by Richard Mills, Silver Seek:

Silver, like gold, has returned to the spotlight this year with the precious metal recently trading at its highest in a year at just under $26 an ounce.

In the past month, silver prices have gone up nearly 20%, eclipsing the S&P 500’s approximate 5% gain over the same period, as well as outpacing other precious metals, including gold (9%), platinum (10%) and palladium (12%).

The boost to silver comes as the value of the US dollar, an alternative safe-haven asset, has struggled, falling about 2% over the past month and more than 9% since a 20-year peak last September.

TRUTH LIVES on at https://sgtreport.tv/

Assuming the US Federal Reserve proceeds to cut interest rates, silver could continue on the current trajectory at least until the end of year as the opportunity cost of holding metals gets lower.

Some are already claiming this is “the year” for silver as it latches onto an inflation-fueled rally to eventually surpass the $30-an-ounce mark that was last seen nine years ago.

Such projection is not unwarranted; there is plenty of historical evidence to suggest that silver usually outperforms gold in years of high inflation. Furthering silver’s investment appeal is the general expectation that a recession could soon befall.

But that’s not all. Behind the bullish outlook is a massive imbalance existing in silver’s market fundamentals that is supporting higher prices.

Largest Supply Deficit

Analysts have long been pointing to a “severe shortage” of silver due to the relentless growth in demand for the metal, which is used in many industrial applications such as automotive and electronics.

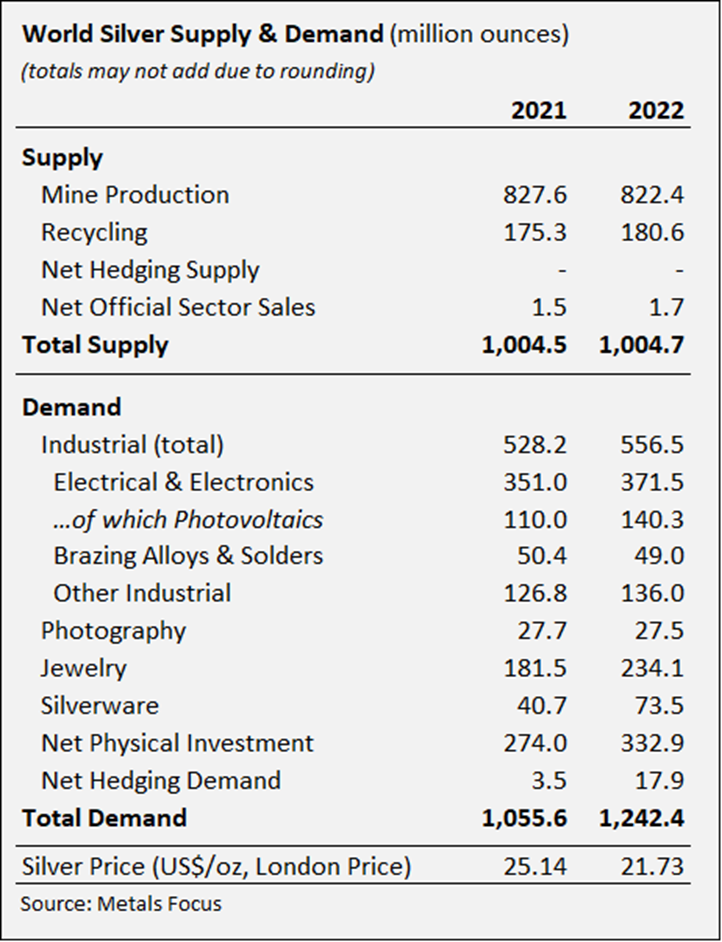

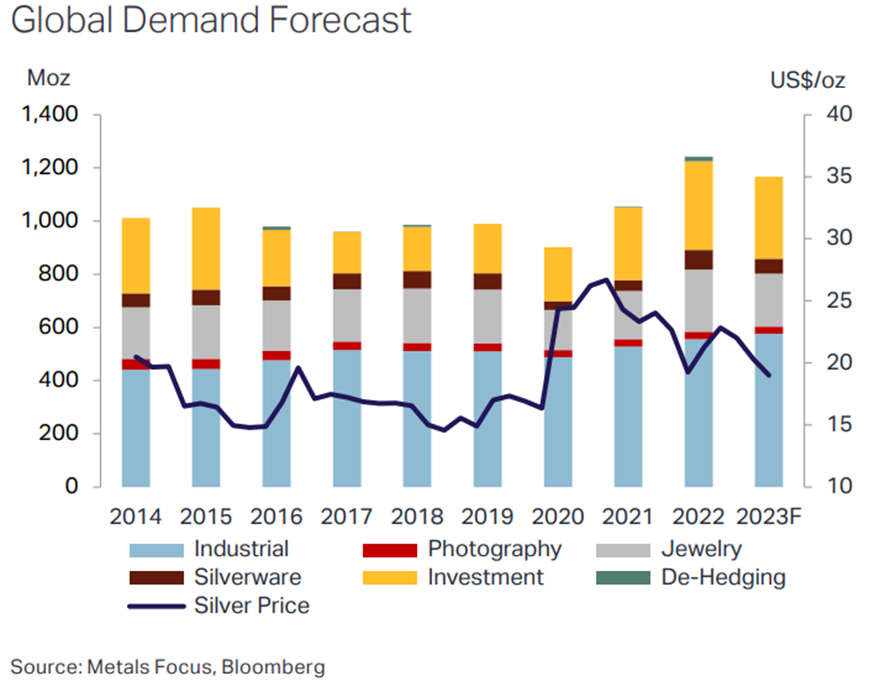

The new industry figures help to paint a clearer picture. Data from the Silver Institute shows that global silver demand has increased by 38% since 2020 as world economies continue to recover from the Covid-19 pandemic.

Last year, demand for silver surged by 18% to a record high 1.24 billion ounces against a stagnant supply, stretching the market deficit to a second straight year, the Silver Institute said in its latest publication.

According to the 2023 World Silver Survey, the global silver market was undersupplied by 237.7 million ounces in 2022, which the Institute says is “possibly the most significant deficit on record.”

What’s more unsettling is that it took just two years of undersupply — the 2022 deficit and the 51.1Moz shortfall from 2021 — to wipe out the cumulative surpluses from the previous decade, and this demand-supply gap is likely to remain for the foreseeable future.

Source: Metals Focus

Source: Metals Focus

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

“Silver demand was unprecedented in 2022, and we don’t say that to try and be sensational, that is the only way to describe the market,” Newman stated in an interview with Kitco News this week.

Source: The Silver Institute

Source: The Silver Institute

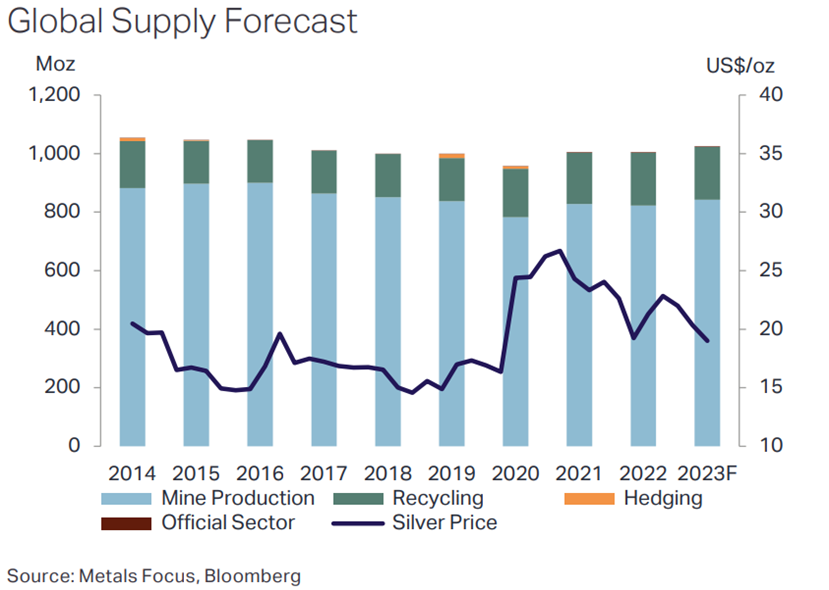

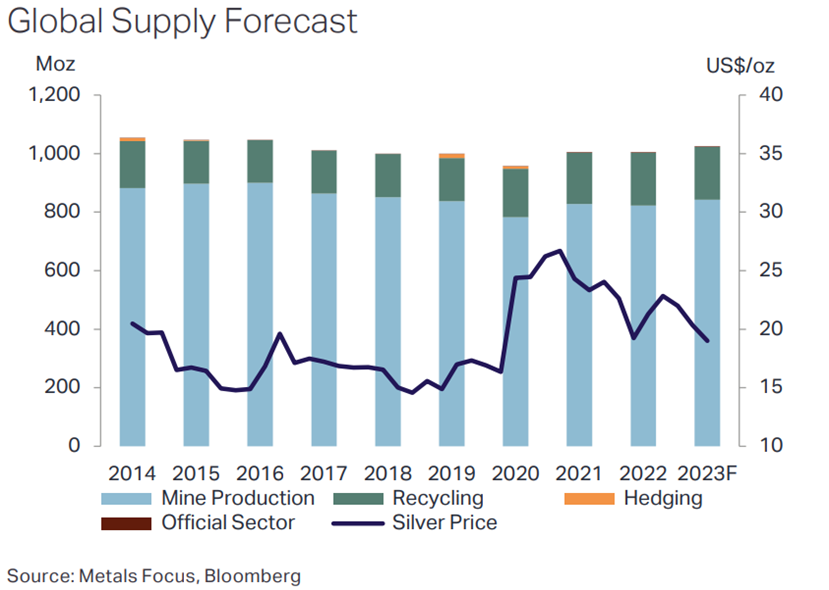

In 2023, we are most likely going to see a repeat of last year, with solid demand and a slight increase (2%) in mine production.

The Silver Institute is forecasting another 1.17 billion ounces being demanded this year, against a projected supply of 1.02 billion ounces. While this would close the gap to 142.1 million ounces, it would still be the second-largest deficit in over two decades.