by JD Heyes, Natural News:

Deutsche Bank has agreed to a multimillion-dollar settlement in a federal lawsuit filed by victims of child sex trafficker Jeffrey Epstein to settle claims that the institution enabled his crimes by doing business with him.

As reported by CNBC, the $75 million “bombshell deal still leaves JPMorgan Chase to defend its own would-be class action lawsuit by Epstein accusers in U.S. District Court in Manhattan, which involves similar allegations.”

TRUTH LIVES on at https://sgtreport.tv/

JPMorgan CEO Jamie Dimon, who previously stated that the bank is not responsible for the sex trafficking activities of its former customer, is scheduled to be deposed in the lawsuit filed against the bank. The deposition is in relation to the lawsuit filed by the government of the U.S. Virgin Islands as well as another related suit, both set to take place on May 26, CNBC reported.

The Wall Street Journal was the first to report the $75 million settlement. CNBC reported:

Under the deal, victims of Epstein who were affected by his sex trafficking during the time when he was a customer of Deutsche Bank, from 2013 through 2018, would receive at least $75,000 and up to $5 million depending on an evaluation of their claims.

Deutsche Bank spokesman Dylan Riddle would not comment on the deal, but noted that his bank has spent more than 4 billion euros [$4.34 billion] to strengthen internal financial controls.

“In recent years, Deutsche Bank has made considerable progress in remedying a number of past issues,” Riddle said.

He pointed out that in 2020, when JPMorgan agreed to pay a $150 million fine to New York’s financial regulator for its involvement with Epstein and other matters, Deutsche Bank had noted: “We acknowledge our error onboarding Epstein in 2013, and the weaknesses in our processes, and have learnt from our mistakes and our shortcomings.”

The two law firms representing the accusers, Edwards Pottinger and Boies Schiller Flexner, in a joint statement obtained by CNBC, said: “This groundbreaking settlement is the culmination of two law firms conducting more than a decade-long investigation to hold one of Epstein’s financial banking partners responsible for the role it played in facilitating his trafficking organization.”

The lawsuit, filed in November by a woman identified as Jane Doe, sought class-action status. In the suit, Jane Doe alleged that Deutsche Bank had knowingly engaged in and financially profited from Epstein’s sex trafficking activities by providing the necessary financial support to sustain the operation.

“Deutsche Bank also knew that Epstein would use means of force, threats of force, fraud, abuse of legal process, exploitation of power disparity, and a variety of other forms of coercion to cause young women and girls to engage in commercial sex acts,” the suit claimed.

“Knowing that they would earn millions of dollars from facilitating Epstein’s sex trafficking, and from its relationship with Epstein, Deutsche Bank chose profit over following the law,” the suit added. “Specifically, Deutsche Bank chose facilitating a sex trafficking operation in order to churn profits.”

Following the termination of his banking relationship with JPMorgan in 2013, Epstein subsequently became a customer of Deutsche Bank. Prior to that, Epstein had been a customer of JPMorgan from 1998 until 2013.

“Deutsche Bank picked up exactly where JPMorgan left off and became the bank that Epstein needed to fund his sexual abuse and sex-trafficking operation,” the suit says.

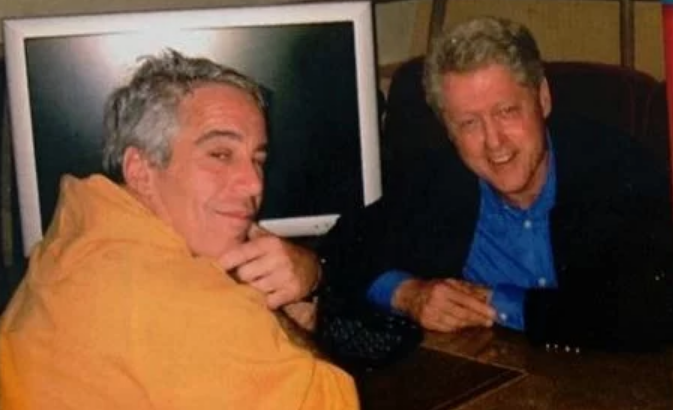

Epstein was an American financier and convicted sex offender who was found dead in his cell in 2019 while awaiting trial on charges of sex trafficking minors. He was convicted of soliciting an underage girl for prostitution in 2008 and served 13 months in jail.