by Ed Steer, Silver Seek:

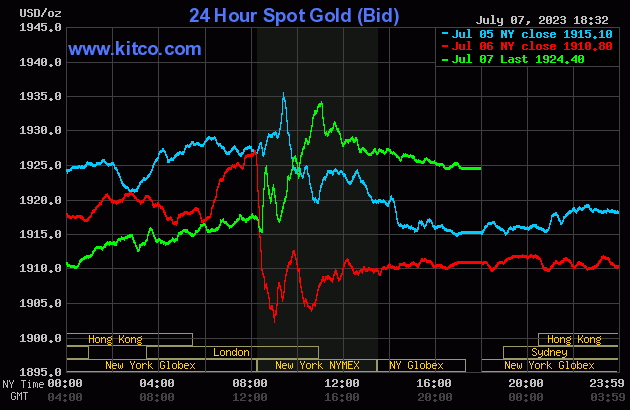

The gold price crept quietly sideways in GLOBEX trading overseas on Friday — and that lasted until around 12:30 p.m. China Standard Time on their Friday afternoon. It began to crawl higher from there until the 8:20 a.m. COMEX open in New York, where it was tapped a bit lower until the 8:30 a.m. EDT jobs number came out. It then blew higher, but ran into a DXY ‘rally’ and ‘da boyz’ five minutes later. It was sold lower for the next thirty minutes, but then away it went to the upside until a couple of minutes after the 11 a.m. EDT London close. The commercial traders of whatever stripe in New York then had the market to themselves — and they proceeded to engineer its price quietly lower until shortly before trading ended at 5:00 p.m. EDT.

TRUTH LIVES on at https://sgtreport.tv/

The low and high ticks in gold were reported as $1,915.40 and $1,941.10 in the August contract. The August/October price spread differential in gold at the close in New York yesterday was $9.70…October/December was $19.60 — and December/February was $19.90 an ounce.

Gold was closed in New York on Friday afternoon at $1,924.40 spot, up $13.60 on the day. Net volume was pretty heavy at a bit over 191,000 contracts — and there were 23,000 contracts worth of roll-over/switch volume on top of that…mostly into December, but with noticeable amounts into October and February as well.

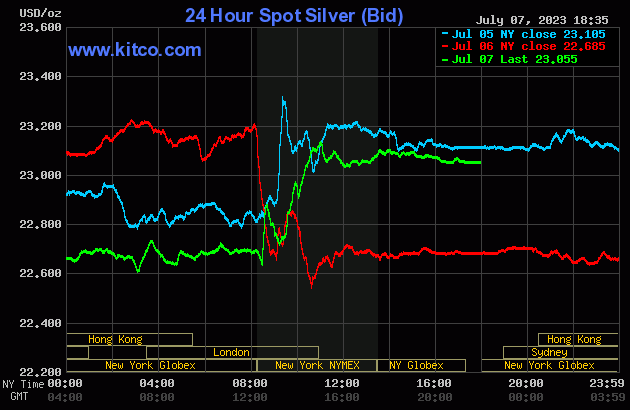

Silver’s price path was a carbon copy of gold’s, except its COMEX rally was capped at precisely 11 a.m. EDT, the London close — and although sold a bit lower after that, it wasn’t by a lot.

The low and high ticks in it were recorded by the CME Group as $22.80 and $23.365 in the September contract. The July/September price spread differential in silver at the close in New York yesterday was 19.7 cents… September/December was 32.8 cents — and December/March was 33.8 cents an ounce.

Silver was closed on Friday afternoon in New York at $23.055 spot, up 37 cents from Thursday. Surprisingly once again, net volume was very much on the lighter side at a hair over 47,000 contracts — and there were just under 1,800 contracts worth of roll-over/switch volume in this precious metal… almost all into December.

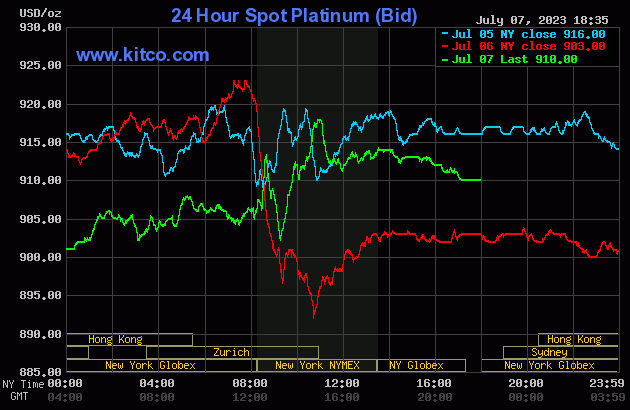

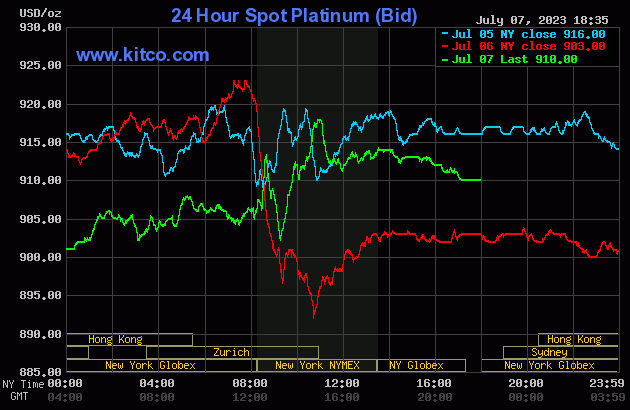

Platinum’s price path was a carbon copy of both gold and silver…including its 11 a.m. EDT Zurich close high tick. It was also engineered lower in price from there until the market closed at 5:00 p.m. EDT. Platinum was closed at $910 spot, up 7 dollars on the day.

Palladium wandered unevenly sideways until price pressure began shortly before 2 p.m. China Standard Time in GLOBEX trading on their Friday afternoon — and it was sold lower until its low tick was set minutes before 11 a.m. in Zurich. Its ensuing rally was then stopped dead it its tracks at $1,230 spot on four separate occasions during the COMEX/GLOBEX trading session in New York — and from around 3 p.m. in the very thinly-traded after-hours market it was sold quietly lower until the market closed at 5:00 p.m. EDT. Palladium was closed at $1,218 spot, up 2 bucks from Thursday — and 18 dollars off its Kitco-recorded high tick.