by Ed Steer, Silver Seek:

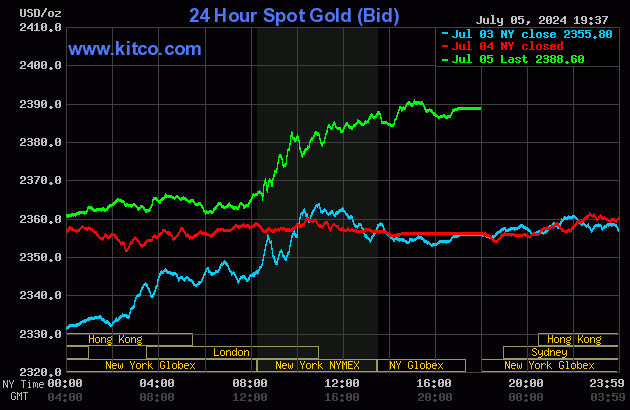

The gold price wandered/crept quietly, broadly and unevenly higher until minutes before 1 p.m. BST in Globex trading in London. Then a rally of some size erupted — and from its quiet saw-tooth pattern thereafter, it was obvious that it was running into quiet opposition all the way up until its high tick of the day was set a couple of minutes after 3 p.m. in after-hours trading in New York. Very shortly after that it had a quiet and descending down/up move that ended about fifteen minutes before the 5:00 p.m. EDT close.

The low and high ticks in gold were reported by the CME Group as $2,356.00 and $2,401.50 in the August contract. The August/October price spread differential in gold at the close in New York yesterday was $23.40…October/

TRUTH LIVES on at https://sgtreport.tv/

December was $23.90 — and December/February was $23.20 an ounce.

Gold was closed on Friday afternoon in New York at $2,388.60 spot, up $32.60 from its close on Thursday. Net volume [which includes Thursday’s] was on the heavier side at a bit under 234,500 contracts — and there were just under 57,000 contracts worth of roll-over/switch volume on top of that…mostly into December, but with very noticeable amounts into October, plus February and April of next year.

I note that 72 gold, plus a whopping 451 silver contracts were traded in July yesterday, so we’ll see what that translates into in this evening’s Daily Delivery and Preliminary Reports.

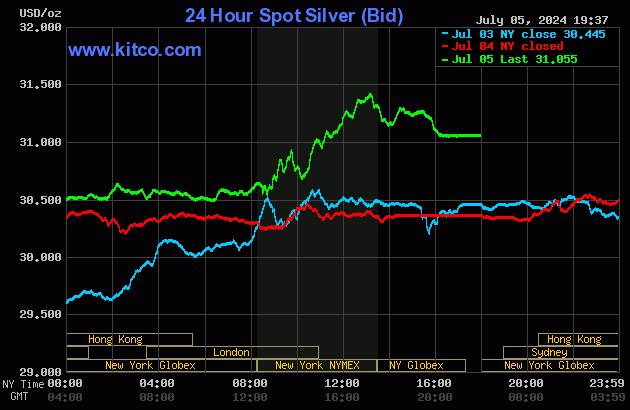

Silver’s price path was mostly similar to gold’s throughout most of the Globex trading session, except its rally didn’t get underway until precisely 8:30 a.m. in COMEX trading in New York. That choppy rally ran into ‘da boyz’ a couple of minutes before 1:15 p.m. — and they sold it unevenly lower until the market closed at 5:00 p.m. EDT.

The low and high ticks in silver were recorded as $31.79 and $30.45 in the September contract…an intraday move of $1.34 the ounce — and that’s because of an ugly but brief spike lower at exactly 8:30 a.m…something that reader Dave Draughon pointed out . The July/September price spread differential in silver at the close in New York yesterday was 30.1 cents… September/December was 45.7 cents — and December/March was 46.2 cents an ounce.

Silver was closed in New York on Friday afternoon at $31.055 spot…up 69.5 cents from Thursday — and a hefty 36.5 cents off its Kitco-recorded high tick. Net volume [which also includes Thursday’s] was about 93,500 contracts — and there were a tiny bit over 8,000 contracts worth of roll-over/switch volume out of September and into future months in this precious metal… almost all into December, but with a bit into March25 as well.

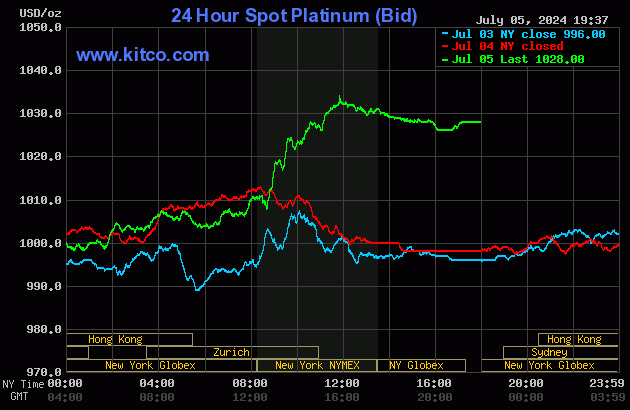

The platinum price didn’t do much until around 1:40 p.m. China Standard Time in Globex trading on their Friday afternoon. At that juncture a quiet and bit uneven rally commenced that really took flight around 8:45 a.m. in COMEX trading. The not-for-profit commercial sellers capped its price at 11:50 a.m. EDT — and from that point it crept very quietly lower until 4 p.m. in after-hours trading — and then ticked a dollar or two higher going into the 5:00 p.m. EDT close. Platinum was closed at $1,028 spot…up 30 bucks from Thursday’s close — and 6 bucks off its Kitco-recorded high tick.

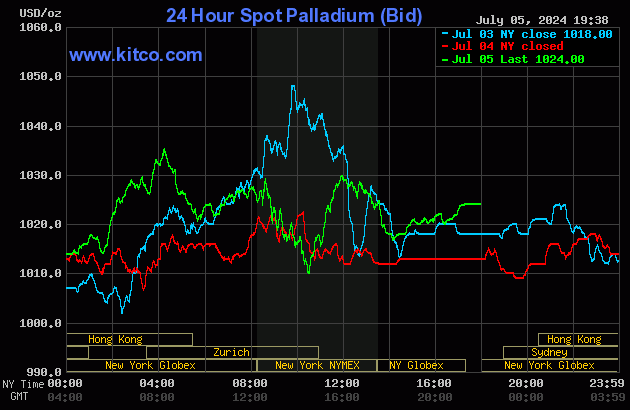

Palladium’s three rally attempts in Globex and COMEX trading were all turned lower, but it still managed to close up 11 dollars on the day at $1,024 spot…but 13 bucks off its Kitco-recorded high tick.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 76.9 to 1 on Friday…compared to 77.6 to 1 on Thursday.