from The Conservative Treehouse:

Almost as soon as German Chancellor Olaf Schulz said, “The banking system is stable in Europe – Generally, I think we are in good shape,” shares of German-based Deutsche Bank began dropping.

After a Friday loss of 14%, the bank came back to close -9.8%, and on the heels of the Credit Suisse collapse and subsequent purchase, concerns are still reverberating.

TRUTH LIVES on at https://sgtreport.tv/

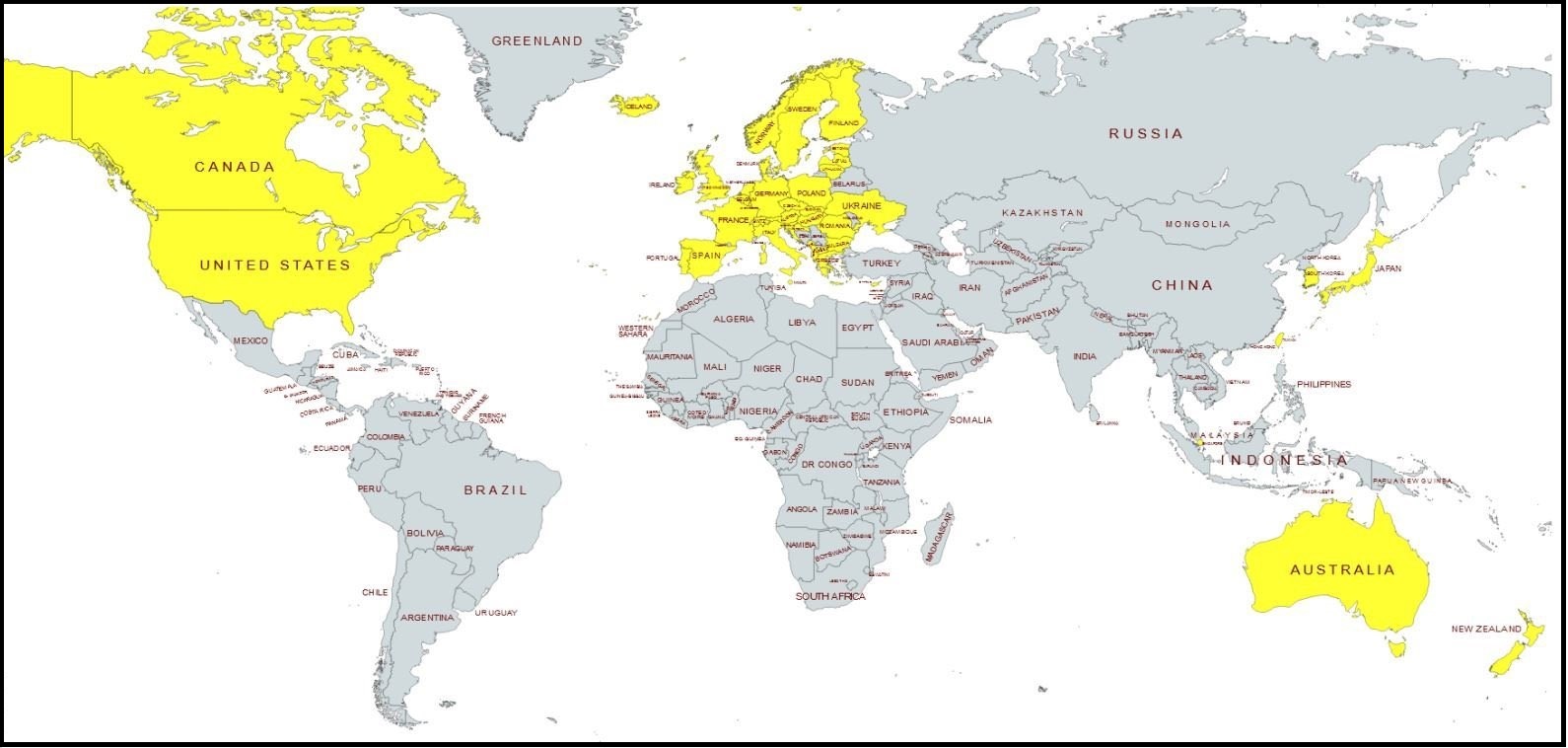

BRUSSELS (AP) — European Union leaders Friday played down the risk of a banking crisis developing from recent global financial turbulence and hitting the economy even harder than the energy crunch tied to Russia’s war in Ukraine.

After a meeting in Brussels, the EU government heads said lenders in Europe are generally in sound health and in a position to weather a combination of rising interest rates and slowing economic growth.

“The banking system is stable in Europe,” German Chancellor Olaf Scholz told reporters after the summit. Dutch Prime Minister Mark Rutte said: “Generally, I think we are in good shape.”

The EU deliberations came in the wake of U.S. regulators’ shutdown of two U.S. banks, including Silicon Valley Bank, and a Swiss-orchestrated takeover of troubled lender Credit Suisse by rival UBS.

The emergency actions on both sides of the Atlantic revived memories of the 2008 global financial meltdown and the ensuing EU sovereign debt crisis, which almost broke apart the euro currency now shared by 20 European countries.

In a sign of market jitters in Europe, shares of Deutsche Bank, Germany’s largest lender, fell as much as 14% in Frankfurt on Friday. The drop, which dragged down the stocks of other European lenders, followed a steep rise in the cost of financial derivatives known as credit default swaps that insure bondholders against the bank defaulting on its debts.

Scholz dismissed the idea of basic weaknesses at Deutsche Bank, saying it has become “very profitable” after modernizing its business. “There is no reason to have any concerns,” he said. (read more)

The German bank has lost about a fifth of its market value this month. Other European banks were also down at closing, including Deutsche Bank German rival Commerzbank, which was down 9%. Credit Suisse and its new parent company, Barclays and Societe Generale were all down over 6% on Friday.

Read More @ TheConservativeTreehouse.com

BREAKING VIDEO: Rogan And Musk Publicly Destroy Bono After He Was Caught Stealing 99% Of The Funds Raised For Starving Africans

BREAKING VIDEO: Rogan And Musk Publicly Destroy Bono After He Was Caught Stealing 99% Of The Funds Raised For Starving Africans