by Alasdairr Macleod, Schiff Gold:

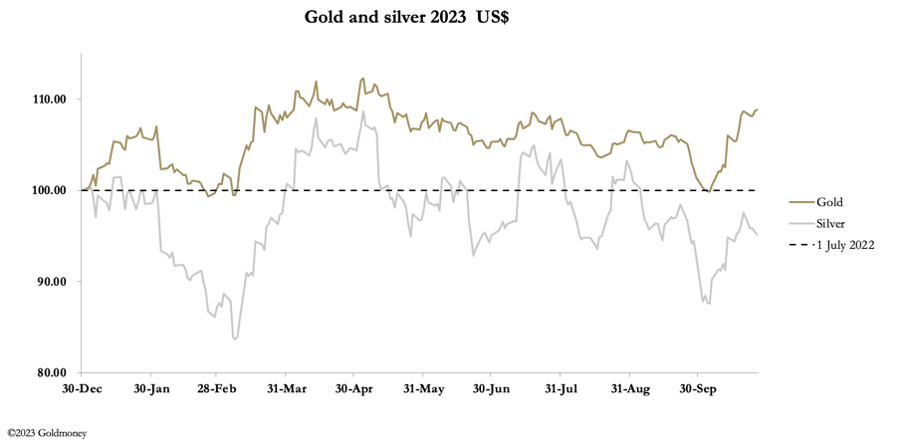

This week, gold and silver went their separate ways, with gold rising and silver falling. In European trade this morning gold was $1985, up $4 from last Friday’s close, while silver was 22.81, down 21 cents. Gold is edging higher, while silver edges lower.

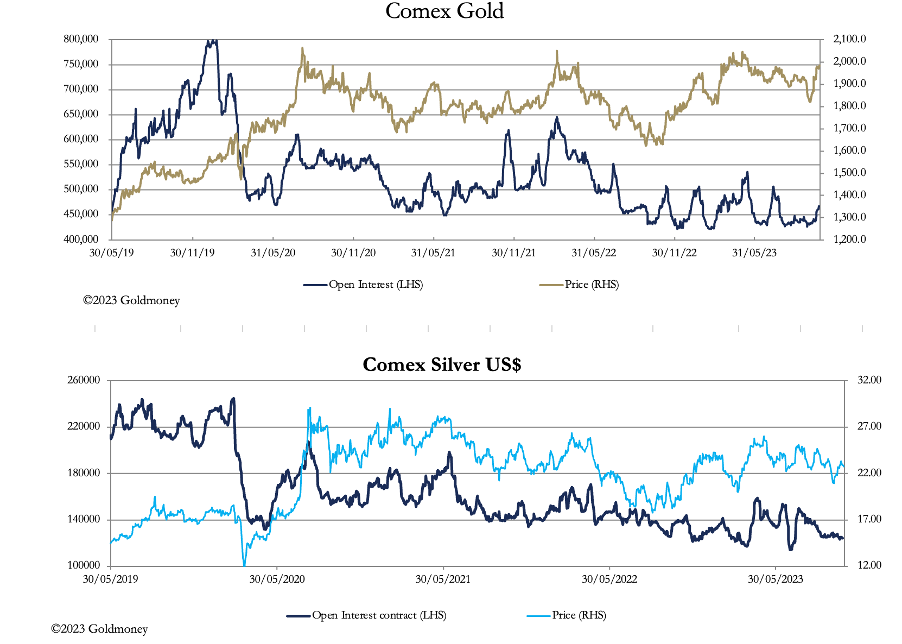

Indeed, all the action is in gold, with Comex Open Interest continuing to rise as our next chart shows, while that of silver is still subdued.

TRUTH LIVES on at https://sgtreport.tv/

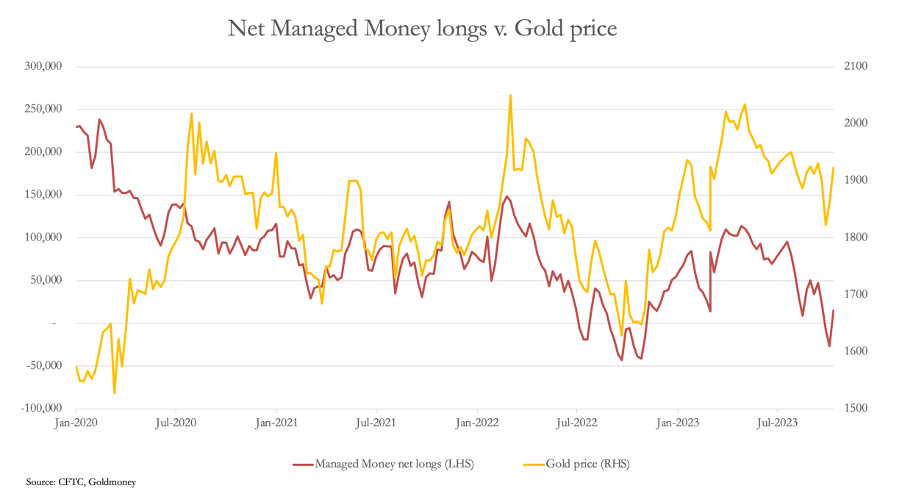

This month, the relationship has driven the gold/silver ratio higher, currently at 87. But it is not as if the hedge funds have been aggressive buyers of gold contracts. While in these markets the Commitment of Traders figures for 17 October are stale (update for 24 October due tonight), they revealed that the Managed Money category was only net long 15,103 contracts. The next chart shows the position relative to the gold price.

The widening gap between the price and net longs is bullish. It means the gold price has held up well despite hedge funds not buying. With Open Interest having increased by under 30,000 contracts since the COT figures, hedge funds are unlikely to be more than 35,000—40,000 contracts net long today against a neutral position of over 100,000 contracts. In other words, after a rise of $175 in this month alone, gold still looks oversold.

The slight caveat is that in the next few days, there is the month end contract expiry, when the Swaps and market makers could make a concerted effort to get prices down so that as many call options as possible expire worthless.

There are two reasons for this change in behaviour: geopolitics, and a growing awareness of the dire state of the US Government’s finances. The Israeli-Hamas situation is the most urgent. Yesterday, American jets attacked Hamas-related positions in Syria. At the same time, President Putin has invited senior Hamas and Iranian leaders to Moscow for talks, probably to America’s annoyance.