from ZeroHedge:

More than four years ago, when China first launched its latest “deleveraging” campaign targeted at bursting the country’s housing bubble in a controlled fashion, which coincidentally was the single largest asset for China’s massive middle class, we – and many others – said that this experiment was doomed and that all China is doing is delaying the inevitable bailout of the property sector with another metric asston of new debt. Well, as the news overnight confirmed, we were right… but not before China saw all of its largest domestic real estate developers collapse, push its housing market into a deflationary tailspin from which the country has not yet recovered, and suffered five years where its economy stagnated and pushed social tension to the edge.

TRUTH LIVES on at https://sgtreport.tv/

So what happened?

On Friday, Chinese policymakers unveiled a fresh batch of easing measures for the housing market, including:

- clear top-down guidance for local governments to purchase existing housing inventory for public housing provision,

- an RMB300bn relending quota for destocking the housing market,

- reductions in downpayment ratios and mortgage rates,

- more policy support to secure the delivery of pre-sold homes.

Needless to say, local government (which is really just an extension of the central government) purchases of existing housing inventory is for lack of a better word, nationalization, and as Goldman writes in its post-mortem (pdf available to pro subs), if implemented at scale, can help stabilize home sales, prices and completions, but the boost to new starts and land purchase would be limited.

And while lower downpayment ratios and mortgage rates may boost home sales to some degree, the magnitude of downpayment ratio reductions was relatively small this time, and the pace of cuts to effective mortgage rates could be somewhat constrained by bank net interest margins.

In total, Goldman expects more housing easing efforts down the road — especially on the demand-side — and view funding and implementation as key for the effectiveness of any property market rescue plan. Besides the RMB300bn relending quota, the PBOC’s pledged supplementary lending (PSL), local government special bonds (LGSB), policy bank bonds and commercial bank loans could be potential funding sources for housing destocking. Upcoming policy events will be worth monitoring closely, especially on solutions to address funding and implementation bottlenecks.

1. What’s new today? Following the April Politburo meeting, Chinese policymakers have significantly stepped up their easing efforts to help stabilize the property sector, on both funding and policy solutions. There were a batch of fresh housing easing measures unveiled today (17 May):

- At a video conference today on securing home completions, Vice Premier He Lifeng required to clearly understand the people nature (“人民性”) and political nature (“政治性”) of real estate work, and called for more forceful policy measures to secure the delivery of pre-sold homes and digest unsold commodity housing. He specifically mentioned that for cities with high housing inventory, local governments can purchase part of commodity housing to convert into public housing, based on the local situation and at reasonable prices. He required continued policy efforts on the risk disposal of property developer debt, and the “Three Major Projects” for the property sector (i.e., urban village renovation, public housing provision, and emergency public facilities).

- At the State Council press conference this afternoon, a PBOC spokesman announced an RMB300bn relending program to support local government purchase of existing housing inventory and converting into public housing (“保障性住房再贷款”). The relending interest rate will be set at 1.75%, and the tenor will be 1yr, eligible for rolling over four times if necessary. As banks will receive relending funds amounting to 60% of the principal of their loans to qualified projects, PBOC expects the RMB300bn relending quota to support RMB500bn in bank lending for housing destocking. On the implementation, PBOC highlighted that local governments should appoint local SOEs as agents to purchase housing inventory, but these agents should not engage in local government implicit debt (LGFVs are not qualified). Housing inventory purchase eligible for the relending support should be completed but unsold commodity housing, per the PBOC’s requirement.

- According to the PBOC’s announcements released today, the nationwide floor for mortgage interest rates will be removed, implying local governments have more discretion to lower their local effective mortgage rates if needed. If there is any major change in the supply-demand dynamics of the property market, PBOC would consider resuming the nationwide floor for mortgage rates. PBOC also lowered the minimum down-payment ratio by 5pp, to 15% for first-time buyers and to 25% for second-home buyers. Housing provident fund loan rates will also be lowered by 25bp, effective 18 May.

- National Financial Regulatory Administration (NFRA) pledged to support property projects in the “whitelist” through both new loan issuance and existing loan extensions, with due risk management. Ministry of Housing and Urban-Rural Development (MOHURD) required local governments to push forward the implementation of “whitelist” projects, and commercial banks to increase lending to these projects.

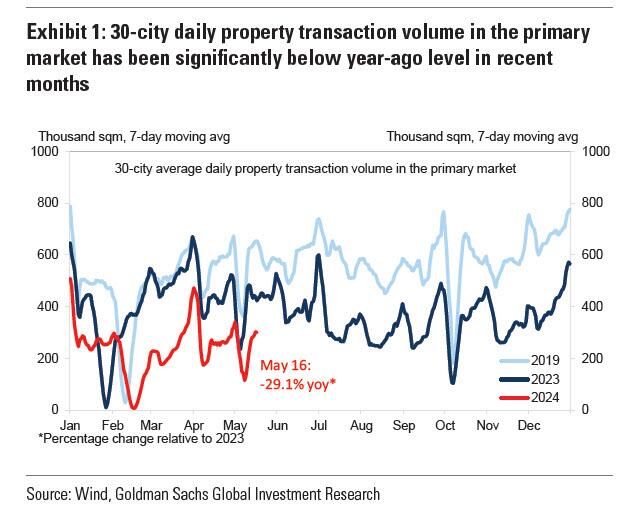

2. Why now? Despite the previous round of housing easing measures, property headwinds are still strong: new home sales have remained around 30% below year-ago levels in recent months…

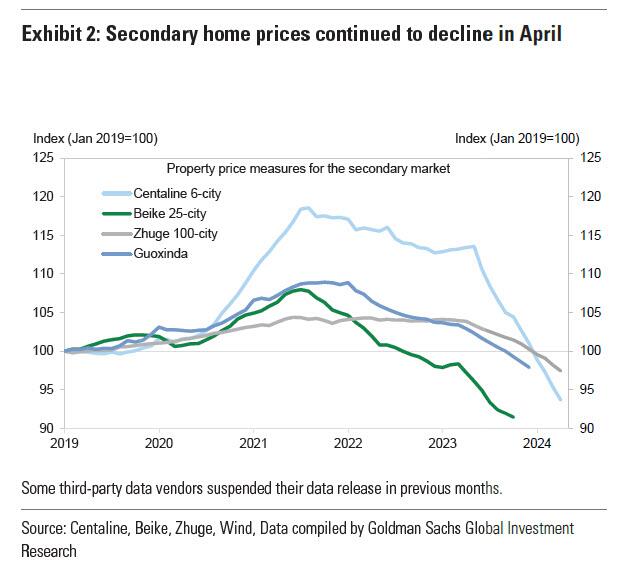

… housing inventory has stayed elevated, secondary home prices declined further in April…

… and some private developers (e.g., Vanke, Agile) continue to face challenging funding conditions. Here, Goldman asserts that “recent developments suggest to us that the prolonged property sector weakness has likely breached policymakers’ pain threshold, pushing them to step up housing easing and to shift the strategic focus towards digesting existing housing inventory.”