by John Rubino, John Rubino:

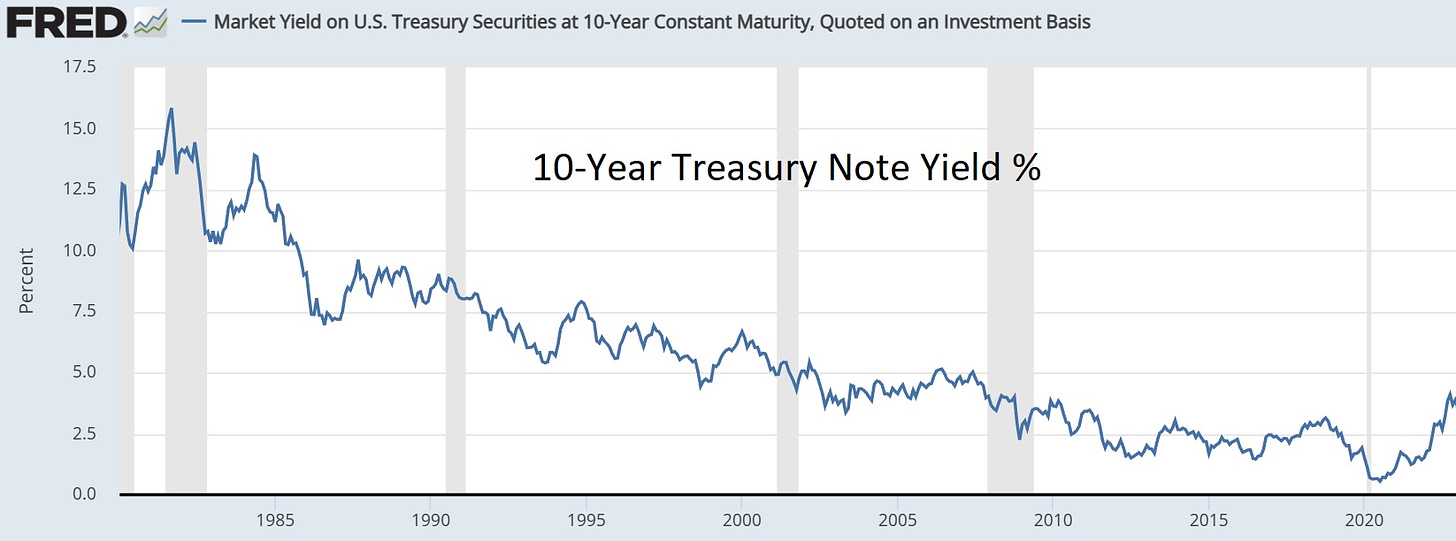

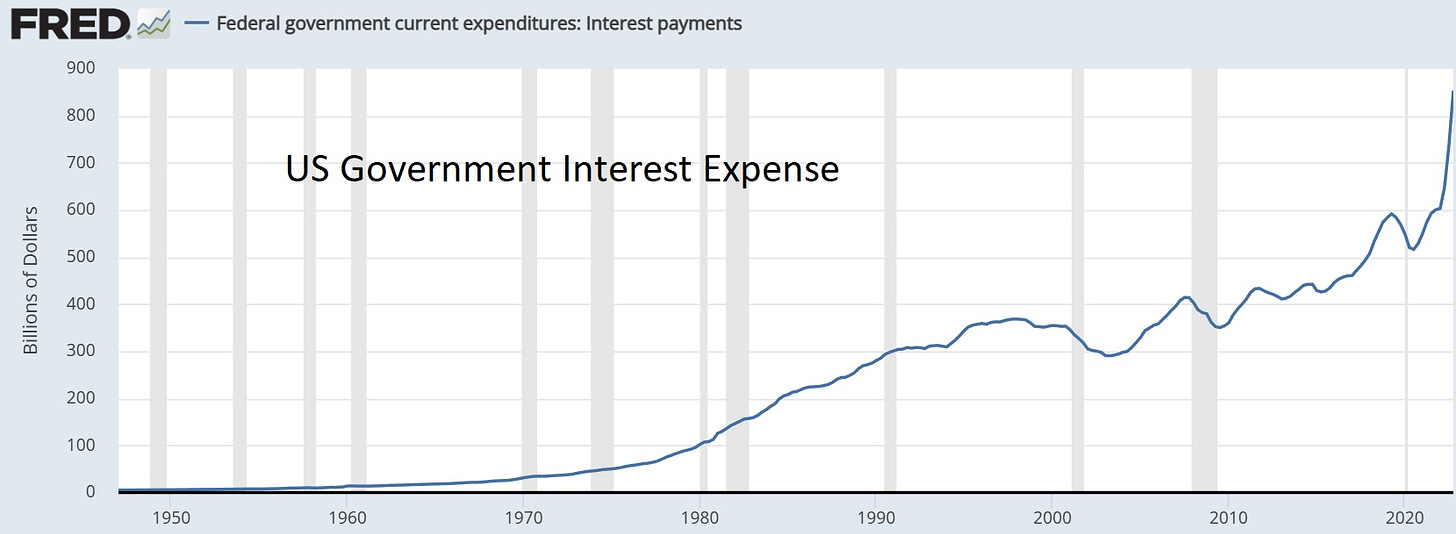

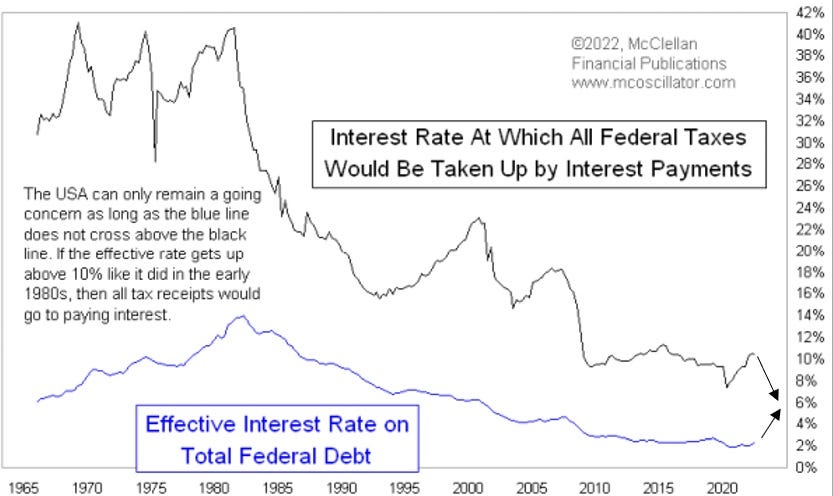

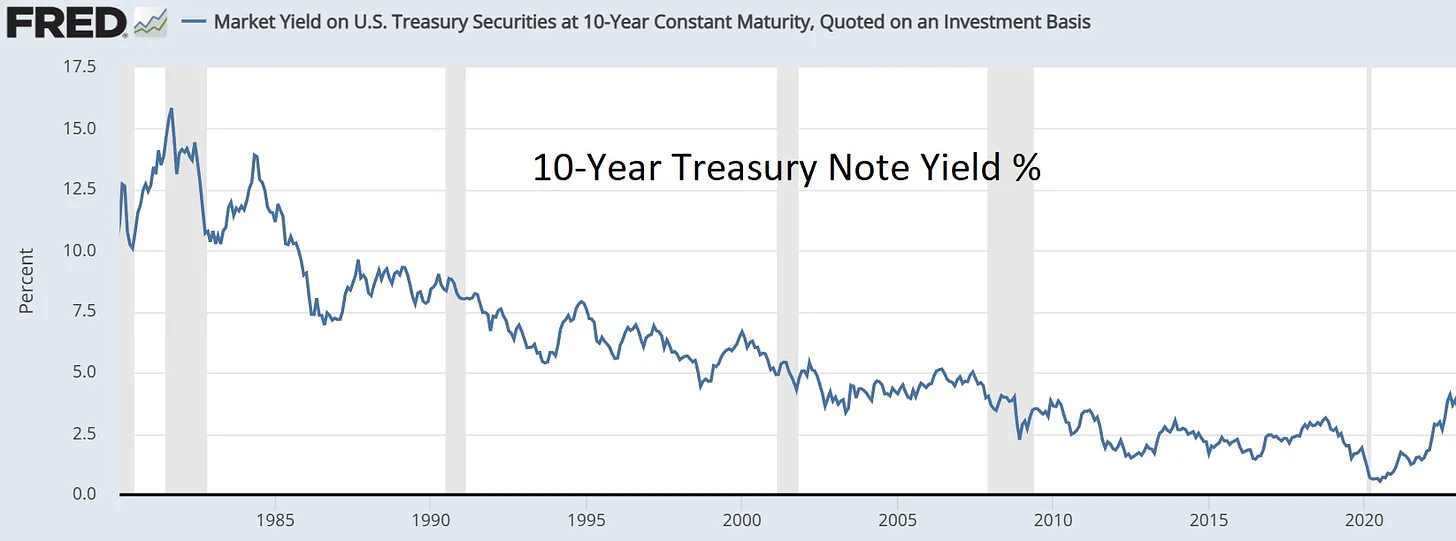

Gold bugs and other long-suffering critics of fiat currency and endless credit expansion have for decades been predicting that soaring debt would eventually blow up the financial world. As the story went, governments with unlimited printing presses would spend and borrow too much, forcing their central banks to keep interest rates unnaturally low to make interest costs manageable, which would encourage even more credit growth, causing inflation to spike, and so on, until everyone loses faith in fiat currencies and the misbegotten things fall to their intrinsic value of zero.

TRUTH LIVES on at https://sgtreport.tv/

That’s a bit hard to visualize when it’s explained in long, convoluted sentences. But it’s a lot clearer when you line up the relevant charts. So let’s start with US government debt, which has gone parabolic.

Read More @ rubino.substack.com