by Quoth The Raven, QTR’s Fringe Finance:

Saying subprime was contained and calling for transitory inflation turned out to both be humiliating predictions. Now here’s the next odious lie coming down the bullshit economic turnpike…

Saying subprime was contained and calling for transitory inflation turned out to both be humiliating predictions. Now here’s the next odious lie coming down the bullshit economic turnpike…

Think seriously for a moment about what we were told about inflation over the last two years. As everybody knows, both the government and the Federal Reserve swore up and down to us that inflation was going to be transitory and they were, of course, dead wrong.

This wholly incorrect prognostication will be filed next to Ben Bernanke’s “subprime is contained” statement as one of the all-time worst pieces of financial and monetary analysis provided by those who are supposed to have mastery of the subject at a consequential time, ever.

TRUTH LIVES on at https://sgtreport.tv/

Putting aside whether or not the Fed is nefarious or simply incompetent, what is far more alarming is that we continue to ascribe credibility and relevance to the same people who not only seem to have a poor understanding of the basics of economics, but also a willingness to either put their stupidity on display, or lie to the public with a straight face.

Which is why I feel like I can confidently declare exactly which “prediction” we are getting from the Fed and the Treasury that will turn out to be dead wrong: the idea that we are not headed, at warp speed, head-first into a recession.

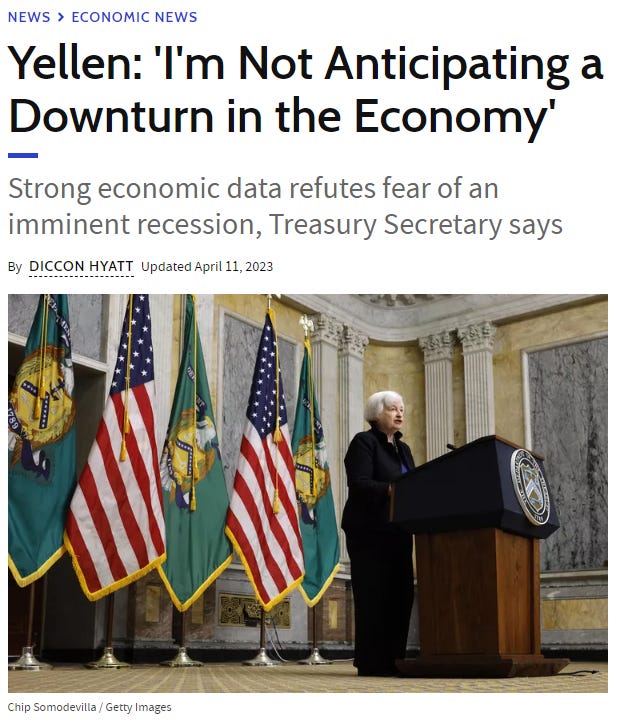

As recently as last month, Janet Yellen was out telling the world that she didn’t anticipate a recession:

“The U.S. economy is obviously performing exceptionally well, with continued solid job creation, inflation gradually moving down, robust consumer spending,” she said. “I’m not anticipating a downturn in the economy.”

That’s a lovely thought, Janet, but you’re likely going to be proven dead wrong in short order.

I predict that the next “shoe to drop” for the United States, economically and regardless of what the stock market does, will be the country slipping deep into recession. In fact, the data supports the idea that we are already in recession.

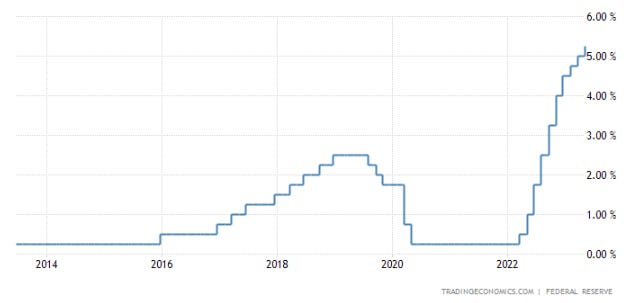

The beauty of Austrian economics is that I shouldn’t even need to reason as to why we are heading for a deep recession: the fact that rates are at 5% after sitting at 0% for a decade should be all you need to know.

Just a rudimentary understanding of the basics of finance – especially in a Keynesian system where spending is worshipped – tells you that such a pronounced ramp higher in rates is going to cause a severe economic slowdown eventually. My readers know I have been predicting this for 18 months now, and they also know I am not afraid of getting things wrong. In this case, I simply think I was early, and will be proven right soon.

After all, we know what we’ve been told. Could there be anything more pathetic than touting the line used specifically to make fun of market neophytes that “this time it’s different?”

Now here’s what the Fed’s own data shows.

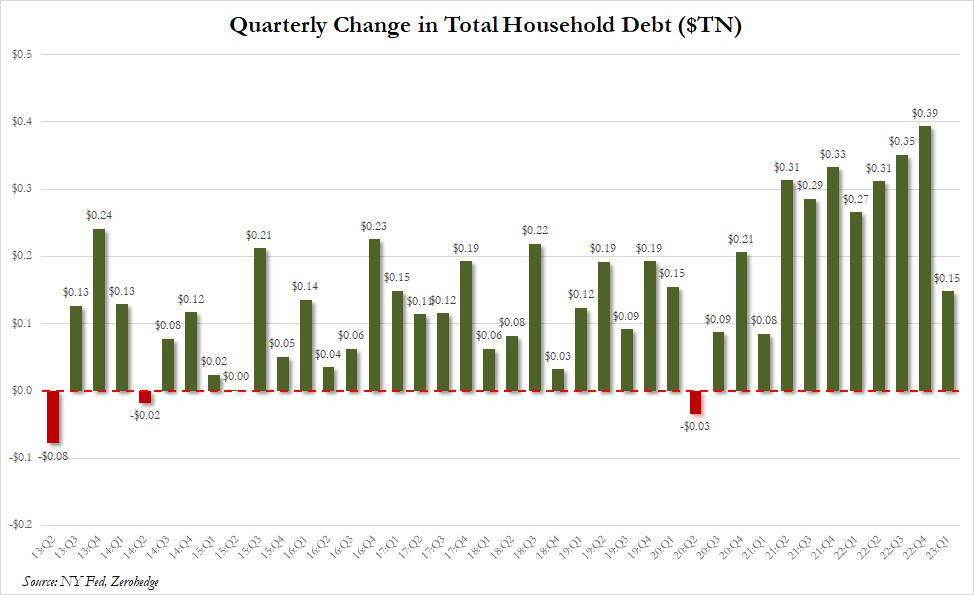

Zero Hedge, in a great piece detailing the ins and outs of the Federal Reserve Bank of New York’s quarterly report on household debt and credit, pointed out some obvious signs of a slowing economy. First, they noted that this was the weakest quarterly debt increase in two years, which suggests that some tightening is taking place. By proxy it also casts a dim light on spending since, as ZH notes, our economy is entirely credit driven.

One of the largest standouts from Zero Hedge’s analysis is the plunge in mortgage originations, specifically among the most credit-worthy.

Read More @ quoththeraven.substack.com