from ZeroHedge:

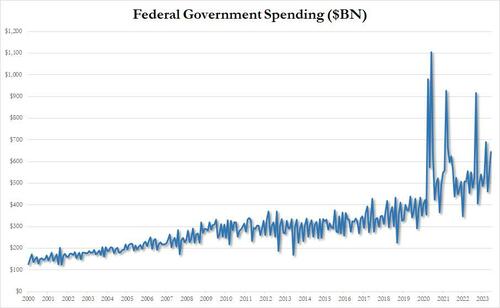

There was a shocking number in today’s latest monthly US Budget Deficit report. No, it wasn’t that US government outlays unexpectedly soared 15% to $646 billion in June, up almost $100 billion from a year ago…

… while tax receipts slumped 9.2% from $461 billion to $418 billion, resulting in a TTM government receipt drop of over 7.3%, the biggest since June 2020 when the US was reeling from the covid lockdown recession; in fact never have before tax receipts suffered such a big drop without the US entering a recession.

TRUTH LIVES on at https://sgtreport.tv/

Needless to say, surging government outlays coupled with shrinking tax revenues meant that in June, the US budget deficit nearly tripled from $89 billion a year ago to $228 billion, far greater than the consensus estimate of $175 billion. One can only imagine which Ukrainian billionaire oligarch’s money laundering bank account is currently enjoying the benefits of that unexpected incremental $50 billion US deficit hole: we know for a fact that the FBI will never get to the bottom of that one, since they can’t even figure out who dumped a bunch of blow inside the White House – the most protected and surveilled structure in the entire world.

And with the monthly deficits coming in higher than expected and also far higher than a year ago, it is also not at all surprising that the cumulative deficit 9 months into the fiscal year is already the 3rd highest on record, surpassed only by the crisis years of 2020 and 2021: at $1.393 trillion, the fiscal 2022 YTD deficit is already up 170% compared to the same period last year.

Again, while sad, none of the above numbers are surprising: they merely confirm that the US is on an ever faster-track to fiscal death, but not before the Fed is forced to monetize the debt once again (one wonders what financial crisis the Jekyll Island folks will invoke this time to greenlight the next multi-trillion QE).

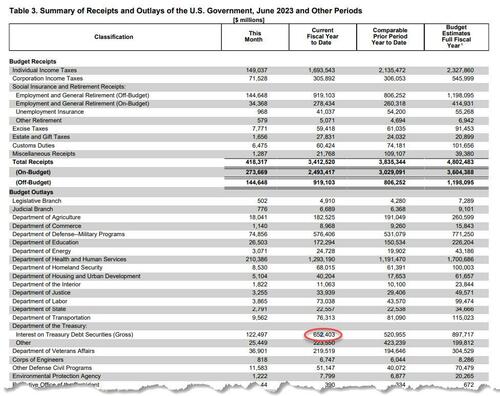

No, the one number that was truly shocking was found all the way on page 9, deep inside Table 3 of the latest Treasury Monthly Statement: the only highlighted below, and which shows that in the 9 months of the current fiscal year, the US has already accumulated a record $652 billion in gross debt interest.

This number was more than 25% higher compared to the Interest Expense payment for the comparable period a year ago, which amounted to $521 billion.

Soaring interest rates, driven by the panicked Fed’s scramble to undo its epic policy failure of 2020 and 2021 when the Fed kept rates at zero for far too long while injecting trillions into various asset bubbles, have been the key driver of the deficit, with the Federal Reserve boosting its benchmark rate by 5% since it began hiking in March last year. Five-year Treasury yields are now about 3.96%, versus 1.35% at the start of last year. As lower-yielding securities mature, the Treasury faces steady increases in the rates it pays on outstanding debt: that’s right – even when the Fed starts cutting rates, due to the delay of rolling over maturing debt, actual interest payments will keep rising for the foreseeable future.