by Jim Willie, Gold Seek:

A historical paradigm shift is in progress. The process of de-Dollarization began with Russia in response to the Maidan coup in Kiev back in 2014. The Russian reacted in multiple ways, but the Eurasian Trade Zone grew. That was the Jackass name given, which has emerged as the BRICS Union in recent years. Numerous nations have followed the Russian lead in removing the USDollar from their trade payments and banking practices. The American observers have dismissed this trend as trivial and not enduring. They are wrong, dead wrong. In the last 18 months, the Japanese had dumped $240 billion in USTreasury Bonds over a 12-month period. They continue. They accumulate Gold in their banking reserves, thus following the BRICS theme, their operating policy. The macrocosm, by contrast, will feature 20 nations dumping USTBonds en masse, and acquiring Gold for banking reserves. The UAE will become a primary office for the conversion, their Dirham notably pegged to the USD.

TRUTH LIVES on at https://sgtreport.tv/

THE PETRO-YUAN EMERGENCE

A tremendously important development has occurred in recent months, which the US lapdog subservient press has ignored. The entire Persian Gulf has embraced the Petro-Yuan defacto Standard for oil & gas payments. This spring, France purchased a large long-term LNG supply from the United Arab Emirates, the contract calling for CHYuan payments. Iran, Saudi, UAE, Qatar, and the entire Gulf monarchies have discarded the USD payment standard, and have followed what the Saudis began. All oil & gas payments are to be paid in CHYuan. The Iranians and Saudis, joined by the Emirates, have declared peace and constructive economic engagement, much to the dismay, frustration, and vitriol of the Americans and Izzies. The entire Arab and OPEC community has followed the Petro-Yuan Standard. It has become the installed standard in the primary oil center, with very little recognition by New York mavens, who are overwhelmed by toxic health mandates and preoccupied by lesbian/gay norms. The implications are vast. Entire nations, acting as customers for energy shipments, will remove the USTBonds from their banking system. They will not purchase new USTBonds upon scheduled auctions. In effect, the OPEC and entire Energy world has gone to the PetroYuan, and all their customers will thus de-Dollarize.

The USGovt debt default and USTBond default are certain events, written in stone. The USGovt will monetize its own debt, and be subjected to debt downgrade. An international divestiture of USTBonds will ensue across the entire global financial sector. The USGovt will acquire a Ponzi reputation with a broad smear. Remarkably, no G-7 Sovereign debt has a bid for several months, as almost no global demand exists anymore. Such is the consequence of the growing crisis of confidence for the Biden Show, the tragic Ukraine War, the momentum of the emerging BRICS Union, the chaos in the European Union, and the backfire on the illicit economic lockdown. The USGovt is racking up a cool $1 trillion in fiscal deficits every six months, and foreign bondholders are talking openly about how they will never be repaid. As time passes, not only is a debt default likely to splash onto the financial rags, but accusations of the United States acting as a rogue nation. Then comes global economic embargo, and a trickle for import supply amidst price inflation and product shortage.

THE TOXIC VAT

As the BRICS Union progresses, though quietly, the process of dumping USGovt debt securities in large quantities and acquiring Gold in large quantities will make the news. The Japanese central bank has shown the way with one quarter $trillion in USTBonds discharged. They have earned assassinations of middle level officials in response. The US-UK-Swiss cabal responds in nefarious manner always. The French central bank dumped $70 billion during the same 12 months. Next comes several nations dumping USTBonds in big tranches. They will threaten Project Sandman, the two-day dumping of $2 trillion in USGovt bonds.

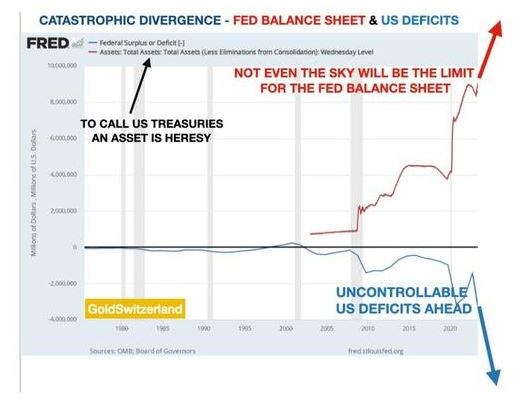

WHEN SOVEREIGN ENTITIES DUMP EN MASSE THEIR USTREASURYS, THE USDEPT TREASURY AND USFED WILL BE OBLIGATED TO SOAK UP THE SUPPLY, PRECISELY BECAUSE DONE IN GIGANTIC VOLUME. The USGovt and USFed cannot afford to have tens of $billions in USTBonds suddenly appear as supply upon the bond market, since it would cause a market seizure. When two or three, maybe more, sovereign entities dump the USGovt bonds on the market, the bond market can be quickly overwhelmed. Refer to central banks and sovereign wealth funds, managed by oil monarchies. Therefore, the USFed in all likelihood will be required to absorb an unusually large volume of USTBonds, expanding the Fed Balance Sheet from the current $9 trillion level to maybe $12 or $15 trillion quickly. In the past 20 years, the USFed has absorbed many impaired bonds, mostly of corporate type, since they did not wish to see the corporate bond market destroyed. But it too is a wrecking zone, especially after the 2017 downgrade of bellwether GE Bonds, the best in class. The shame of having a Bad Bank for unwanted unsellable USTBonds will make the greatest blemish in US financial history, the manifestation of a cancer. The ultimate ignominy, a grand decline cometh from global currency reserve for the King Dollar, to the chasm of Bad Bank and toxic vat for bonds with dubious value.

The USFed Balance Sheet has expanded tremendously, especially since the year 2020 when it was ONLY $4 trillion. A month ago it was around $9 trillion, without much corresponding attention or concern. The Balance Sheet was under $1 trillion when Obama the Kenyan roamed the White House with his sordid parties, whose activities are fully protected by the Secret Service and FBI. Thanks to Egon von Greyerz for the graphic with annotations.

![]()

IN THE PASSAGE OF TIME, PROBABLY WITHIN ONE YEAR, THE USTBONDS WILL BE CONSIDERED IMPAIRED BONDS. THEY CALL IT BAD PAPER IN THE BOND PITS. THEY ARE PROBABLY HERE AND NOW BEING SOLD AND REDEEMED AT CLOSE TO HALF PRICE, A 50% HAIRCUT. Last month, the Jackass heard rumors of USTBonds being redeemed at 40 cents on the dollar. No confirmation came afterwards. My gutt says that for redemption of large tranches like $10 billion or greater, when proceeds are delivered in the country’s local currency, expect a 30 to 40 cent haircut on the bond. This is a default liquidation in progress, a hidden default.

Some background on accounting practices during the gathering of large-scale impaired bonds and generally referred to bad paper. They must be written down in value as accounting losses. WHEN MERGER & ACQUISITIONS ARE DONE FOR AN AILING FIRM, THE NEW PARENT FIRM OFTEN CREATES WHAT IS CALLED A “BAD BANK” FOR PUTTING THE DEEPLY IMPAIRED (ALMOST WORTHLESS) SECURITIES. The Bad Bank is where impaired paper goes to die, later written off as total losses in a quarterly filing. The Bad Bank is an accounting category for rubbish, the various financial flotsam and jetsam. They might hope to sell some securities in the Bad Bank for 10 cents on the dollar. When Lehman Brothers was carved up, many of its securities were exotic rubbish, like the Collateralized Debt Obligations which bore falsely rated tranches of garbage interwoven in fraudulent deception. Today the commercial mortgages form vast reams of bad paper, impaired bonds, a product of the illicit economic lockdowns. My Jackass forecast is that the USFed will be transformed into the biggest Bad Bank in modern history, loaded down by at least $15 trillion in unresolvable impaired worthless paper.

The good faith of the USGovt is gone, since over-run by fascists, globalists, and mafias. The ransacking of the USDept Treasury is well underway. The Biden gangsters sacked control of the USFed printing press operations, and use the machinery to send palettes of $100 bills to Ukraine. The image of the USGovt will enter a terminal decline, where the fraud, waste, and pilferage will be the story in the annals of history. The USGovt has squandered $25 trillion in defense budgets, ineffective weapon systems, predatory wars, NATO corruption, and narcotics enterprise, with no economic benefit as a result. The USGovt has weaponized the USDollar, and foreign nations have reacted in kind with a financial war. These declining traits were evident and widespread for the last 40 years or more. In fact, they have been present since the 1971 abrogation of the Bretton Woods Gold Standard. The Bad Bank concept will emerge in the passage of time, a new crown to replace the discarded Golden chassis.

THE USGOVT WILL HAVE A POTENTIAL PARTNER SERVING AS A BAD BANK, NAMELY THE UNITED ARAB EMIRATES. The UAE has offered to serve as the BRICS Union sales office (aka dumping ground) for USTBonds. It is unclear as yet how this role will function. The UAE central bank will accept USTBonds for sale. They must provide funds in high volume as proceeds for the sales. It is not clear whether the UAE will be making redemptions with a discount (haircut) like 30 to 60 cents per face value dollar. It is also not clear in what form the UAE will make payouts, like in a particular currency. One can speculate that they might offer AEDirham, except that tremendous dilution would occur upon a grand sudden expansion of their native currency. They might offer Chinese Yuan upon certain conditions for Gold purchase, such as requisite usage of the CHY to buy the Gold. The Gold providers as source might be content with holding CHY. It is believed that Dollar Swaps upon USTBond sales of large size might require the seller to accept a haircut on the bond sale payout. That would constitute a bond default, and would eventually lead to the adverse publicity. When the USGovt debt default arrives, nobody really knows. But the consequences would be both dire and very unexpected, like a total flattening of the Treasury Yield Curve.