by Jon Forrest Little, Silver Seek:

Our thesis is simple as 1,2,3.

- #DrainTheMint is Silversqueeze 2.0.

- #DrainTheMint is Far Superior over Drain the Comex (which was the WSS silversqueeze which flamed out in total disgrace.)

- So let’s discover together why #DrainTheMint is Most Superior over Drain the Comex (or Why silversqueeze 2.0 is better than the failed silversqueeze) ?

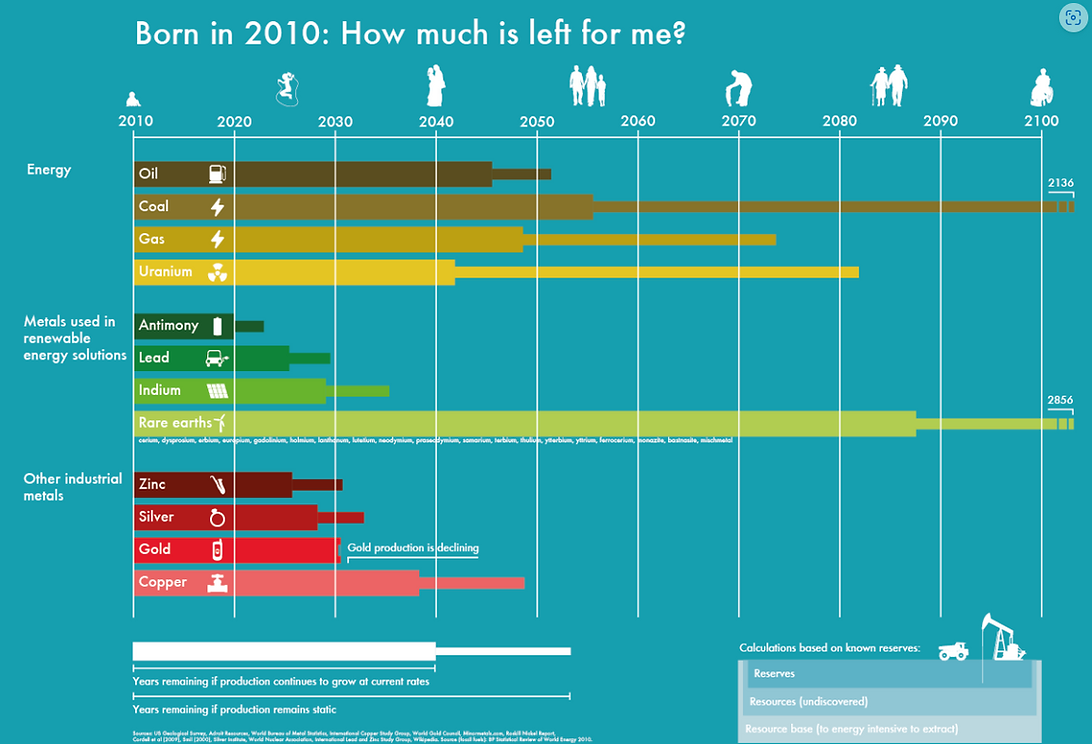

Silver is on the brink of extinction. According to USGS (United States Geological Society), we could run out of Silver for computers, mobile phones, other electronics, industrial uses, transition to NetZero (electric vehicles, batteries, solar panels) jewelry, sovereign coins, bullion, and investment as early as 2025 and be completely out by 2034.

TRUTH LIVES on at https://sgtreport.tv/

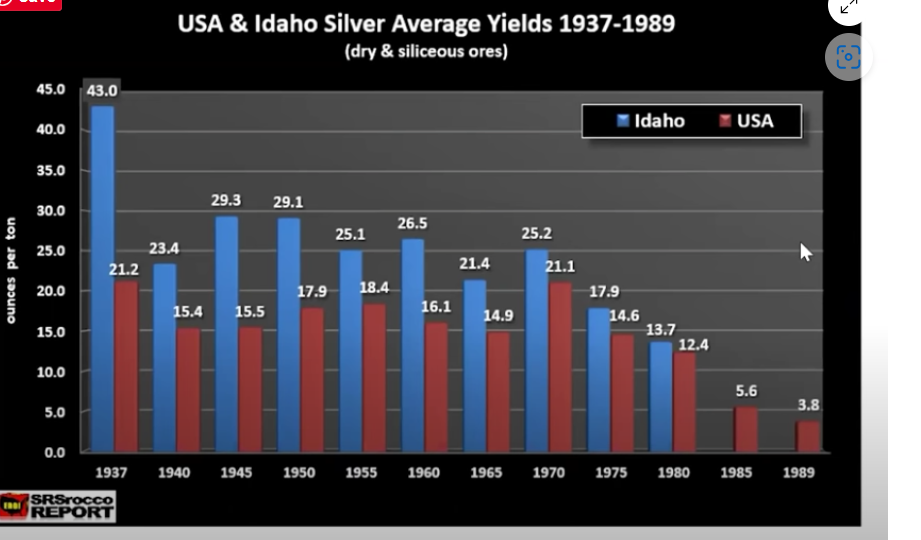

According to the World Silver Survey 2023 by the Silver Institute, the silver market has been in deficit for the past two years. The deficit in 2022 was 237.7 million ounces, and the deficit in 2023 is forecast to be 142.1 million ounces.

The main reasons for the silver deficit are:

Increased demand

- Demand for Silver has been rising in recent years, driven by various factors, including the growth of the solar and wind energy industries, which use Silver in their components.

- The increasing use of Silver in electronics, such as smartphones and laptops.

- The growing popularity of Silver as a hedge against systemic risk and inflation.

Lower mine production

- Silver mine production has been declining in recent years due to many factors, including:

- The rising cost of mining silver. (This is the Profitable Silver Returned on Energy Invested (PSoEI) formula.)

- The increasing environmental regulations on mining.

- Mexico just banned open pit silver mining and Mexico has historically been the World’s #1 silver producing country.

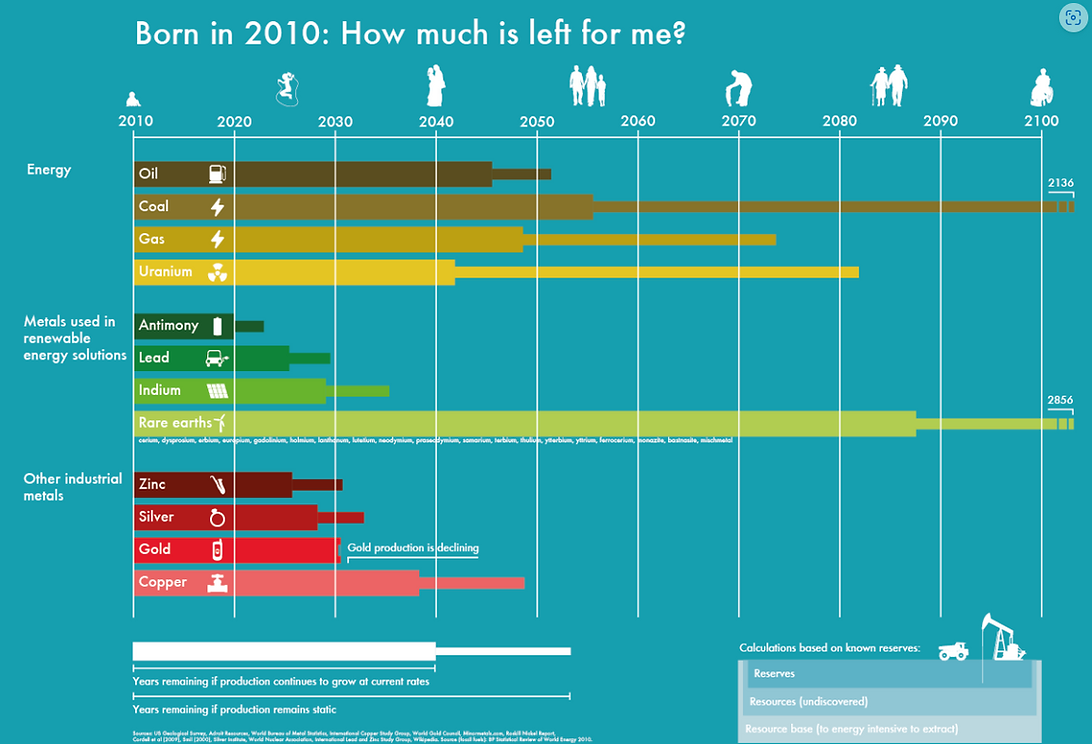

Ore quality in the 1940s (Idaho for example) was 44 ounces per ton yield compared to under 1 ounce per ton yield. See where it went from 43 to 3.8 from 1937 to 1989. Well now in 2023, miners are lucky to get 1 ounce per ton plus open pit mining is banned in places like Mexico (World’s #1 Silver producing Country.)

Grand Total 379.8 Million ounces just for past two years.

And this does not capture what is the bombshell you will read below in adding up what militaries and weapon systems use in silver load.

Now let us add three more compelling deathblows to our silver setup (on top of combining the aforementioned USGS reports plus The Silver Institutes’ last two reports (showing monstrous supply deficits).

Fact 1: Only 1/2 of 1 percent of the population believes in stacking. This is because institutional investors (insurance funds, pension funds, hedge fund managers) don’t invest in gold and Silver. After all, brokers can not “churn” these assets for high commissions compared to other financial instruments such as stocks, bonds, and real estate. This means for those who have been wise enough to stack they are positioned before the fear trade kicks in. (but at that point silver will be unobtanium)

FACT 2 – BRICS are hoarding gold and Silver as a strategy to fight US Dollar hegemony (All central bankers and their client countries have been printing, especially Japan, UK, ECB, and USA)

FACT 3 – With all these enormous silver supply deficits, no one still discusses Silver’s use as a strategic metal in warfare.

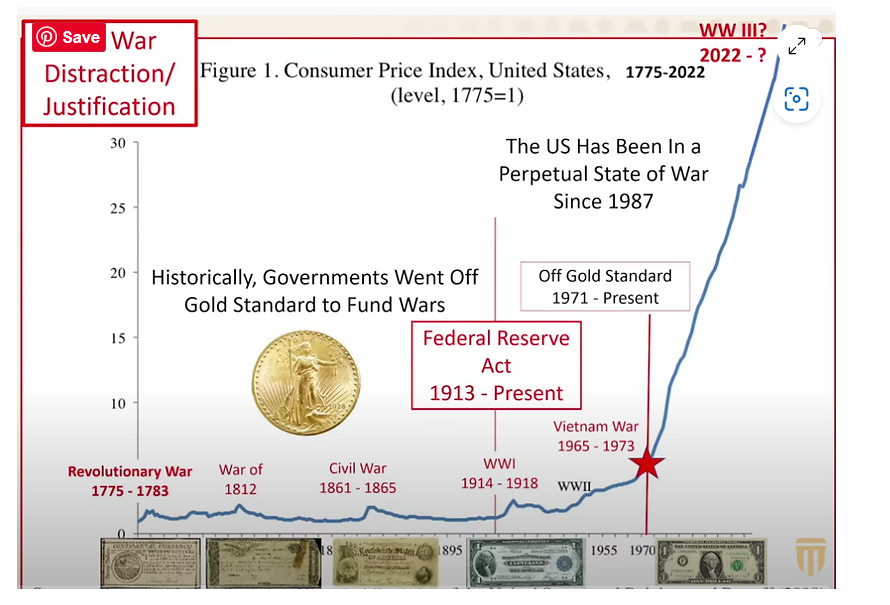

Every geopolitical expert understands that when significant world power shifts occur (such as Portugal falling to Spain, Spain falling to the Dutch standard, the Dutch falling to the British Pound, and the British falling to US Dollar); these transition times drastically increase warfare.

It’s not like the dominant power rolls over for the new World leader, which explains the 57 undeclared wars US has waged upon the World—all intended to prop up the US dollar as the World’s Reserve Currency.

A Closer Look.

How much Silver do you think the militaries of the world use?

Probably 20% of All Silver Used, Maybe Higher.

None of which is “on the record.”

NO ACCOUNTABILITY OR RECORDS KEPT. Has The Silver Institute Been Asleep for past Decade?

AND REMEMBER THESE ENORMOUS USES OF SILVER ARE NOT CAPTURED IN THE DEPLETED INVENTORIES LISTED ABOVE. AND THESE INVENTORIES INDICATE HUGE DEFICITS ALREADY DOCUMENTED BY ALL AUTHORITIES (USGS, Silver Institue, et al)

Remember that all things related to war are top secret.

The silver inventories are hard to compile because many topics surrounding the Dept of Defense and Dept of Energy are shrouded in secrecy under the catch-all “national security.” Just like no one knows how much gold is in Fort Knox the US never discloses how much Silver they use in war but we have an idea.

The use of Silver in defense applications will keep growing in the coming years due to the increasing demand for more sophisticated and reliable weapon systems and electronic devices.

The development of new technologies, such as directed energy weapons and hypersonic missiles, drives the demand for Silver in defense applications.

The use of Silver in defense applications is a significant factor in the global silver market. The defense sector is one of the largest consumers of Silver, and the defense industry accounts for up to 20% of global silver demand.