from ZeroHedge:

In today’s world of at times unparalleled idiocy at the top echelons of power, nobody can hold a candle to the government and central bank of Japan.

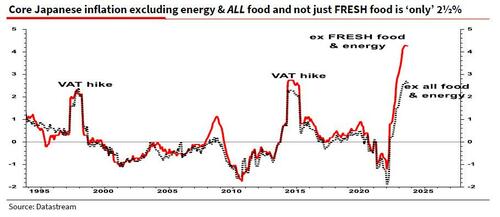

Consider this: as the BOJ injects billions of liquidity into its bond market every single to prevent a crash that could mark the end of Japanese civilization as we know it (for context, the BOJ owns more than half of all JGBs outstanding, blurring the lines between fiscal and monetary policy, and adding to financial instability risks; furthermore the size of the BOJ’s balance sheet – at almost $6.5 trillion – is the largest in the world in GDP terms, and substantially higher than the Fed’s or the ECB’s) Japan has seen the yen collapse at such a rapid pace that it would make banana republic currencies such as the Turkish Lira blush. And as the yen imploded, and historic inflation spread across the otherwise deflating Japan…

TRUTH LIVES on at https://sgtreport.tv/

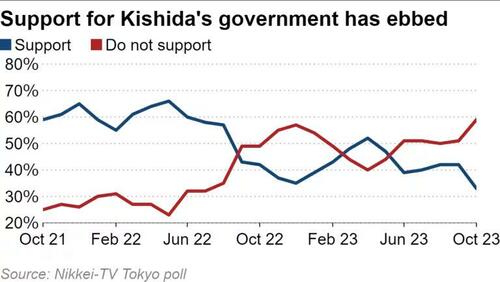

… the approval rating of Japan’s PM Kishida cratered…

… as the Japanese learned that the one thing that is worse than deflation is inflation, something we warned of not too long ago.

The blowback against the Japanese Lira begins.

Let’s see how long Kishida allows the BOJ to cremate the JPY once Japan’s plummeting standard of living and his approval rating starts correlating to the yen pic.twitter.com/qcKAgvXukz

— zerohedge (@zerohedge) August 29, 2023

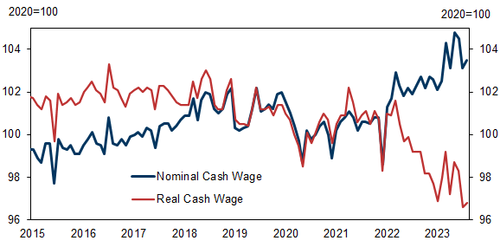

What is just as remarkable is that in the land of the rising sun idiocy, what Kishida is telling his voters is that all shall be well and that wages will magically explode higher, sparking a new golden age in what is arguably the western world’s cheapest economy. Of course, what is really happening is just the opposite: while nominal wages have indeed risen, that is entirely due to soaring inflation, meanwhile real wages are the lowest on record.

And while the BOJ had every opportunity to normalize this slow-motion social, monetary and economic collapse a few days ago when it could have propped up the currency at the expense of higher wages by eliminating the Frankenstein monster that is NIRP and YCC, it failed to do so, ensuring that when the day of reckoning finally comes (and it will, as Bloomberg’s Simon White explained) it will be catastrophic beyond anything seen during the Lehman collapse (oh, and the yen will explode higher).