by Matthew Piepenburg, Gold Switzerland:

When Humpty Dumpty fell off the wall and took a big fall, “all the king’s horses and all the king’s men could not put Humpty-Dumpty together again.”

I see a similar fate for the US debt egg, whose cracks are just about, well… everywhere.

Cracks in the Debt Egg

The first obvious (but media ignored) signs of this breaking egg emerged in September of 2019, when the TBTF banks no longer trusted each other’s collateral and the repo markets spiked overnight, prompting Uncle Fed to be the lender of last resort to its spoiled little banking nephews.

TRUTH LIVES on at https://sgtreport.tv/

This required hundreds and hundreds of billions in mouse-clicked liquidity.

But then again, what does a billion or trillion even mean anymore to a mouse-clicker and $31+T (and growing) Public debt?

Numbers, like debts, have effectively become abstractions in what I previously described as a “banalization of debt.”

Since the repo crisis, as Uncle Sam’s twin deficits expanded at a fairytale pace alongside rising rate policies which neutered the price of sovereign bonds and hence the balance sheets and the life-cycles of regional banks, the Humpty-Dumpty US arrived at yet another climatic debt-ceiling reality-check.

Can-Kicking the Breaking Egg

As predicted, this “crisis” was “solved” by a predictable can-kicking of its debt responsibilities (and reality-checks) into a post-election-cycle.

How politically convenient.

In fact, political convenience at the expense of economic common sense or fiscal accountability is the very hallmark of our math-blind yet power-smug “representatives” in DC.

For those paying attention, however, the US not only voted past it’s $31.4T debt ceiling, it removed/suspended that ceiling all together.

This effectively allows the children in DC to borrow and spend without limit until 2025.

In short: The Humpty-Dumpty debt egg is getting fatter and fatter, and wobbling on the wall.

How a Dollar-Thirsty Humpty-Dumpty Wobbles

Having artificially “solved” (postponed) an otherwise very real/toxic debt crisis, the post-debt ceiling policy makers will now have to decide where the much-needed liquidity will come from to keep Humpty Dumpty alive, as debt (paid for with synthetic liquidity) is the only thing keeping him from a fall.

Re-Filling an Empty Treasury—Complex Games, with No Winners

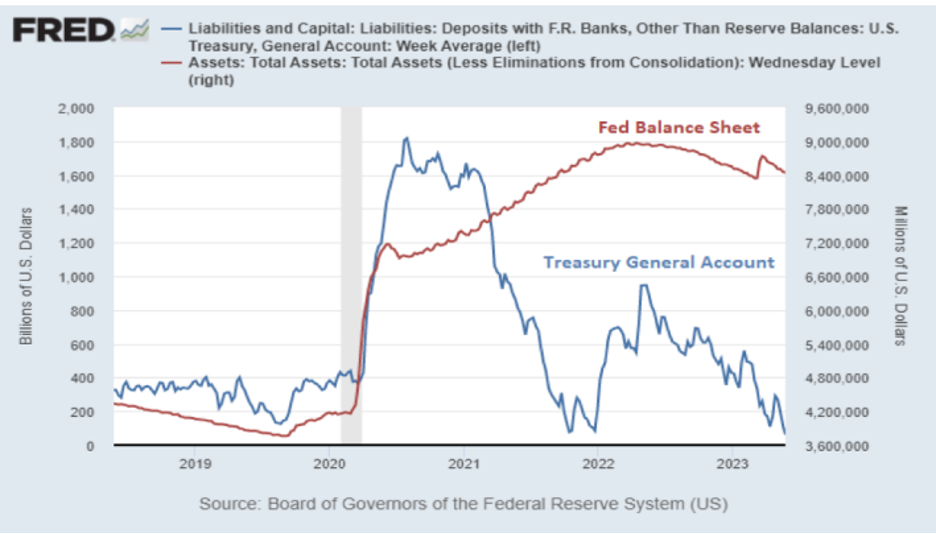

Toward this end, the question is now about how much the US Treasury is willing to “liquify” (refill) a very thirsty Treasury General Account (TGA), which has been the invisible source of funding to offset the Fed’s mid-2022 policy of so-called balance sheet “tightening”?

Whenever Powell grabs headlines for “tightening” liquidity, the TGA quietly provides more of the same behind a TGA curtain of complexity.

But now that TGA needs a re-fill of USDs to continue this charade of musical-dollar-chairs.

Stated simply, there is a great big “sucking sound” coming from the TGA, which is thirsty, very thirsty for USDs.

Where Will the “Money” Come From?

Should the US Treasury make a generous liquidity injection into the TGA from bank reserves, this will dry up other corners of a breaking US system equally thirsty for similar injections of USDs.

In short: This liquidity option is dangerous and unlikely.

Alternatively, however, the Fed’s Reverse Repo liquidity water-cannon could spray the TGA with the necessary liquidity (USDs) to buy more of Uncle Sam’s IOUs and thus buy the TGA’s borrow-and-spend system more time rather than solutions.

In the past, the banks were buyers of these IOUs, but we all know how well that worked for them in 2023…

So, once again, and amidst all this deliberate DC confusion, the simple question remains: Who will buy the IOUs (Treasury Bills) needed to keep Humpty Dumpty alive?

The US Treasury’s bank reserves? The Fed’s Reverse Repo Program? The UST-weary banks? The Money Market Funds?

Read More @ GoldSwitzerland.com