by 2nd Smartest Guy in the World, 2nd smartest Guy in the World:

The Federal Reserve is a privately owned central bank that is neither Federal, nor does it have any reserves. It is a wholly criminal operation whose main functions are to slowly impoverish America while enriching its owners and those closest to the profligate money printing scam.

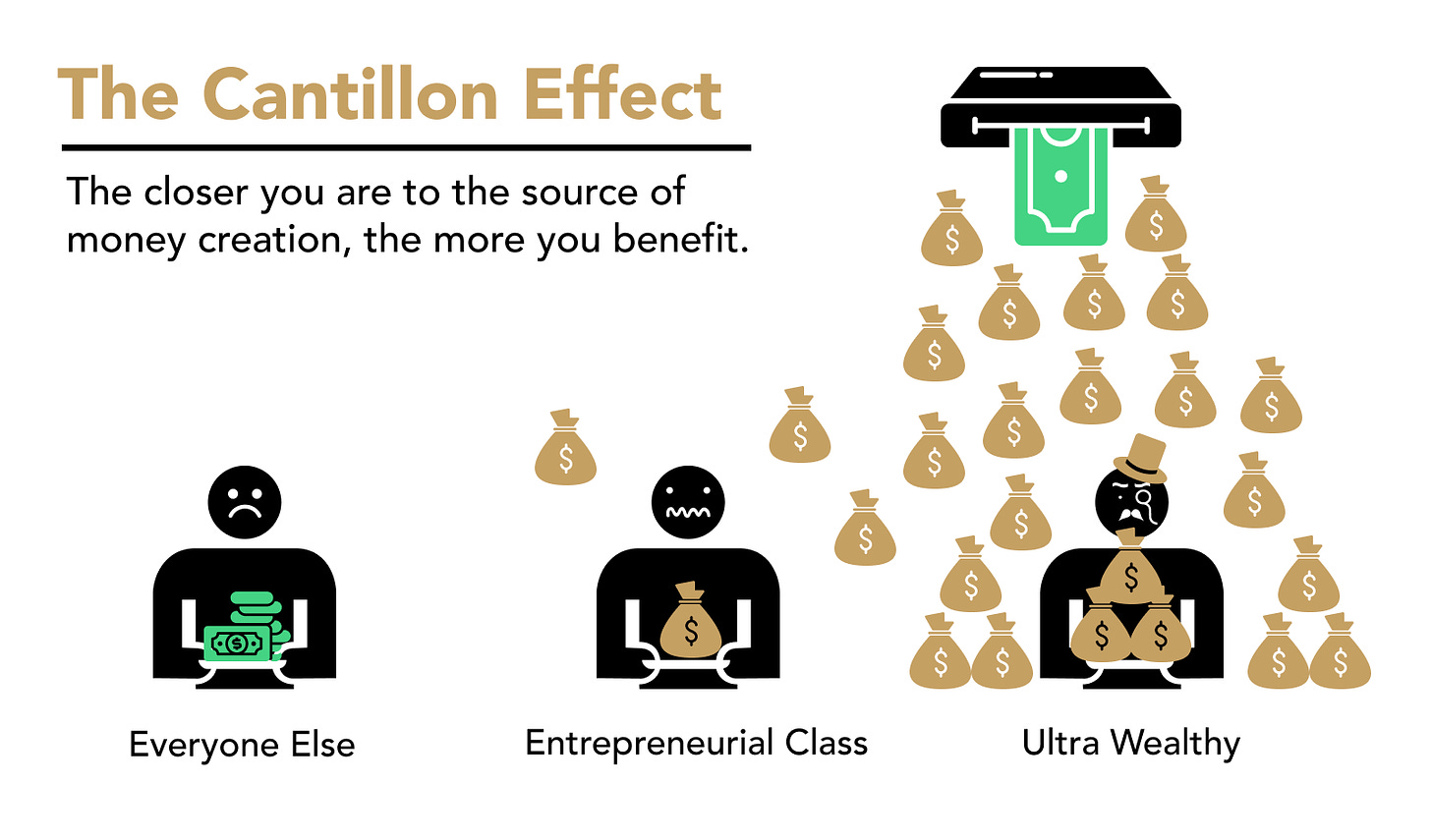

The Cantillon effect shows us that those closest to the money printer benefit the most; to wit:

TRUTH LIVES on at https://sgtreport.tv/

Thus, the mere existence of the Fed and its ruinous mandates ensures that “everyone else” will, over time, be stripped of their wealth. Using inflation as a monetary weapon, the Fed is the singular cause of this stealth tax; in other words, inflation is a direct result of money printing, and nothing else.

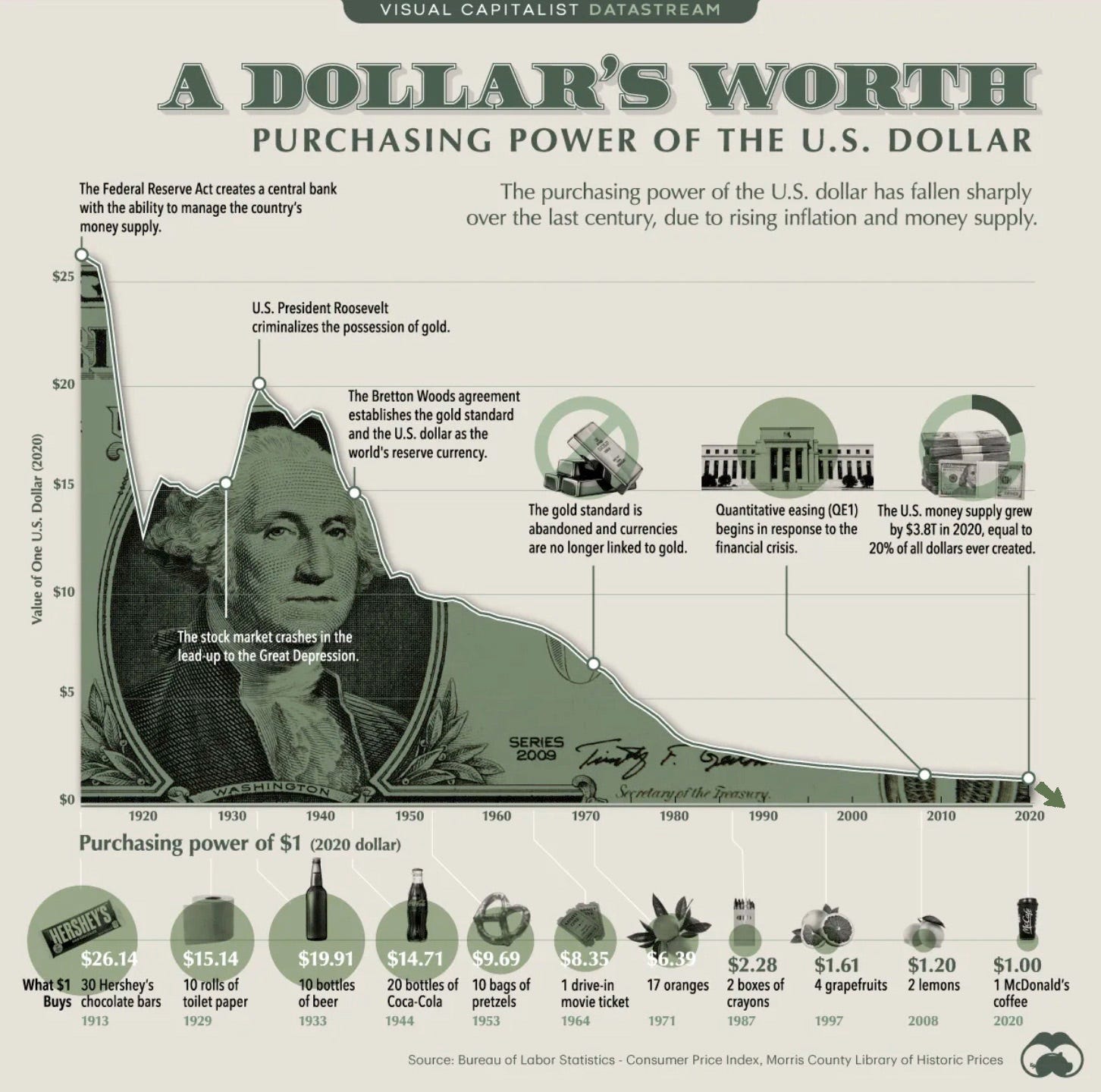

Under cover of the PSYOP-19 scamdemic, the Fed conjured fiat out of thin air in unprecedented and orgiastic amounts by kicking their quantitive easing (QE) scheme into ever higher gears and printing over $3 trillion dollars in a matter of months! To provide a little context to this staggering and illicit amount of money printing, it took from the Fed’s fraudulent inception in 1913 till around the end of 2008 to accumulate $1 trillion on their asset books!

Currently, the Fed’s asset books are a tick under $8 trillion, notwithstanding their shadow books which could have many more trillions under its racketeering mismanagement:

Now we are faced with the engineered monetary scourge known as biflation, a term that most are unfamiliar with, whereby central banking planning that increases the money supply while further subverting free markets by manipulating the price of money (i.e. interest rates) results in the simultaneous occurrence of both inflation and deflation.

What we are now undergoing is the decimation of the last vestiges of the dollar’s purchasing power:

Which brings us to the barbaric relic known as gold. This precious metal has been used by humans for well over 5,000 years as a store of wealth and medium of exchange. The price of gold has recently surged in dollar terms, and for good reason. Gold has hit its all time high (ATH), and is trading as of this writing at around $2,315. Inflation adjusted, gold would have to hit $3,400 to reach a true nominal ATH.

The most accurate way to appreciate the rising price of gold is not by thinking of it as becoming more expensive, but, rather, that the dollar is becoming cheaper, or less valuable.

As the Fed continues to deliberately eviscerate We the People’s wealth via their counterfeiting and interest rate manipulations, the price of gold will continue to rise.

Most major central banks around the world are buying up gold at exceptional rates precisely because they realize that the global financial system is untenable, and they know what is coming down the pike. Which is also why various nations are now demanding their gold from the Fed.

Read More @ 2ndSmartestGuyintheWorld.com