by Ted Butler, Silver Seek:

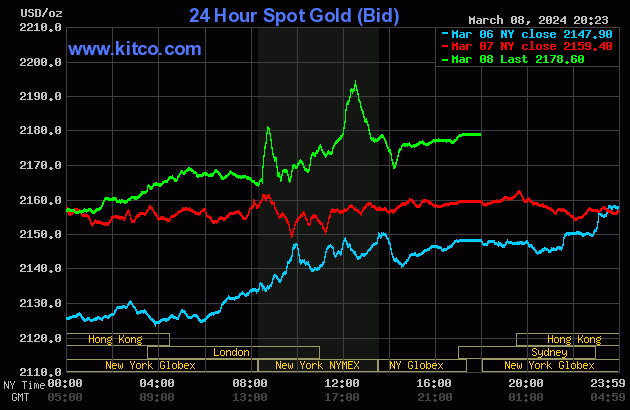

Gold’s quiet rally that began at the start of Globex trading in New York on Thursday evening was turned lower around 8:40 a.m. China Standard Time on their Friday morning — and its low tick was set at exactly 11 a.m. CST. It then wandered quietly higher until at or minutes before the 10:30 a.m. morning gold fix in London — and was sold a tiny bit lower from there until the jobs number hit the tape. The gold price went ‘no ask’ — and ‘da boyz’ appeared in seconds — and had the price back to its pre-8:30 a.m. price by 9:15 a.m. It crawled quietly higher from there until it took off anew starting a few minutes before 12 o’clock noon — and the commercial traders of whatever stripe reappeared — engineering it brutally lower until around 2:15 p.m. in after-hours trading in New York. Its ensuing rally ran into ‘something’ about fifteen minutes later– and from that juncture it crept very quietly higher until the market closed at 5:00 p.m. EST.

TRUTH LIVES on at https://sgtreport.tv/

The low and high ticks in gold were recorded by the CME Group as $2,161.20 and $2,203.00 in the April contract. The April/June price spread differential in gold at the close in New York yesterday was $20.80…June/August was $19.00…August/October was $18.60 — and October/December was $18.50 an ounce.

Gold was closed in New York on Friday afternoon at $2,178.60 spot, up another $19.20 from Thursday — and about 16 bucks off its Kitco-recorded high tick. Net volume was monstrous once again at 275,000 contracts — and there were an eye-watering 115,000 contracts worth of roll-over/switch volume out of April and into future months…mostly into June, but with noticeable amounts into August and December as well.

I saw that 259 gold, plus 115 silver contracts were traded in March yesterday, so it will be interesting to see what that translates into in this evening’s Daily Delivery and Preliminary Reports.

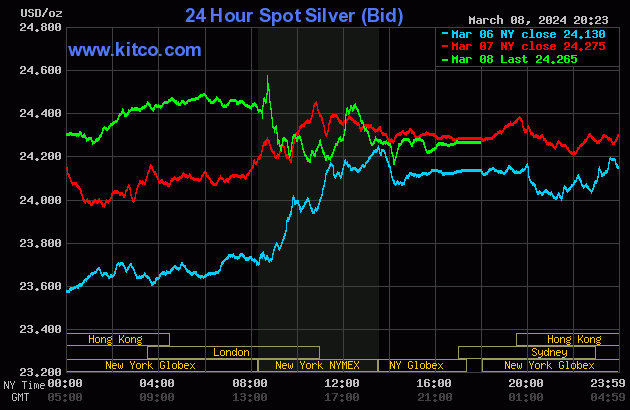

Silver’s decent rally attempt in very early Globex trading on Thursday evening in New York met the same fate as gold’s — and it was also sold lower until 11 a.m. China Standard Time on their Friday morning. It then wandered a bit higher until 11 a.m. in London — and was sold a bit lower until the jobs number showed up at 8:30 a.m. in COMEX trading in New York. Its spike higher ran into ‘da boyz’ as well — and its price was brutally suppressed after that, with its low tick of the day set around 2:10 p.m. in after-hours trading. It recovered a bit from there in short order, but was then forced to trade sideways until the market closed at 5:00 p.m. EST.

The high and low ticks in silver, both of which were set in New York, were reported as $24.86 and $24.38 in the May contract. The March/May price spread differential in silver at the close in New York yesterday was 21.0 cents…May/July was 22.4 cents…July/September was 21.9 cents — and September/December was 30.8 cents an ounce.

Silver was closed in New York on Friday afternoon at $24.265 spot, down a penny on the day — and 22.5 cents off its Kitco-recorded high tick. Net volume was certainly on the heavier side at 80,500 contracts — and there were a bit over 5,000 contracts worth of roll-over/switch volume on top of that in this precious metal…mostly into July and September.

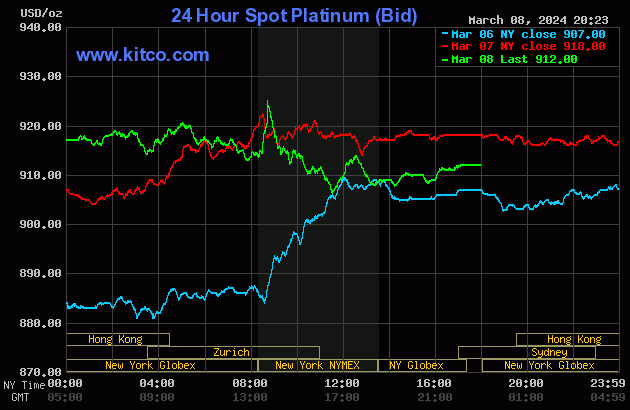

Platinum wandered very quietly sideways to a hair lower in Globex trading on Friday. It also jumped higher at the release of the jobs number — and from that juncture its price was managed in a similar fashion as silver’s. It was closed at $912 spot, down 6 bucks on the day.

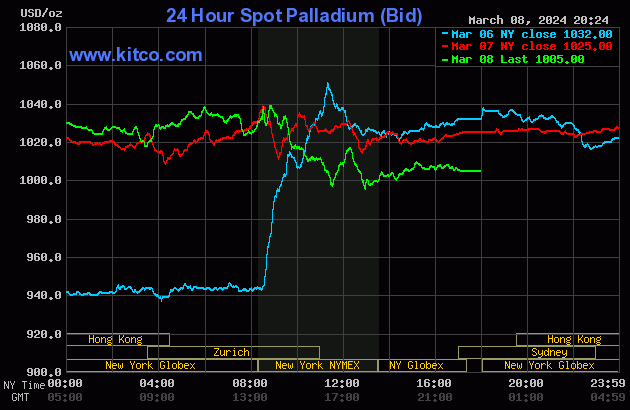

Palladium wandered somewhat broadly sideways until it too ran into ‘something’ at 8:30 a.m. in New York. Twenty or so minutes after that, the engineered price decline commenced in it — and it was sold unevenly lower until 1 p.m. in COMEX trading. It crawled a bit higher for the next two hours and a bit, before trading sideways until the market closed at 5:00 p.m. EST. Palladium was closed at $1,005 spot, down 20 dollars on the day.

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 89.8 to 1 on Friday…compared to 89.0 to 1 on Thursday.