by Michael Maharrey, Schiff Gold:

The Biden administration just ran the largest November budget deficit in history.

And it managed this feat even with a 9% increase in government receipts.

The November budget shortfall came in at $314.01 billion, according to the Monthly Treasury Statement. That was 26% higher than the November 2022 deficit.

TRUTH LIVES on at https://sgtreport.tv/

Just two months into fiscal 2024, the federal government has run up $380.58 billion in red ink. This follows on the heels of the third-largest annual budget deficit in history.

The US government took in $274.83 billion in revenue. That was up from $252.11 billion in November 2022, bucking the trend of generally declining government receipts.

The federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned at the time that it wouldn’t last. And it didn’t. Government receipts fell by 9.3% in fiscal 2023.

Government tax revenue will decline even faster as the economy spins into a recession.

But the real problem is on the spending side of the ledger.

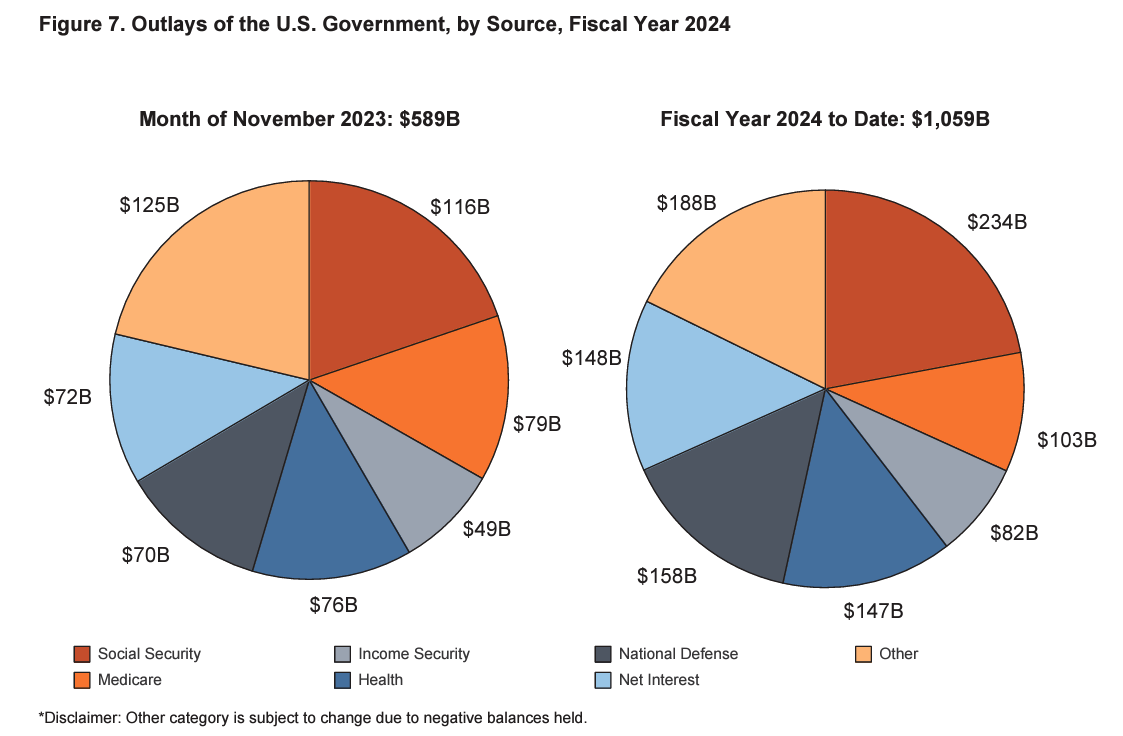

The Biden administration blew through $588.84 billion in November, up 18% from November 2022. That pushed total spending to nearly $1.06 trillion through the first two months of fiscal 2024.

This underscores the fact that the fundamental issue isn’t that the US government doesn’t have enough money. The fundamental problem is that the US government spends too much money. Despite the pretend spending cuts, the debt ceiling deal didn’t address that problem. Even with the new plan in place, spending will go up. No matter what you hear about spending cuts, the federal government constantly finds new reasons to spend more money.

Government spending is already historically high. That means big budget deficits will continue and the national debt will mount.

The national debt blew past $33 trillion on Sept. 15. As of Dec. 12, it stood at $33.85 trillion.

Most people seem to think the excessive spending, the growing deficits, and the national debt don’t matter, but somebody has taken notice. Last month, Moody’s Investor Service lowered its outlook on US government credit from “stable” to “negative.” This could be a prelude to a downgrade in the country’s AAA credit rating.

THE INTEREST PROBLEM

This rapid increase in the national debt is happening during a time of sharply rising interest rates. This is a big problem for a government that primarily depends on borrowing to pay its bills, and is likely one of the reasons that the Federal Reserve has surrendered to inflation. The borrow-and-spend US government can’t function in a high interest rate environment.

Uncle Sam spent $79.92 billion in interest expense to finance the national debt in November. That was more than national defense ($70 billion) and more than Medicare ($79 billion). The only higher spending category was Social Security.