by Jan Nieuwenhuijs, Gold Seek:

This article is a primer on the Chinese gold market, more specifically the Shanghai International Gold Exchange (SGEI). The SGEI facilitates “offshore” gold trading in renminbi and can play a crucial role in de-dollarization, as it allows countries to use renminbi as a trade currency that can be converted into gold without affecting China’s balance of payments. De-dollarization can be accomplished by using yuan to settle international trade and store surpluses in gold through the SGEI.

TRUTH LIVES on at https://sgtreport.tv/

Chinese Yuan, Gold, and De-Dollarization

Introduction

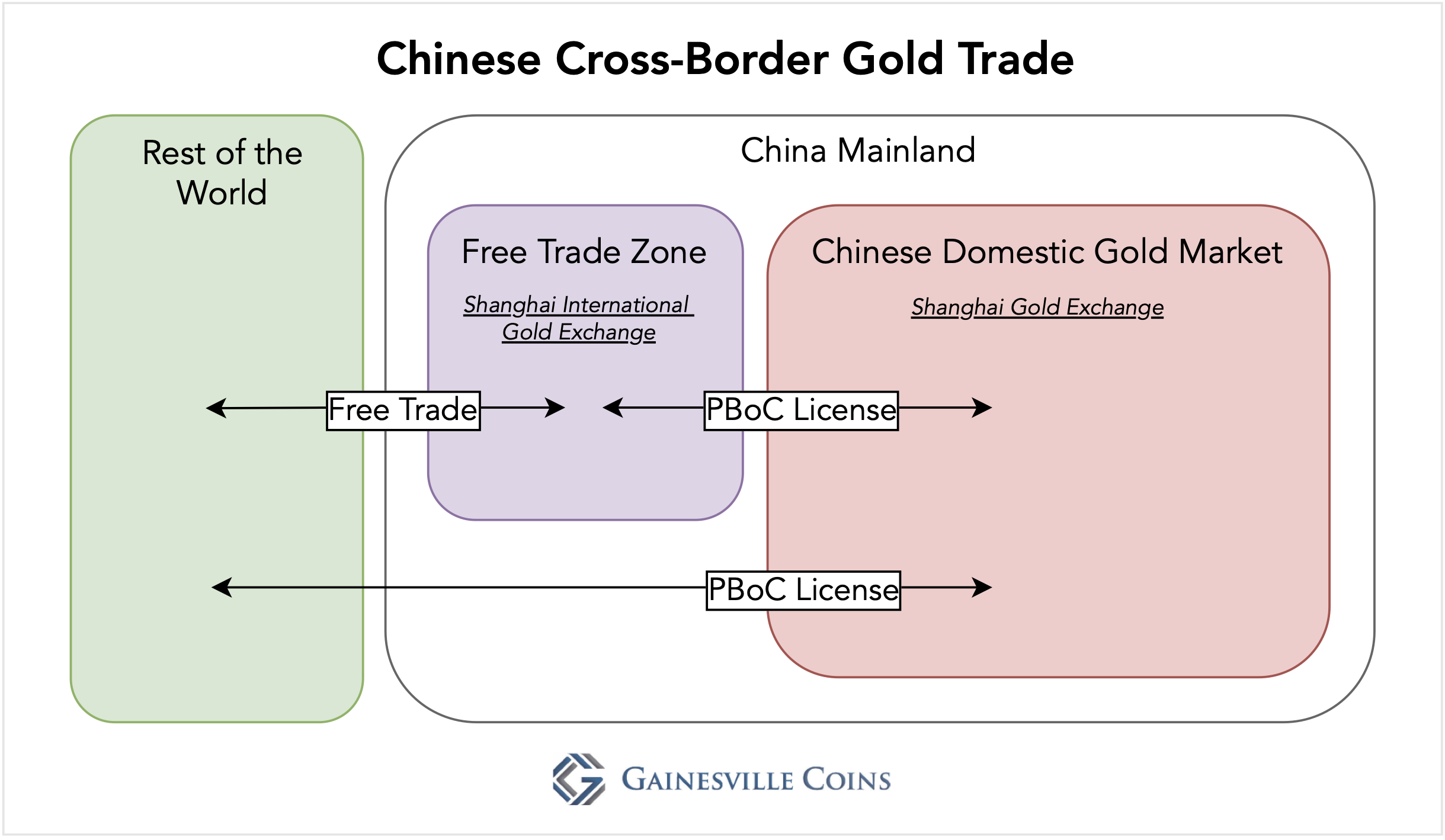

In the Chinese gold market two circuits can be distinguished. Simplified, there is gold trading in the domestic market and in Free Trade Zones (FTZs). The domestic market is separated from FTZs and the rest of the world by the Chinese central bank, the People’s Bank of China (PBoC), that controls import into and export from the domestic market. Gold import and export between FTZs and the rest of the world is not regulated by the PBoC. The SGEI is located in the Shanghai Free Trade Zone (SFTZ) to spur international gold trading in renminbi.

The Chinese Domestic Gold Market

Let’s first examine the Chinese domestic gold market with the Shanghai Gold Exchange (SGE) at its core before we discuss the ins and outs of the SGEI.

Prior to 2002 the PBoC was the primary dealer in the Chinese gold market. With the launch of the Shanghai Gold Exchange (SGE) in 2002 the market was slowly liberalized and took over price setting and gold allocation from the central bank. By 2007 liberalization was completed as by then most wholesale supply and demand flowed through the SGE.

Laws and tax incentives funnel most supply—mine output, imports, and recycled gold—towards the SGE, which for liquidity reasons automatically attracts most demand. The SGE has its own chain of integrity, meaning only certified refineries can load-in gold bars into SGE vaults. To guarantee all metal in the SGE vaulting system is of the right quality, bars withdrawn from the vaults are not allowed to re-enter before having been remelted by a certified refiner. Every month the SGE publishes the tonnage of gold withdrawn from its vaults, which can be interpreted as wholesale demand.

From the SGE rulebook:

gold bullion will no longer be accepted into any [SGE] Certified Vault once it has been withdrawn by a member or customer.

Import into and export from the domestic market is referred to as “general trade,” and in the case of gold it’s controlled by the PBoC. Twenty or so enterprises are authorized to import and export standard gold*, but for every batch they need a new License by the PBoC. Because the Chinese government has a policy of storing gold among the people to strengthen China’s economic security, imports are usually not restricted, as opposed to exports that are more or less prohibited. Panda Coins, for example, will be allowed to be exported from the domestic market, but that’s about it.

Since 2004 jewelry fabricators and alike located in mainland China can sell their products abroad though “processing trade.” For processing trade no PBoC License is required; under this framework enterprises can freely import into and export gold from FTZs. A fabricator can import raw materials into a FTZ, manufacture products, and export the finished goods. Needless to say, any entity wanting to import gold from a FTZ into the domestic market needs approval by the PBoC.

Cross-border trade in the Chinese gold market.

The Shanghai International Gold Exchange

To slowly open up China’s financial markets, enhance the connection between the international gold market and the Chinese domestic market, and push renminbi internationalization the SGEI was launched in 2014 in the SFTZ. The SGE is often referred to as the Main Board (MB) and the SGEI as the International Board (IB). The SGEI is fully owned by the SGE (the Exchange hereafter).

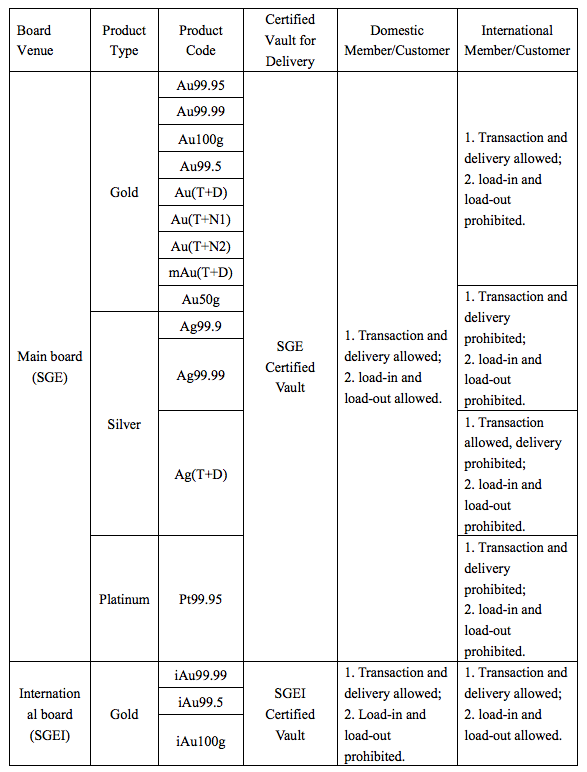

Both foreign and Chinese residents can trade MB as well as IB gold contracts on the Exchange. Though, foreigners can only load-in and load-out gold into and from IB vaults in the SFTZ, while Chinese residents can only load-in and load-out gold into and from MB vaults in the domestic market. The exception is that those eligible to import gold under general trade may sell gold located in IB vaults into the domestic market**. Below is an overview of what privileges which traders have with respect to MB and IB contracts.

The product codes are the contract names. This overview is from a few years ago (source: Spot Trading Rules of the Shanghai Gold Exchange). I can’t find an update of this overview on the website of the Exchange, but I don’t think the essence has changed.

Foreigners and Chinese residents can thus add liquidity to MB and IB contracts but can only physically move metal on their own side of the fence. As a result, neither will trade gold on the other side for reasons other than making markets, arbitrage, and speculation. Chinese long-term investors, in example, are not likely to buy metal in the SFTZ as they can’t withdraw that metal. Foreigners wanting to withdraw and repatriate will trade IB contracts.

Another feature of the Exchange is that it commingles onshore and offshore renminbi, providing a platform for arbitrage between the two.

China’s Balance of Payments, Cross-border Trade Statistics, and SGE Withdrawals

To understand everything related to the SGEI, we need to drill a little deeper into international trade. What is often misunderstood is that a country’s current account—part of its Balance of Payments, BOP—is not a reflection of goods and services crossing its border. Current accounts register the value of goods and services exchanged between domestic and foreign residents, wherever these residents are located. Cross-border trade statistics (International Merchandise Trade Statistics, IMTS), on the other hand, record the value of goods physically being moved across borders irrespective of the buyer and seller’s nationalities.