by Pam Martens and Russ Martens, Wall St On Parade:

In 2020, Netflix released a documentary series titled “Filthy Rich,” based on the book by the same name. The series examined how sex trafficker Jeffrey Epstein was able to continue to enjoy his wealth and power even after Palm Beach, Florida police had built a case that he had sexually-assaulted more than a dozen young girls – many from public schools in middle-class areas surrounding the mansions of Palm Beach.

TRUTH LIVES on at https://sgtreport.tv/

A sweetheart deal between the Florida State Attorney and the U.S. Department of Justice allowed Epstein to serve just 13 months in jail from June 2008 to July 2009, most of it in a work release program in which he was driven to an office daily by his chauffeured limousine. Epstein was allowed to be on the loose for another decade until the Department of Justice was embarrassed into arresting Epstein on federal sex trafficking charges on July 6, 2019, following an explosive series of articles about Epstein’s victims by Julie Brown in the Miami Herald. (Epstein died in a Manhattan jail on August 10, 2019, a little more than a month after his arrest. His death was ruled a suicide by the New York City Medical Examiner.)

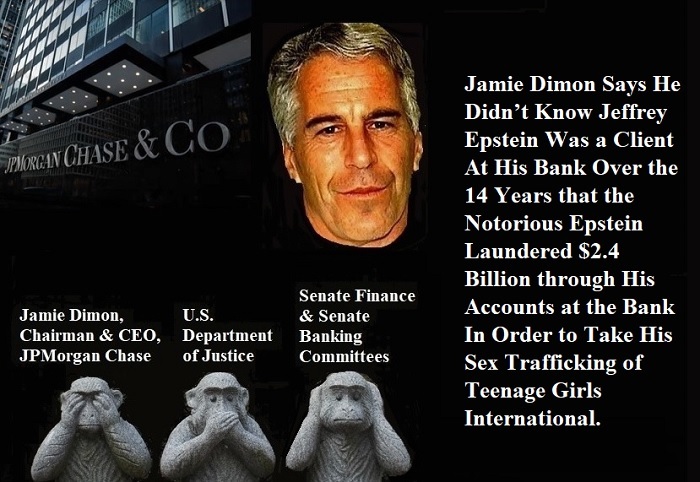

Despite Epstein’s earlier arrest in Florida and sensational headlines that followed, Epstein was able to continue his long-term banking relationship with the largest bank in the United States – JPMorgan Chase – until at least 2013. (JPMorgan Chase is now a five-count felon itself, able to endlessly cut sweetheart deals with the U.S. Department of Justice.)

One of Epstein’s protectors at JPMorgan Chase was Mary Erdoes – who continues to serve as CEO of the bank’s Asset & Wealth Management business that caters to the ultra-wealthy.

Erdoes may never get as “filthy rich” as Epstein, but she has sold $29 million of her JPMorgan Chase stock since just before Epstein’s arrest in 2019. That includes the following amounts: $3.9 million so far this year; $3.7 million in 2023 as headlines flew around the world over the Epstein-related allegations against the bank made by the Attorney General of the U.S. Virgin Islands in federal court in Manhattan; $3.9 million in 2022; $7.4 million in 2021; $2.4 million in 2020; and less than three months before Epstein was indicted in 2019, Erdoes sold $7.95 million. These dollar amounts do not include the millions in stock sales that Erdoes made, ostensibly to pay taxes on stock awards.

How did Erdoes come by all of this stock in the bank? The company granted it to Erdoes on the basis of good performance.

This is what the Attorney General of the U.S. Virgin Islands alleged in a federal lawsuit last year against JPMorgan Chase and Erdoes: (Epstein owned a private island and compound in the U.S. Virgin Islands.)

“In 2006, a JP Morgan Rapid Response Team noted that Epstein ‘routinely’ made cash withdrawals in amounts from $40,000 to $80,000 several times per month, totaling over $750,000 per year. In addition, Mary Erdoes admitted in her deposition that JP Morgan was aware by 2006 that Epstein was accused of paying cash to have underage girls and young women brought to his home. In the years that followed, JP Morgan employees, including senior executives, emailed internally that Epstein was under investigation or had been sued for trafficking or sexual abuse. This includes an email in 2010 between Mary Erdoes and Jes Staley regarding a federal investigation of Epstein for child trafficking; a 2011 email summarizing a few 2010 news stories connecting Epstein to human trafficking and promising to ‘monitor the accounts and cash usage closely going forward;’ and a 2011 compliance memo noting that ‘[n]umerous articles detail various law enforcement agencies investigating Jeffrey Epstein for allegedly participating in child trafficking and molesting underage girls’ and that ‘Epstein had settled a dozen civil lawsuits out of court from his victims regarding solicitation for an undisclosed amount.’ Internal emails also questioned who Epstein’s clients were, circulating an article regarding whether Epstein was running a Ponzi scheme.

“Indeed, Epstein’s behavior was so widely known at JPMorgan that senior executives joked about Epstein’s interest in young girls. In 2008, for example, Mary Erdoes received an email asking her whether Epstein was at an event ‘with miley cyrus.’ In her deposition, Mary Erdoes testified that JP Morgan terminated Epstein as a customer in 2013 after she became aware that the withdrawals were ‘actual cash.’ However, Epstein had made substantial cash withdrawals every year he banked with JP Morgan….”

This is how the New York Times reported Erdoes’ role with Epstein in August 2019: “When compliance officers at JPMorgan Chase conducted a sweep of their wealthy clients a decade ago, they recommended that the bank cut its ties to the financier Jeffrey E. Epstein because his accounts posed unacceptable legal and reputational risks.” The reason the relationship was allowed to continue, “according to six former senior executives and other bank employees familiar with the matter, was that Mary C. Erdoes, one of JPMorgan’s highest-ranking executives, intervened to keep him as a client, ” according to the New York Times article.

Read More @ WallStOnParade.com