by Matthew Piepenburg, Gold Switzerland:

Ever since day-one of the predictably disastrous and politically myopic insanity of weaponizing the world reserve currency against a major power like Russia, we warned that the USD had reached an historical turning point of slow demise and increasing de-dollarization.

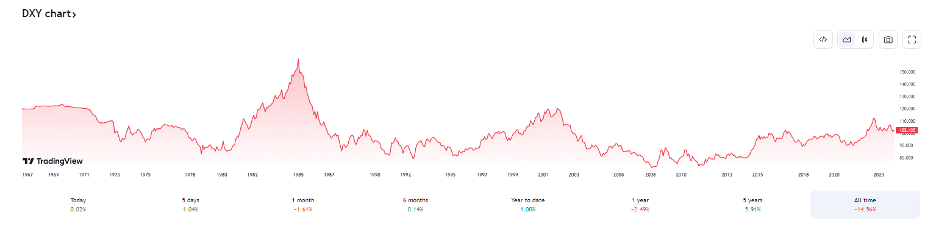

We also warned that this would be a gradual process rather than over-night headline, much like the slow but steady death of the USD’s purchasing power since Nixon left the gold standard in 1971:

TRUTH LIVES on at https://sgtreport.tv/

But as we’ll discover below, this gyrating process is happening even faster than we could have imagined, and all of this bodes profoundly well for physical gold, yet not so well for the USD.

Bad Actors, Bad Policies & Predictable Patterns

Regardless of what the media-mislead world thinks of Putin, weaponizing the USD was a foreseeable disaster which, naturally, none of DC’s worst-and-dimmest, could fully grasp.

This is because chest-puffing but math-illiterate neocons pushing policy from the Pentagon were pulling the increasingly visible strings of a Biden puppet at the White House.

In short, the dark state of which Mike Lofgren warned is not only dark, but dangerously dumb.

These political opportunists have forgotten that military power is not as wise as financial strength, which is why broke (and increasingly centralized nations) inevitably lead their country toward a state of permanent ruin preceded by cycles of war and currency-destroying inflation.

Sound familiar?

Despite no training in economics, Ernest Hemingway, who witnessed two world wars, saw this pattern clearly:

We also found “Biden’s” sanctions particularly comical, given that his former boss clearly understood the dangers of such a policy for the USD as far back as 2015:

The myopic (i.e., patently stupid) sanctions against Putin simply (and predicably) pushed Russia and China closer together while the BRICS+ nations increasingly began arbitraging gold for oil.

Or stated more bluntly, DC’s plan to weaken the Rubble has only served to put the USD at historical risk.

Does the Petrodollar Suck?

Throughout2022 and 2023, we warned of the weakening respect Saudi Arabia has for the allegedly Biden-“lead” US in general and its increasingly unloved UST and weaponized USD in particular.

Of course, we were specifically warning of the slow, gradual and yet again—inevitable—demise of the oh-so important Petrodollar which has been a critical “straw” of the milkshake theory’s faith in global demand for the USD.

But as the facts are now making increasingly clear, that “straw” is no longer sucking on a USD which much of the world now considers, well, a Dollar that sucks…

Three days after Christmas, the Wall Street Journal confessed what JP Morgan’s head of global commodities strategy had been tracking since 2015, namely that approximately 20% of the global oil bought and sold in 2023 was in currencies other than the USD.

Ouch.

That Dollar-straw appears to be losing its sucking-power, no?

Currently, this is because two nations all too familiar with American sanctions—i.e., Iran and Russia—just happen to have a lot of oil and have cranked up their oil selling in alternative currencies among willing buyers like China and India.

Read More @ GoldSwitzerland.com