from The Conservative Treehouse:

An Ask Me Anything thread is soon to follow. Here’s the context:

I never expected to travel the world of a dollar-based central bank digital currency implementation. Two years ago, I was surprised by the construct of the Western sanctions against Russia; however, my curiosity was driven more by the outcome of the intended economic isolation, and not necessarily about the granular construct of the sanctions themselves.

What surprised me initially, was the conversation that never took place in the financial sector. For the first time in history the U.S Dollar was being used as a weapon, not only against Russia, but against any Western corporation who did not comply with the demands of the U.S government. I began highlighting the issue MARCH 5, 2022.

TRUTH LIVES on at https://sgtreport.tv/

The sanctions against Russia were unlike any set of sanctions that came before. The financial sanctions against Iran, Cuba, North Korea and Venezuela all stood as examples of prior economic sanction constructs, but the financial sanctions against Russia were different. The SWIFT exchange was shut down, Western trade into Russia was halted, and private Western corporations were forced to divest themselves of assets held within Russia.

Under the guise of “economically isolating Russia”, the sanction regime was driven by the U.S. Treasury, U.S. State Dept., and fully supported by Western allies in Europe, Canada, Japan, Australia and New Zealand. Each of the aforementioned nations followed the exact same path.

Given the history of the prior decade,where Russia enlarged its footprint of influence, the sanction regime just did not make sense. It was obvious that non-Western nations would continue trading with Russia, and most of those same non-Western nations were trading with the USA. My simple question was, “won’t alternate countries just step in to fill the void of trade eliminated by the sanctions?”

If, for example, India is still buying widgets from the Western zone, wouldn’t an enterprising Indian company just start buying extra widgets from the USA, Canada or Europe and then begin brokering a portion of those products into Russia? It seemed like common sense, and indeed that type of exchange is exactly what happened.

On the ground, in Russia, there are now Western stores missing, but the Western products are still available under different Russian flagship names. Starbucks closed, and now as you can see from above, it’s Stars Coffee. Same coffee, tables, chairs, cups, and even employees, just a different name. Starbucks, and every other Western company was forced to divest, sell assets at fire sale prices, and exit the market.

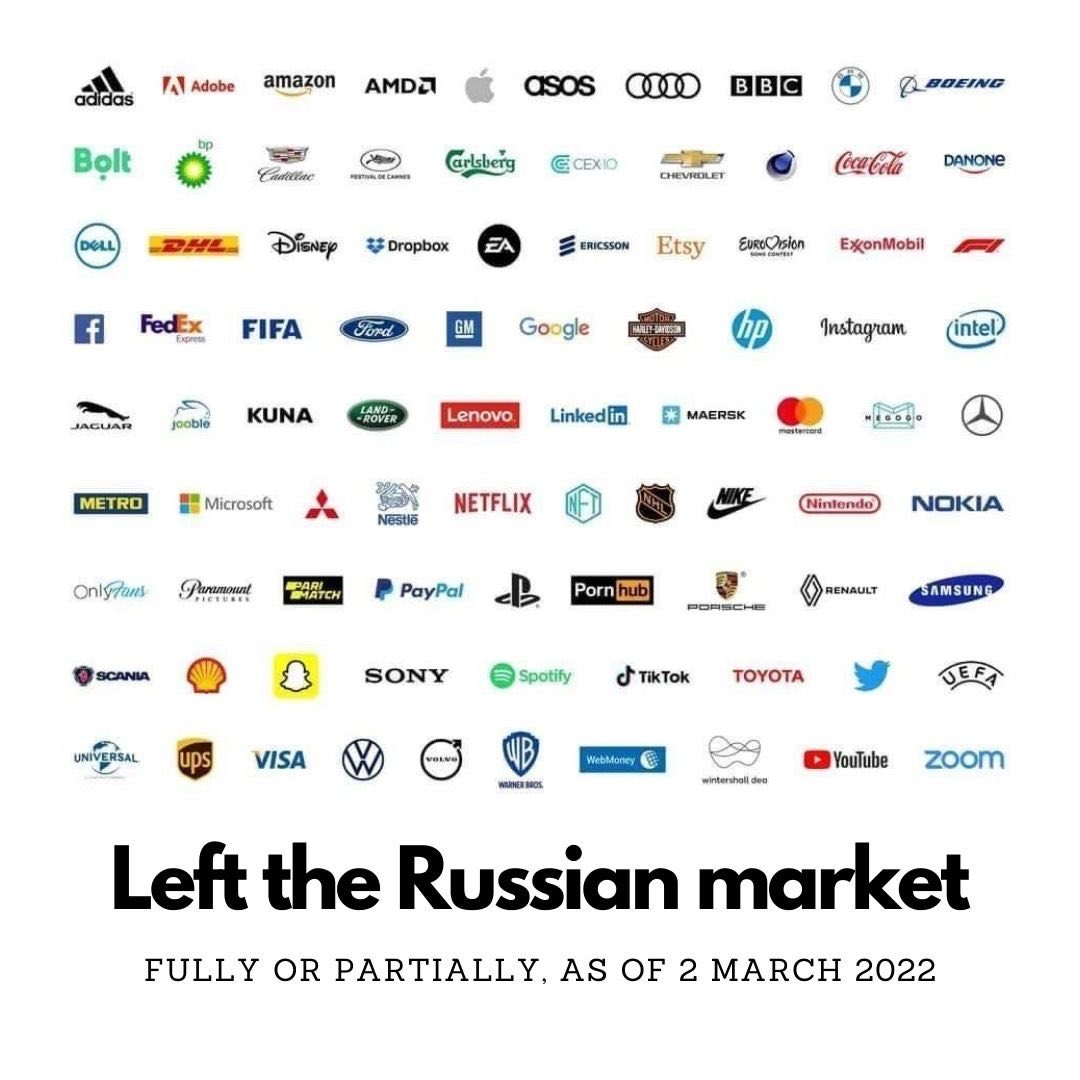

All the following companies did the same.

Despite all the parent companies leaving, their retail products are still available through a system of brokered buying and distribution. Third-party companies simply stepped in to fill the void. You can still buy the newest Samsung TVs and Apple iPhones in Russia, but now they come with a slightly higher price, as the broker adds their markup.

Despite all the parent companies leaving, their retail products are still available through a system of brokered buying and distribution. Third-party companies simply stepped in to fill the void. You can still buy the newest Samsung TVs and Apple iPhones in Russia, but now they come with a slightly higher price, as the broker adds their markup.

On the financial side, the inability to work in dollars or Euros was initially a problem, but workarounds were fast to surface {SEE HERE}.

What I soon realized, in my research, was that essentially nothing changed for the ordinary people within Russia, other than some “branded items” were no longer available. Factually, most Russian people didn’t care, and a large percentage are oblivious to the sanction issue. The sentiment of nationalism or national pride actually increased; they rallied around their leadership.

Two years later, the economy is doing well, Russia is selling energy to nations who have a need, trade is taking place in non-dollar denominations, and the impact is, well, really not much.

Read More @ TheConservativeTreehouse.com