by 2nd Smartest Guy in the World, 2nd Smartest Guy in the World:

The debt-tax-slave screws are being increasingly tightened by the privately owned central bank, and their partner-in-crime the illegitimate IRS.

This Substack has been raising the alarm about CBDCs for quite some time now:

How Technocommunism Will Institute The CBDC: The Central Bank Game Plan In Under 3 Minutes

TRUTH LIVES on at https://sgtreport.tv/

The entire global financial system is now essentially a technocommunist black ops money laundering crime scene. Central banks, their wall street coconspirators and the major corporations are all colluding in ushering in their hyper-centralized CBDC dystopia. This central bank “currency” will of course be inextricably tethered to the A.I. social credi…

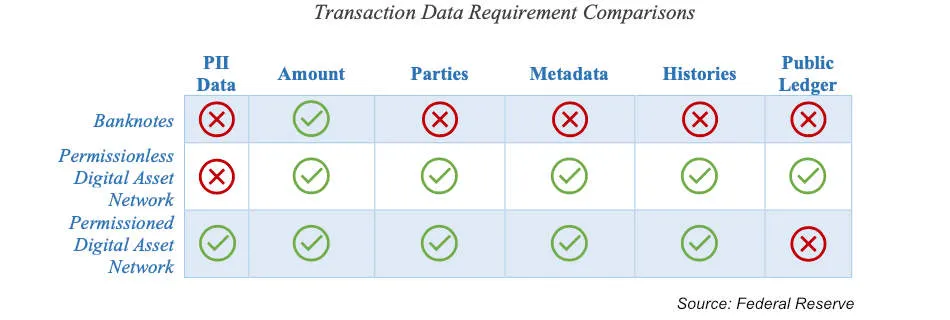

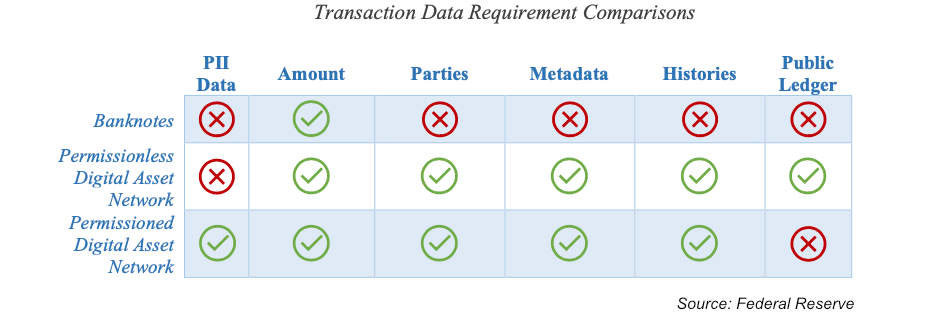

In a recently published Federal Reserve paper entitled, Data Privacy for Digital Asset Systems, this criminal central planning politburo claims that the desire for anonymity through cash transactions is misguided, and, ultimately, impossible to achieve in digital systems. Which is precisely why the Fed wants to ban cash by instituting their CBDC.

Data privacy in digital asset systems is of sustained importance to end users. However, there can be disconnect between an end user’s expectations of privacy while using a digital asset payment system and the system’s actual treatment of collected, stored, and used data.

Since even decentralized blockchains are essentially immutable ledgers, the Fed argues that all transactions are ultimately traceable. Without getting into technical blockchain mechanics, this is only partly true, and there are methods by which crypto offramps could circumnavigate these monetary technocommunist parasites, as well as strategies for remaining exclusively within DeFi ecosystems in a kind of real-world local DeFi barter network.

But the key takeaway is that the Fed is gearing up to attempt to strip away all privacy by phasing out cash while concurrently leveraging their mutable (i.e. hackable by virtue of their misguided mandates to incessantly tinker with controls in order to manipulate slave behavioral patterns via UBI, time-constrained tokens, etc.) CBDC.

Using their usual disingenuous anti money laundering (AML) and know your client (KYC) stricture excuses, the paper pretends to care about illegal activities. As such, the Fed apparatchiks are concerned that multiple small crypto payments could bypass their controls; thus, they propose spying on all transactions with “permissioned” hybrid privacy controls such that no transactions escape their prying A.I. algos.

The paper further finds that a particular combination of popular and emerging technologies may provide as-yet untested but novel benefits to maintaining strong confidentiality – and possibly end users’ expectations of privacy – while data is under audit. A nuanced approach, rather than a reliance on a singular novel PET (privacy-enhancing technologies) or dubious assurances of anonymity, may best facilitate strong confidentiality with sustainable end-user privacy protections for digital asset system users.

The Fed basically admits that they will provide a false sense of privacy and security to end users, while spying on every transaction across their hyper-centralized CBDC blockchain.

No free human being requires a central planners’ “permissioned” fiat, which is another way of saying Statist counterfeiting, or funny money.

The paper concludes by reiterating that the Fed will strip away all privacy under the guise of their “thoughtful” hybrid approach policy; in other words, their CBDC will directly port into the X Everything App social credit score nightmare:

A robust end-user data privacy strategy for a digital asset payment system starts with a thoughtful approach to technical aspects of privacy during the design phase. Anonymity, confidentiality, and full disclosure make up the spectrum of privacy, with each aspect facilitated by different design choices and confidentiality being a worthy goal system wide. A privacy strategy developed through a hybrid approach including privacy-by-design and privacy-by-policy could provide a holistic view of how, when, and where PETs and privacy tools should be employed. Specific combinations of privacy-enhancing technologies, such as fully homomorphic encryption, zero knowledge proofs, and secure multi-party computation, could provide a nuanced and novel approach to data privacy coverage across multiple tiers and use cases within a digital asset’s ecosystem. Additional system technical requirements, such as throughput, or policy requirements, such as auditing compliance, may also impact a privacy strategy’s needs and the resulting mix of privacy enhancing technologies employed throughout a digital asset’s system.

In this Great Reset dystopia, privacy will only be afforded to government, corporations, and their central banksters. This is precisely the reality inversion of the government and banking relationship with their constituents and clients; that is, We the People are the ones that by law must have total privacy, not the government and their coconspirators. The government and the Fed vis-à-vis the totally supplanted Coinage Act by law work for We the People, and as such must be totally transparent, which they are clearly not.

And the other most dangerous threat to privacy and security comes courtesy of the fraudulent IRS, which operates strictly under color of law in such a manner that its mere existence is a total subversion of the 4th Amendment of the Bill of Rights.

Read More @ 2ndSmartestGuyintheWorld.com