by Leo Hohmann, Leo’s Newsletter:

Mega-bank JP Morgan gearing up to launch broad biometric payment system that will be made available to all retailers

Mega-bank JP Morgan gearing up to launch broad biometric payment system that will be made available to all retailers

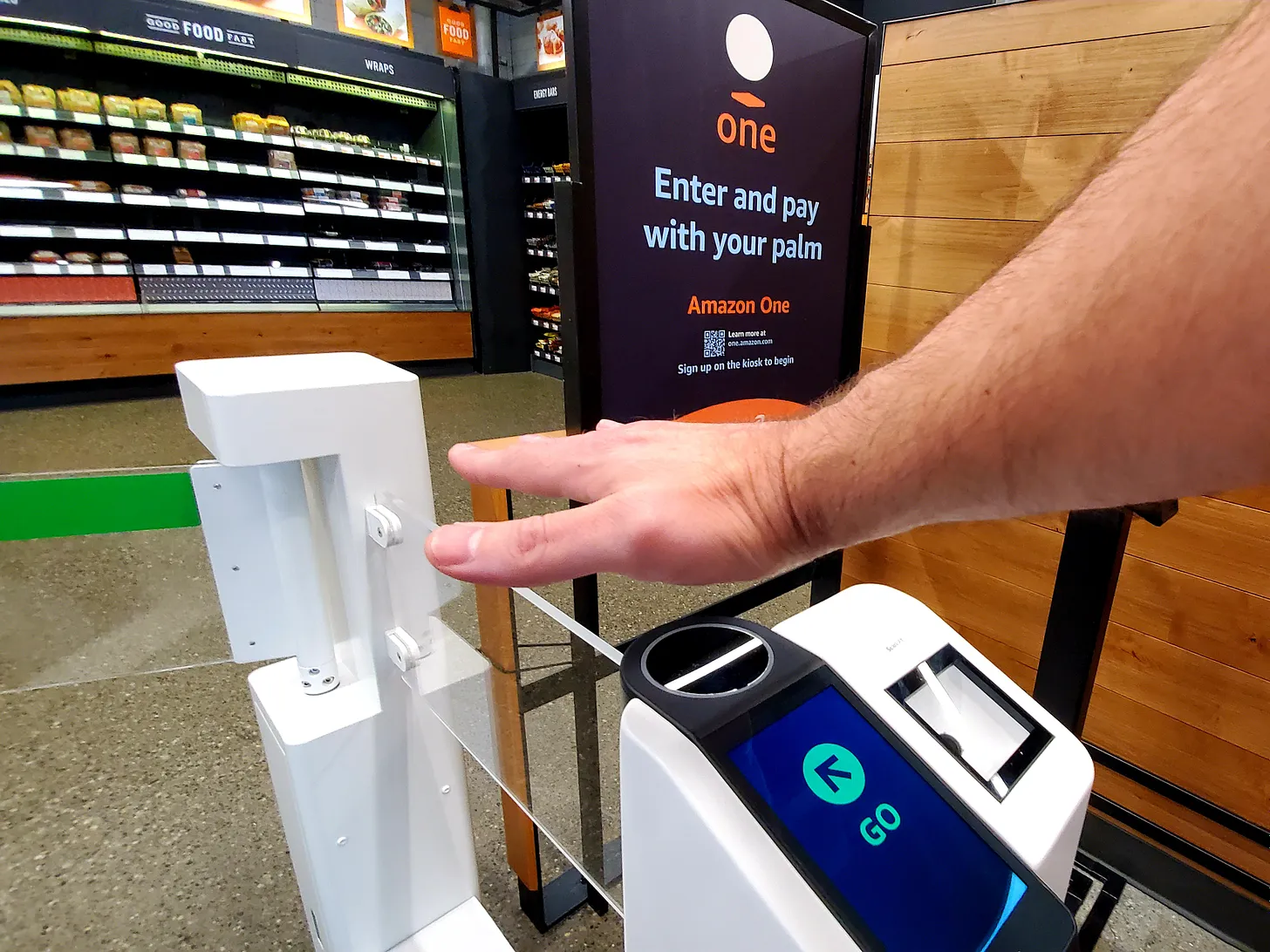

Mega-bank JPMorgan Chase is planning to rollout a biometric payment system and make it available to all U.S. retailers by early next year. This will enable shoppers to make purchases without pulling physical paper (fiat currency) or plastic (credit/debit cards) out of their wallets. All they will need to do is submit to having their palms or faces scanned upon entry into a retail store.

TRUTH LIVES on at https://sgtreport.tv/

David Birch, an advisor and commentator on global digital financial services., penned an article for Forbes last month that should be a wake-up call for anyone familiar with Bible prophecies regarding an end-times beast system that forbids anyone to buy or sell without being “marked” by some sort of tracking technology. (See Rev. 13)

In the article, Birch quotes JP Morgan’s executive director of biometrics and identity solutions, Prashant Sharma, as saying, “We would like every merchant to adopt this, but at the end of the day, it is going to be a merchant’s choice.”

Birch then goes on to explain why almost all merchants will end up choosing to go down this dystopian route and adopt the technology. Shoppers at some point may actually demand it, for the “convenience” of getting them in and out of the store faster.

Here are a few trending statistics provided in the article:

Right now just one in four Americans, 25 percent, are comfortable using a biometric hand scanner for payment. The numbers are higher in other countries, with 50% of Canadian and British consumers being open to adopting biometric payment systems.

While U.S. consumer confidence in facial-recognition biometrics “remains high” for security purposes, he said support for the use of this technology in retail settings has fallen significantly in recent years. If Americans knew just how insidious this technology is, they would not support it in any environment, whether for law enforcement and “security” purposes, or for retail purchases.

“I think, as other observers do, that these consumer attitudes are a function of familiarity, which is why they will change quickly,” Birch writes. “The more exposed consumers are to biometrics at point of sale (POS), the more comfortable they will be with this technology.”

He adds that,

“Americans are already beginning to experience a variety of new biometric payment options and I am sure that much wider adoption will accelerate. One place that Americans will become more familiar with the technology is sports and events where the technology is already being used to great effect.”

He cites the example of Amazon, which launched its Just Walk Out store in the Seattle Seahawks’ Lumen NFL stadium. The AI-based checkout allows fans to enter a concession stand, grab what they want, and walk directly back to their seats without going through a checkout process.

According to Birch: “Fans clearly like it, because the stadium saw double sales when compared to the previous store in the same location.”

Amazon is moving away from Just Walk Out for its retail stores and is focusing on its Amazon One palm-recognition solution. The company has launched an app that allows customers to sign up for the service using their phone instead of visiting a store. Customers can create their profile by logging into their Amazon account, taking a photo of their palms and adding a payment method.

There are now 500 Whole Foods Market stores in the U.S. using Amazon One, along with several Amazon stores and more than 150 third-party locations including stadiums, airports and convenience stores, Birch reports.

Read More @ leohohmann.substack