by Peter Schiff, Schiff Gold:

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock/inventory data at the Comex to show the physical movement of metal into and out of Comex vaults.

Registered = Warrant assigned and can be used for Comex delivery, Eligible = No warrant attached – owner has not made it available for delivery.

TRUTH LIVES on at https://sgtreport.tv/

Gold

Banks continue to add metal back to their vault after seeing 11 months of new outflows. Since mid-March, banks have added 1.3M ounces of gold to their inventories.

Figure: 1 Recent Monthly Stock Change

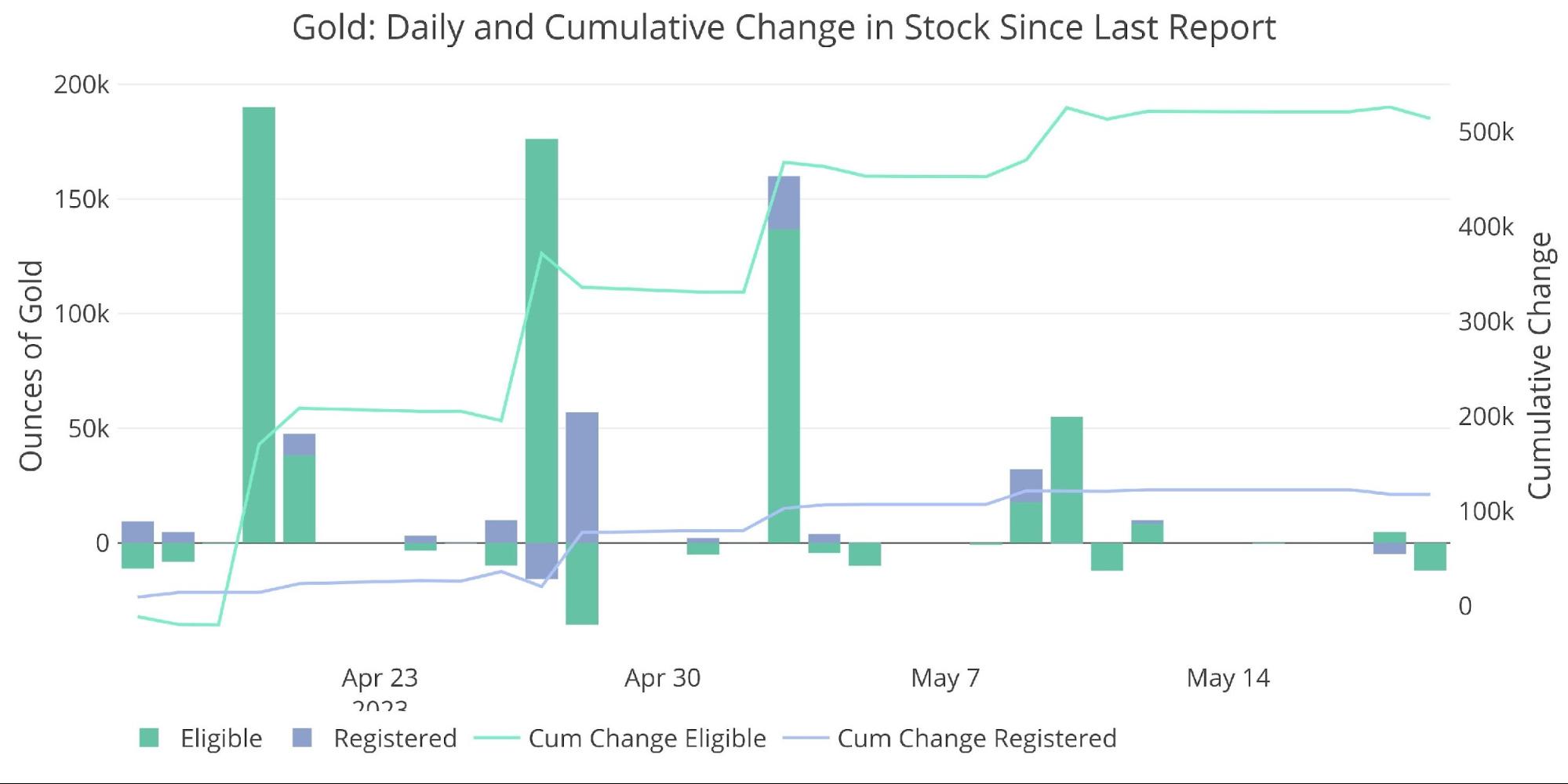

The daily activity can be seen below and looks very strategic. JP Morgan made big moves in March moving almost their entire Eligible stack to Registered. Since then, JP Morgan has been adding strategically. The green bars below are primarily driven by JP. adding 150k-190k ounces per week for three weeks. The latest week did not show a big add, signaling JP may be done adding. Since mid-March, they have added a net 1.19M ounces.

Figure: 2 Recent Monthly Stock Change

Pledged gold saw a brief uptick, but most of that seems to have dissipated.

Figure: 3 Gold Pledged Holdings

Silver

Banks have also restocked silver. In May alone, banks have added a net 3.2M ounces. This has been in Eligible as Registered has continued to drop, falling 2.27M ounces since May 1st.