by Brian Shilhavy, Health Impact News:

The Big Tech crash that I have been warning about since the last quarter of 2022, has now arrived, and it is crashing our entire economy.

It started in 2022 with the blowup of the Cryptocurrency Ponzi scheme called FTX, whose CEO now sits in prison serving a 25-year sentence for fraud and conspiracy. (Source.)

This started massive Big Tech layoffs that have continued through this year, and in March of 2023, some of the largest Big Tech Silicon Valley banks failed.

TRUTH LIVES on at https://sgtreport.tv/

But a total collapse of the U.S. financial system was averted by a new Ponzi scheme, the AI bubble that I have been warning about for over a year and a half.

Now everyone is admitting that it has been a bubble all along as investors look to dump their technology stocks as quickly as possible, as the “Magnificent 7” companies (Apple, Google, Facebook, Amazon, NVIDIA, Microsoft, and Tesla) have now lost a combined $1.28 TRILLION in market cap over three sessions. (Source.)

Original image source ZeroHedge News.

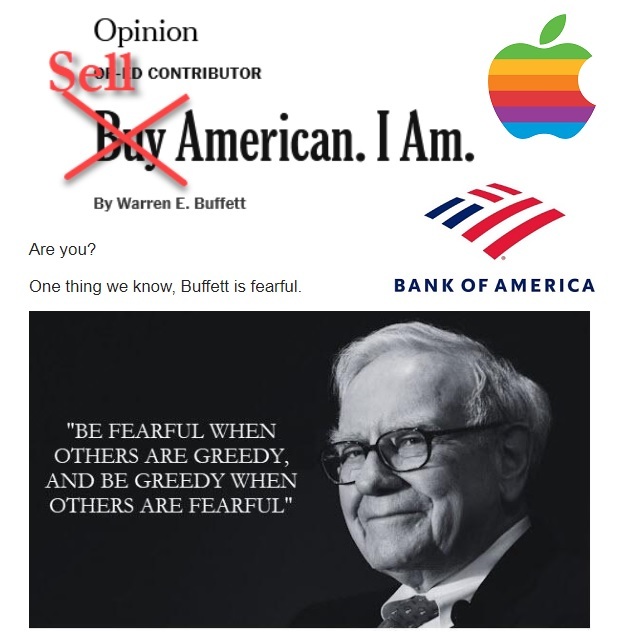

Last week it was widely published in the financial news that Warren Buffett was liquidating much of his stock in Bank of America, signaling serious trouble in the banking sector.

And then this weekend, after Friday’s stock market close, it was reported that Buffett had also been quietly liquidating shares in Apple Computers, one of his most iconic investments in the 21st Century, and for long periods of time holding the top position as America’s most valued stock.

Buffett Calls The Top: Berkshire Quietly Dumps Half Its Apple Shares Amid Unprecedented Selling Spree

When yesterday we said, when discussing Buffett’s ongoing liquidation of his Bank of America stake, that “Berkshire’s rising cash stockpiles merely reflect the firm’s inability to find deals in today’s overvalued and weak economic environment”, little did we know just how accurate that would be, because fast-forwarding just one day later we find that far from only dumping Bank of America, the 93-year-old Omaha billionaire had been busy quietly dumping his most iconic holding in an unprecedented selling spree that sent Berkshire’s cash pile soaring by a record $88 billion to an all time high $277 billion at the end of Q2.

As shown in the chart below, in the second quarter (which ended June 30, and thus just two weeks after the Apple’s Developer Conference which took place on June 10 and which was – at least on the day of – a total bust), Berkshire sold a net $75.5 billion worth of stock, the bulk of which we now know, came from Buffett’s liquidation of half his Apple shares.

While there was no 13F filed yet to go with the Berkshire’s 10Q, the company did provide a snapshot of its top holdings, revealing that as of June 30 it held only $84.2 billion in Apple stock, down sharply from $135.4 billion as of March 31 and $174.3 billion as of Dec 31, 2023. This translates into just 400 million shares of AAPL held as of June 30, down almost 50% from 789.4 million as of March 31 and 905.6 million as the end of 2023.

The rest of Berkshire’s top 5 holdings (Bank of America, American Express, Coca Cola and Chevron) was left untouched in Q2, meaning that Buffett clearly decided that it was time for Apple to go (we have since learned that subsequent to the end of Q2, Buffett also started to dump a large portion of his Bank of America shares where he is the single largest shareholder). (Full article.)

The catalyst that has seemed to kick off this latest selling spree in Big Tech with huge market losses since last week, was the Bureau of Labor Statistics (BLS) job report last week that showed fewer jobs were added to the economy in July than was expected, showing that the economy is probably now in a recession.

But ZeroHedge News has consistently reported how the BLS has been lying with their data, which they usually revise downward after the reports are released, and that almost all new jobs for the past year or so have been with migrant workers, and not U.S. citizens. This has helped fuel the stock market bubble which is mainly an AI bubble.

ZeroHedge also reported in April this year (2024) that the BLS was caught in a scandal where they were lying to the public, but sharing the real data with a secret group of Wall Street “Super Users.” See:

Scandal Rocks Biden’s Labor Dept For Lying About Sharing Non-Public Inflation Data With Secret Group Of Wall Street “Super Users”

So all of the “growth” in the economy we have been supposedly seeing since the AI boom that started at the beginning of 2023, has been based on LIES!

Many other Big Tech CEOs should also be investigated for fraud like Sam Bankman-Fried, and they should join him in prison for running a huge Ponzi scheme that has now defrauded the American public and put us on the precipice of total disaster.

Read More @ HealthImpactNews.com