by Mish Shedlock, Mish Talk:

Unprecedented US and EU sanctions against Russia have had no impact on Russia’s oil exports or revenue. Who’s the beneficiary?

Unprecedented US and EU sanctions against Russia have had no impact on Russia’s oil exports or revenue. Who’s the beneficiary?

Reuters reports Russia Exports Almost All its Oil to China and India

Almost all of Russia’s oil exports this year have been shipped to China and India, Deputy Prime Minister Alexander Novak said on Wednesday, after Moscow responded to Western economic sanctions by quickly rerouting supplies away from Europe.

TRUTH LIVES on at https://sgtreport.tv/

Russia has successfully circumvented sanctions on its oil and diverted flows from Europe to China and India, which together accounted for around 90% of its crude exports, Novak, who is in charge of the country’s energy sector, told Rossiya-24 state TV.

He said that Russia had already started to forge ties with Asia-Pacific countries before the West introduced sanctions against Moscow following the start of the conflict in Ukraine in February 2022.

“As for those restrictions and embargoes on supplies to Europe and the U.S. that were introduced… this only accelerated the process of reorienting our energy flows,” Novak said.

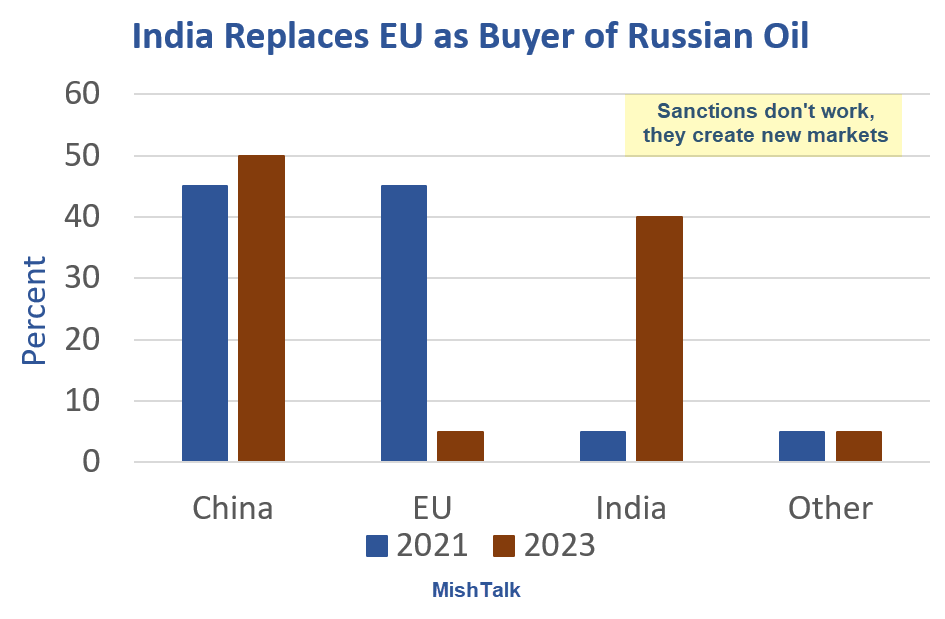

He said that Europe’s share of Russia’s crude exports has fallen to only about 4-5% from about 40-45%.

“The main partners in the current situation are China, whose share has grown to approximately 45-50%, and, of course, India…Earlier, there basically were no supplies to India; in two years, the total share of supplies to India has come to 40%,” Novak said.

Oil Demand Did Not Change

The numbers are believable. Oil demand certainly did not fall. All the sanctions did was force a shift in global supply chains.

There was a cost to Russia to shift supply chains, but there was also a cost to Europe and the US as well.

The increased costs meant a higher price of oil, for everyone.

Buyer’s Cartel Silliness

The number of economists promoting a buyer’s cartel to suppress the price of Russian oil (and only Russian oil) only was stunning.

I laughed at the idea when it was proposed on June 28, 2022 in A Laughable Explanation of the G7 Oil Price Buyers’ Cartel Emerges

The agreement, reached in the early hours of the third day of the G7 summit at Schloss Elmau in the Bavarian Alps, follows growing frustration among Western countries that their embargoes on Russian oil have had the counterproductive effect of driving up the global crude price. This has led to a situation where Moscow ends up earning more money for its war chest and where oil market reactions help drive runaway inflation.

The statement from the leaders ultimately identified this specifically as a preferred choice. “We will consider a range of approaches, including options for a possible comprehensive prohibition of all services, which enable transportation of Russian seaborne crude oil and petroleum products globally, unless the oil is purchased at or below a price to be agreed in consultations with international partners,” the statement said.

Root of the Stupidity

The G7 does not want Russia to sell any oil but if they succeeded, the price has to rise unless production picks up elsewhere or demand drops.

Rather than admit economic fundamentals, G7 leaders, especially Biden and Macron keep doubling down on dumber and dumber ideas.

Despite the obvious stupidity of the scheme, some prominent economists backed the idea.

Central Bank Buy-Ins

Treasury Secretary and former Fed Chair Janet Yellen signed off on the cartel idea.

Former ECB president Mario Draghi also pushed the idea.