paper and physical gold in 2022.

TRUTH LIVES on at https://sgtreport.tv/

A few months later, and two years after gold ETF holdings continued to drop even as the price of gold rose, it finally happened: attempts at brute gold price manipulation via shifts in ETF holdings finally ended, and with gold at all time highs, ETF flows finally turned positive, a move which we noted would send gold surging even higher (it did).

Of course, it’s not really just hedge fund buying: as we first explained back in 2022, central bank – mostly Chinese central bank – buying was the biggest driver behind gold’s (physical) decoupling with paper holdings and prices (ETFs). But while many central banks keep their purchases hidden from the public and disclose only what they want to disclose, especially in the case of the PBOC, here hedge funds – perhaps due to their ability to collect and trade on “non-public” central bank information – have become the barometer and real-time indicator of central bank purchasing. As such, spot gold prices are now directly correlating with net gold managed futures (Bloomberg ticker CFCDUMMN), as can be seen on the chart above.

But where things get interesting is that even ETF flows are now turning positive, and when combined with continued central bank buying, combined with record Indian gold imports, combined with unprecedented demand for physical in the US, no wonder that gold is hitting new all time highs day after day.

But that’s just the beginning, another reason why gold is set to soar is the Fed’s recent “recalibration”, whereby Powell launched the easing cycle with a jumbo rate cut which gold clearly thought was unnecessary, hence sending gold surging. This is how Rabobank’s Benjamin Picton put it this morning:

Gold prices traded at fresh all-time highs on Friday, closing well above the $2600/oz barrier. The rally in gold seems unstoppable at this point and resets on the all-time-high are becoming a frequent occurrence. This perhaps comes as no surprise given that the Fed wrong-footed many economists to start the easing cycle with a supersized rate cut even as growth has remained strong, inflation above target and the Federal deficit at eyewatering levels.

What was odd about the surge in gold, which has been the second best performing assets with just Bitcoin outperforming since last week’s rate cut…