from ZeroHedge:

Who could have seen that coming? (here, here, here, and most detailed here)

Admittedly, we were a couple of weeks off, but trouble has been brewing in the banking sector and tonight – after the close – we get the first bank failure of the year.

The FDIC just seized the troubled Philadelphia bank, Republic First Bancorp and and struck an agreement for the lender’s deposits and the majority of its assets to be bought by Fulton Bank.

TRUTH LIVES on at https://sgtreport.tv/

March will be lit:

1. Reverse repo ends

2. BTFP expires

3. Fed cuts (allegedly)

4. QT ends (allegedly)— zerohedge (@zerohedge) January 8, 2024

Republic Bank had about $6 billion of assets and $4 billion of deposits at the end of January, according to the FDIC (considerably smaller than the $100-200BN assets with SVB and Signature).

The FDIC estimated the failure will cost the deposit insurance fund $667 million.

As The Wall Street Journal reports, Republic First had for months struggled to stay afloat.

Around half of its deposits were uninsured at the end of 2023, according to FDIC data.

Its total equity, or assets minus liabilities, was $96 million at the end of 2023, according to FDIC filings.

That excluded $262 million of unrealized losses on bonds that it labeled “held to maturity,” which means the losses hadn’t counted on its balance sheet.

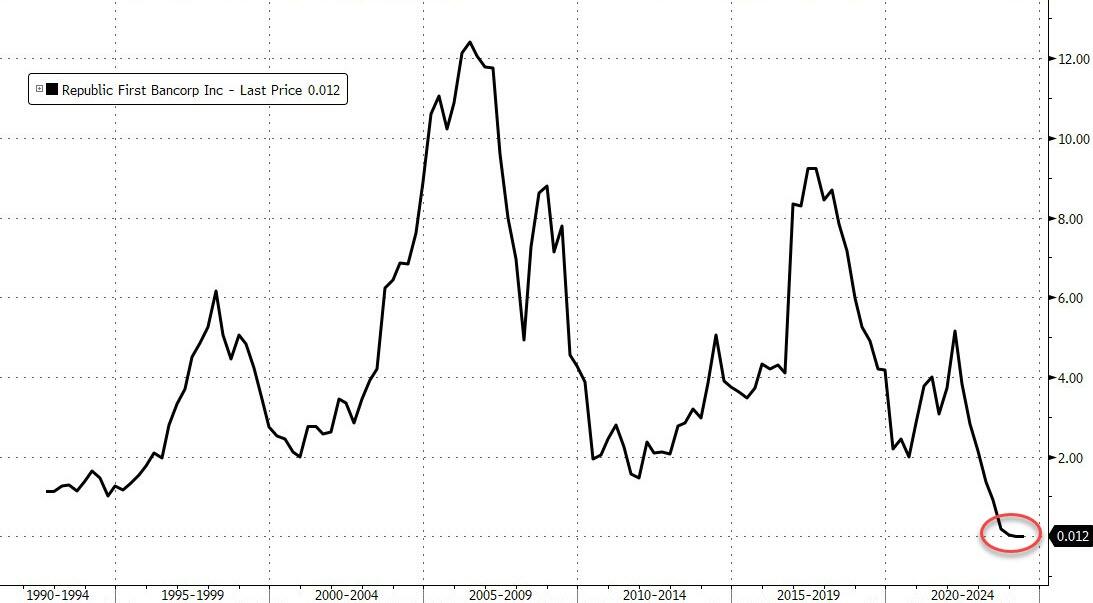

Its stock, which was delisted from Nasdaq in August, had been near zero.

Republic Bank’s 32 branches across New Jersey, Pennsylvania and New York will reopen as branches of Fulton Bank on Saturday, according to a statement from the FDIC.

Depositors of Republic Bank will become depositors of Williamsport, Pennsylvania-based Fulton Bank, the regulator said.

You should not be surprised given that rates are higher now than they were at the start of the SVB crisis – which means, unless banks have hedged hard or dumped their bonds at a loss, they are even more underwater…