by Wolf Richter, Wolf Street:

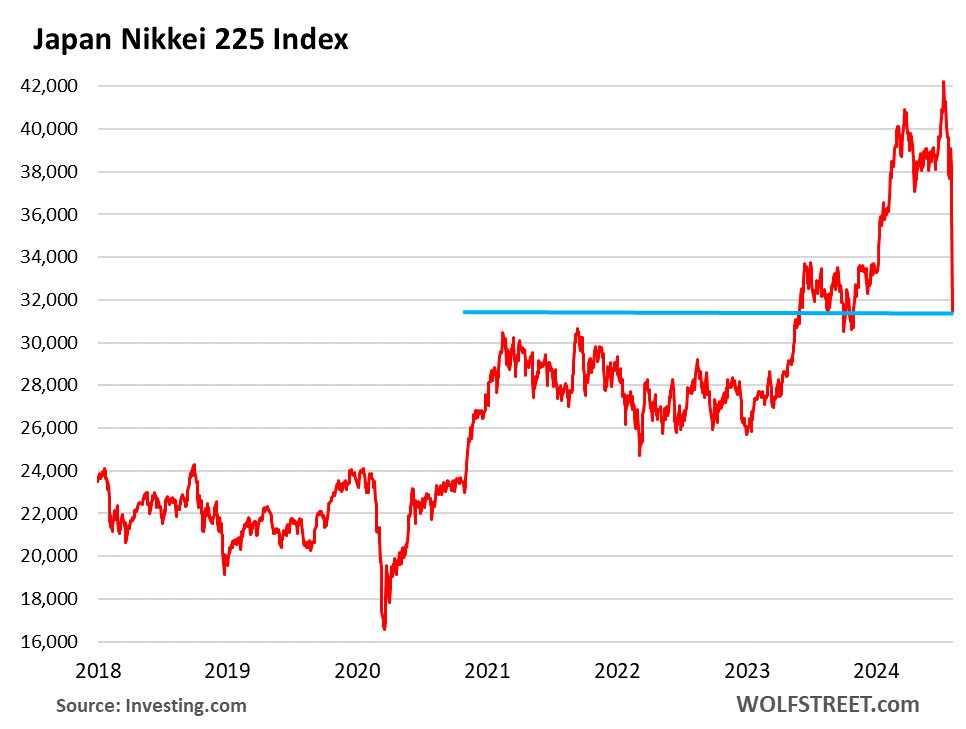

The Japanese Nikkei 225 stock index plunged 12.4% on Monday, after having plunged 5.7% on Friday, and 2.5% on Thursday, bringing the three-day drop since the Bank of Japan meeting on July 31 to 19.6%. On July 31, the BOJ announced the end of free money, a wakeup call for the free-money-addicted foreign investors.

Since the peak on July 10, over those three weeks, the index has crashed 25.5%, to 31,078 (from 42,224 on July 10).

TRUTH LIVES on at https://sgtreport.tv/

But wait… Japanese stocks had surged so much earlier this year and late last year that this three-week 25.5% drawdown only wiped out that surge since the end of October. Escalator up, elevator down. Froth is getting worked off in a short time.

But wait some more… Over the past 12 years, the Nikkei 225 has exploded by 382%, driven by massive QE by the Bank of Japan, which included large-scale purchases of equity ETFs; record share-buybacks by Japanese companies over the past couple of years; Warren Buffett’s hype about Japanese stocks in 2020 (he moves the needle with a few words) after he’d piled into the market; and massive foreign buying all along, given the lure of forever QE, and especially after Buffett’s buy-now signal.

All this has now vanished to support these dizzying price gains. Buffett is selling down his US stock holdings, including over half this Apple shares in Q2. We’re not sure what he did with his Japanese holdings, but knowing what we know about Buffett, he’s unlikely to have gotten caught up in the sell-off, and may have contributed to the selloff by getting out in recent weeks ahead of the others.

Nevertheless, this kind of plunge, amid a whiff of panic, is usually followed by a bounce, on the WOLF STREET dictum: “Nothing goes to heck in a straight line”:

The biggest losers in the Nikkei 225 Index were banks, insurers, financial firms, the largest trading company, manufacturers, and a shipping company — which shows how deep and wide the sell-off was today. These are all big old companies:

| Chiba Bank Ltd. | -23.7% |

| Kawasaki Kisen Kaisha Ltd. | -22.0% |

| Ebara Corp. | -20.3% |

| Mitsui & Co. Ltd. | -19.9% |

| Tokio Marine Holdings Inc. | -19.8% |

| Isetan Mitsukoshi Holdings Ltd. | -19.7% |

| Mizuho Financial Group Inc. | -19.7% |

| Japan Post Holdings Co. Ltd. | -19.5% |

| Resona Holdings Inc. | -19.5% |

| Nitto Denko Corp. | -19.2% |

Korea’s KOSPI index plunged 8.8% on Monday and 12.1% over the past two trading days. Since its all-time high in June 2021, the index has dropped 26%.

Among the biggest listed stocks, the semiconductor makers got crushed, for example, Samsung -10.3% and SK Hynix -9.9%. These stocks had experienced huge increases during the AI-hype rally that is now losing its hot air. For example, SK Hynix, despite the 35% plunge since July 10, is still double of where it had been at the end of 2022.

Taiwan’s TAIEX plunged 8.4% on Monday, driven by the huge semiconductor makers. Taiwan Semiconductor Manufacturing Co. (TSMC), the world’s largest semiconductor maker, plunged 9.7% in Korean trading on Monday. But in US trading today on the NYSE, the shares are recovering.

The other major Asian markets were just a little ruffled by all this drama in Japan, Korea, and Taiwan.

India’s BSE SENSEX Index fell 2.7% on Monday, and is down only 3.7% from its all-time high on Thursday.

Hong Kong’s Hang Seng dropped 1.5%. It’s down 50% from its all-time high in 2018 and back where it had first been in 1999.

China’s Shanghai Composite Index fell 1.5% on Monday and is down 53% from its all-time high in October 2007 and is back where it had first been in March 2007.

In Europe, stocks were comparatively well-behaved. The major indices dropped in the 2% range at the moment: UK’s FTSE -2.0%, the German DAX -1.8%, and the French CAC 40 -1.4%. The Italian and Spanish indices down in the 2.3% range.